NEXT 1 Department of the Treasury Internal Revenue 2023

What is the NEXT 1 Department Of The Treasury Internal Revenue

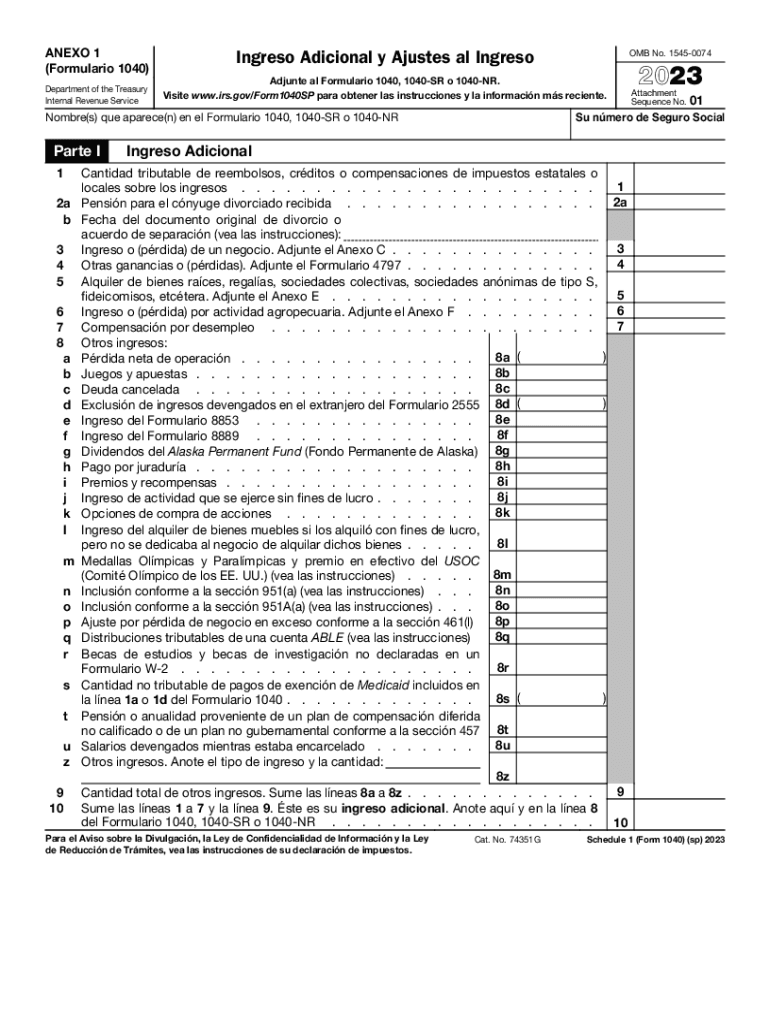

The NEXT 1 form, issued by the Department of the Treasury's Internal Revenue Service (IRS), serves a specific purpose within the realm of tax documentation. This form is essential for individuals and businesses to report particular financial information accurately. Understanding its function is crucial for compliance with federal tax regulations.

How to use the NEXT 1 Department Of The Treasury Internal Revenue

Using the NEXT 1 form involves several steps that ensure accurate completion and submission. Begin by gathering all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via traditional mail, depending on the IRS guidelines.

Steps to complete the NEXT 1 Department Of The Treasury Internal Revenue

Completing the NEXT 1 form requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Follow this with the relevant financial data, ensuring that figures are accurate and reflect your current tax situation. Review the form for any errors before submission to avoid delays or penalties.

Legal use of the NEXT 1 Department Of The Treasury Internal Revenue

The NEXT 1 form must be used in accordance with IRS regulations. It is legally binding, meaning that any inaccuracies or omissions can lead to penalties. Users must ensure they understand the legal implications of the information provided, as it can affect their tax liabilities and compliance status.

Filing Deadlines / Important Dates

Timely filing of the NEXT 1 form is essential to avoid penalties. The IRS sets specific deadlines for submission, which can vary based on the taxpayer's situation. It is important to stay informed about these dates to ensure compliance and avoid any late fees or interest charges.

Required Documents

To complete the NEXT 1 form accurately, certain documents are necessary. These typically include proof of income, such as W-2s or 1099s, along with any other relevant financial statements. Having these documents on hand will facilitate a smoother filing process and help ensure that all information is accurate.

Penalties for Non-Compliance

Failure to comply with the requirements of the NEXT 1 form can result in significant penalties. The IRS may impose fines, interest on unpaid taxes, or other legal consequences. Understanding these risks is vital for taxpayers to ensure they meet all filing obligations and avoid unnecessary financial burdens.

Quick guide on how to complete next 1department of the treasuryinternal revenue

Effortlessly Prepare NEXT 1 Department Of The Treasury Internal Revenue on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage NEXT 1 Department Of The Treasury Internal Revenue on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and eSign NEXT 1 Department Of The Treasury Internal Revenue with Minimal Effort

- Obtain NEXT 1 Department Of The Treasury Internal Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or mask sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Leave behind the issues of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign NEXT 1 Department Of The Treasury Internal Revenue and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct next 1department of the treasuryinternal revenue

Create this form in 5 minutes!

How to create an eSignature for the next 1department of the treasuryinternal revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the NEXT 1 Department Of The Treasury Internal Revenue?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents efficiently. It ensures compliance with regulations related to the NEXT 1 Department Of The Treasury Internal Revenue, streamlining document management and reducing processing times.

-

How does airSlate SignNow help with tax-related documents for the NEXT 1 Department Of The Treasury Internal Revenue?

With airSlate SignNow, you can easily prepare, send, and eSign tax-related documents required by the NEXT 1 Department Of The Treasury Internal Revenue. Our platform enhances accuracy and timeliness, ensuring that documents signNow the IRS quickly and securely.

-

What are the pricing options for airSlate SignNow for businesses dealing with the NEXT 1 Department Of The Treasury Internal Revenue?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes, making it accessible for those handling the NEXT 1 Department Of The Treasury Internal Revenue documents. You can choose from various plans based on your document signing needs and budget.

-

What features does airSlate SignNow offer for compliance with NEXT 1 Department Of The Treasury Internal Revenue regulations?

airSlate SignNow includes features like secure eSigning, document storage, and audit trails that help businesses comply with NEXT 1 Department Of The Treasury Internal Revenue regulations. These features ensure that your documents are signed in a legally binding manner and can be tracked easily.

-

Can airSlate SignNow integrate with other software for seamless management of NEXT 1 Department Of The Treasury Internal Revenue documents?

Yes, airSlate SignNow integrates with various platforms, allowing you to streamline the management of documents required by the NEXT 1 Department Of The Treasury Internal Revenue. Integrations with services like CRM and cloud storage can enhance your workflow efficiency.

-

What benefits can businesses gain from using airSlate SignNow in relation to NEXT 1 Department Of The Treasury Internal Revenue?

By using airSlate SignNow, businesses can enjoy benefits such as expedited processes, reduced paper usage, and improved document accuracy, particularly for the NEXT 1 Department Of The Treasury Internal Revenue forms. This can result in signNow time and cost savings.

-

Is airSlate SignNow secure for handling sensitive NEXT 1 Department Of The Treasury Internal Revenue documents?

Absolutely, airSlate SignNow prioritizes security, employing encryption and secure data storage practices to protect sensitive documents related to the NEXT 1 Department Of The Treasury Internal Revenue. Your data is safe with our industry-standard security protocols.

Get more for NEXT 1 Department Of The Treasury Internal Revenue

- Irginia department of health rappahannock area health district application for temporary resturant permit form

- Printable stamp album pages pdf form

- Appendix 6 undertaking declaration form

- Campbell county occupational license form

- Truicare overseas estate notification form

- Phoenix water bill form

- Application for issue of permanent degree certificate for all form

- Kohler dealer program information form kohler co

Find out other NEXT 1 Department Of The Treasury Internal Revenue

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document