DOR 82514B Azdor 2011

What is the DOR 82514B Azdor

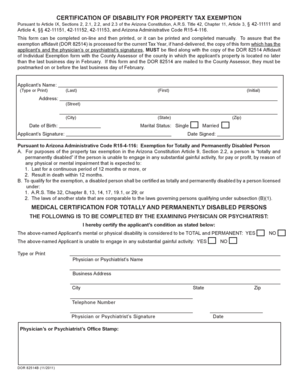

The DOR 82514B Azdor is a specific form utilized for tax-related purposes within the United States. It is designed to collect essential information from taxpayers, ensuring compliance with state regulations. This form may be required for various applications, including but not limited to tax filings, exemptions, or other financial disclosures. Understanding its purpose is crucial for individuals and businesses to navigate their tax obligations effectively.

How to use the DOR 82514B Azdor

Using the DOR 82514B Azdor involves several straightforward steps. First, gather all necessary information, including personal identification details and financial records. Next, access the form, which can typically be found on the state’s Department of Revenue website or through authorized channels. Fill out the form accurately, ensuring that all required fields are completed. Once the form is filled, review it for any errors before submission. Finally, submit the completed form through the designated method, whether online, by mail, or in person.

Steps to complete the DOR 82514B Azdor

Completing the DOR 82514B Azdor requires careful attention to detail. Follow these steps for accurate completion:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documentation, including identification and financial records.

- Fill in the form, ensuring all fields are completed accurately.

- Double-check for any errors or omissions.

- Submit the form through the appropriate channels.

Legal use of the DOR 82514B Azdor

The DOR 82514B Azdor must be used in accordance with state laws and regulations. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies may lead to legal repercussions. The form serves as a legal document, and its completion signifies compliance with tax obligations. Understanding the legal implications of this form helps taxpayers avoid potential penalties.

Key elements of the DOR 82514B Azdor

Several key elements define the DOR 82514B Azdor. These include:

- Identification Information: Personal details such as name, address, and social security number.

- Financial Information: Relevant income and expense details necessary for tax calculations.

- Signature: The taxpayer's signature is required to validate the form.

- Date: The date of submission is crucial for compliance with filing deadlines.

Form Submission Methods

The DOR 82514B Azdor can be submitted through various methods, providing flexibility for taxpayers. Common submission options include:

- Online: Many states allow for electronic submission through their Department of Revenue websites.

- By Mail: Taxpayers can print the completed form and send it via postal service to the designated address.

- In-Person: Some individuals may choose to submit the form directly at local tax offices.

Quick guide on how to complete dor 82514b azdor

Complete DOR 82514B Azdor effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle DOR 82514B Azdor on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign DOR 82514B Azdor with ease

- Find DOR 82514B Azdor and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device of your choice. Modify and eSign DOR 82514B Azdor and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor 82514b azdor

Create this form in 5 minutes!

How to create an eSignature for the dor 82514b azdor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DOR 82514B Azdor and how does it work?

The DOR 82514B Azdor is a cutting-edge electronic signature solution that simplifies document management. With its intuitive interface, users can easily send, sign, and track documents securely. It streamlines the signing process, making it ideal for businesses of all sizes.

-

How much does the DOR 82514B Azdor cost?

Pricing for the DOR 82514B Azdor varies based on the subscription plan you choose. airSlate SignNow offers various pricing tiers to suit different business needs. Each plan provides cost-effective solutions with added features to enhance your document signing experience.

-

What features does the DOR 82514B Azdor offer?

The DOR 82514B Azdor includes features such as customizable templates, real-time tracking, and multi-party signing. It also provides options for secure storage and integration with various applications. These features are designed to improve efficiency and productivity in document management.

-

Can I integrate the DOR 82514B Azdor with other software?

Yes, the DOR 82514B Azdor can seamlessly integrate with numerous software applications, enhancing its functionality. Integration options include popular CRM systems, project management tools, and cloud storage services. This flexibility allows you to create a more cohesive digital workflow.

-

What are the benefits of using the DOR 82514B Azdor?

Using the DOR 82514B Azdor enhances efficiency by reducing paperwork and accelerating the signing process. Businesses can save time and money while ensuring secure document transactions. Additionally, the platform's user-friendly interface makes it easy for anyone to use.

-

Is the DOR 82514B Azdor secure?

Absolutely, the DOR 82514B Azdor prioritizes security with advanced encryption and compliance with industry standards. It ensures that all documents signed through the platform are protected against unauthorized access. You can trust that your sensitive information is safe.

-

Who can benefit from the DOR 82514B Azdor?

The DOR 82514B Azdor is ideal for businesses of all sizes, including freelancers, small businesses, and large enterprises. It caters to industries that require secure document signing and management. Anyone looking for an efficient solution to manage signatures can greatly benefit from it.

Get more for DOR 82514B Azdor

- Illinois attorney health form

- Form 1229a

- Illinois foia form

- Illinois self employment record form

- Il il informational form dhs

- Additional staff support and 1 or 2 person cila request dhs state il form

- Illinois organtissue donor registry cyberdriveillinoiscom form

- Phone 800 367 6401 fax 855 645 8242 form

Find out other DOR 82514B Azdor

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy