Proposition 130 Constitutional Property Tax Exemptions 2023

Understanding Proposition 130 Constitutional Property Tax Exemptions

Proposition 130 introduces significant changes to property tax exemptions in the United States, aiming to provide relief to specific groups of taxpayers. This measure is designed to offer constitutional property tax exemptions to qualifying individuals, such as seniors, veterans, and those with disabilities. By understanding the provisions of Proposition 130, taxpayers can better navigate their eligibility and the benefits available to them.

Eligibility Criteria for Proposition 130 Constitutional Property Tax Exemptions

To qualify for the exemptions under Proposition 130, applicants must meet certain criteria. Generally, eligibility includes:

- Age requirements, typically for seniors aged sixty-five and older.

- Service-related disabilities for veterans, which may require documentation.

- Proof of income or financial need, depending on state regulations.

Each state may have additional specific requirements, so it is essential to review local guidelines to ensure compliance.

Steps to Complete the Proposition 130 Constitutional Property Tax Exemptions

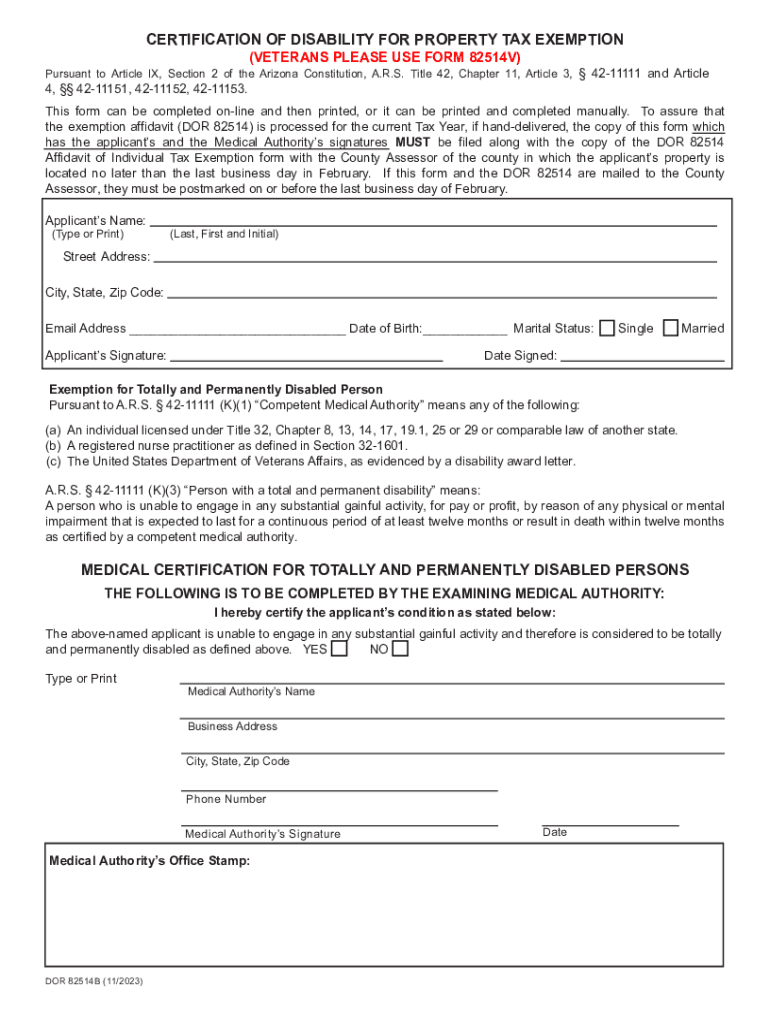

Completing the application for Proposition 130 exemptions involves several key steps:

- Gather necessary documentation, including proof of age, disability, or veteran status.

- Complete the application form accurately, ensuring all required fields are filled.

- Submit the application by the designated deadline, which varies by state.

- Follow up with the local tax authority to confirm receipt and status of your application.

By following these steps, applicants can ensure they meet all requirements and deadlines for the exemptions.

Required Documents for Proposition 130 Constitutional Property Tax Exemptions

When applying for Proposition 130 exemptions, specific documents are typically required to verify eligibility. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Verification of age, such as a birth certificate or other official documents.

- Documentation of disability status or veteran status, which may include medical records or military discharge papers.

- Financial statements or tax returns to demonstrate income levels, if applicable.

Ensuring all necessary documents are prepared can streamline the application process.

State-Specific Rules for Proposition 130 Constitutional Property Tax Exemptions

Each state may implement Proposition 130 differently, leading to variations in rules and regulations. It is crucial for applicants to familiarize themselves with their state's specific guidelines, which may include:

- Different eligibility criteria based on local laws.

- Unique application processes and deadlines.

- Specific forms required for submission.

Consulting the local tax authority or their website can provide clarity on these state-specific rules.

Examples of Using Proposition 130 Constitutional Property Tax Exemptions

Understanding how Proposition 130 exemptions apply can help potential applicants visualize their benefits. For instance:

- A senior citizen living on a fixed income may qualify for a significant reduction in their property taxes, allowing them to allocate funds toward healthcare or other necessities.

- A disabled veteran may receive full exemption from property taxes, providing financial relief and supporting their reintegration into civilian life.

These examples illustrate the positive impact of Proposition 130 on qualifying individuals and families.

Quick guide on how to complete proposition 130 constitutional property tax exemptions

Prepare Proposition 130 Constitutional Property Tax Exemptions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Proposition 130 Constitutional Property Tax Exemptions on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Proposition 130 Constitutional Property Tax Exemptions with ease

- Obtain Proposition 130 Constitutional Property Tax Exemptions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you want to share your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Proposition 130 Constitutional Property Tax Exemptions and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct proposition 130 constitutional property tax exemptions

Create this form in 5 minutes!

How to create an eSignature for the proposition 130 constitutional property tax exemptions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key benefits of Proposition 130 Constitutional Property Tax Exemptions?

Proposition 130 Constitutional Property Tax Exemptions provide property owners with signNow tax relief by exempting certain properties from taxation. This means lower financial burdens for homeowners and businesses alike, allowing them to reinvest in their properties or communities. Understanding these benefits is crucial for maximizing your financial health.

-

How can I apply for Proposition 130 Constitutional Property Tax Exemptions?

To apply for Proposition 130 Constitutional Property Tax Exemptions, you need to complete the appropriate forms provided by your local tax assessor's office. Be sure to include all required documentation to support your claim. Once submitted, you will receive confirmation of your application status, ensuring you’re informed throughout the process.

-

Are there specific eligibility requirements for Proposition 130 Constitutional Property Tax Exemptions?

Yes, eligibility for Proposition 130 Constitutional Property Tax Exemptions typically requires properties to meet certain criteria, such as usage for residential or specific business activities. It’s important to check with your local jurisdiction, as requirements can vary. Being informed about these guidelines helps ensure your application is successful.

-

What costs are involved in applying for Proposition 130 Constitutional Property Tax Exemptions?

Applying for Proposition 130 Constitutional Property Tax Exemptions usually does not involve direct fees, but there may be associated costs such as documentation or appraisal fees. It’s advisable to consult with your local tax authority for detailed information regarding any potential costs. Understanding these can help you budget accordingly.

-

How do Proposition 130 Constitutional Property Tax Exemptions impact property values?

Proposition 130 Constitutional Property Tax Exemptions can positively impact property values by making ownership more affordable. When property taxes are reduced, owners may have more capital to invest in improvements, which can enhance the overall value of the property. This can create a more appealing market for buyers as well.

-

Can I combine Proposition 130 Constitutional Property Tax Exemptions with other tax benefits?

Yes, you may be able to combine Proposition 130 Constitutional Property Tax Exemptions with other tax benefits, depending on local laws and your specific situation. It’s essential to review your options with a tax professional to maximize your savings. By integrating these exemptions effectively, you can enhance your tax strategy.

-

What documents do I need for applying for Proposition 130 Constitutional Property Tax Exemptions?

Generally, you will need documentation like proof of ownership, occupancy details, and any other relevant financial statements to apply for Proposition 130 Constitutional Property Tax Exemptions. Each jurisdiction may require different documents, so it is important to check with your local tax authority. Gathering the right paperwork can streamline the application process.

Get more for Proposition 130 Constitutional Property Tax Exemptions

- Inf 1133 commercial requester account instructionsapplication intellicorp form

- Inv 172a rev dmv ca form

- Bmv wooster power of attorney form 2004

- Form 362 chp 1999

- Department of california highway patrol application for terminal inspection 2007 form

- Google reg 227 form

- Owneramp39s request to purge a manufactured home title coloradogov colorado form

- Co driver handbook form

Find out other Proposition 130 Constitutional Property Tax Exemptions

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document