The with Form 500D, the Corporation May Partially or

Understanding the Form 500D

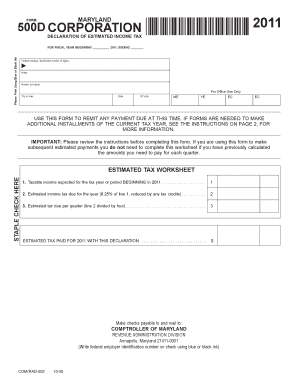

The Form 500D is a specific document used by corporations to report certain financial information. This form is essential for compliance with U.S. tax regulations and is particularly relevant for corporations that may partially or fully meet specific criteria set forth by the IRS. Understanding the purpose and requirements of this form is crucial for businesses to ensure proper reporting and avoid penalties.

Steps to Complete the Form 500D

Completing the Form 500D involves several key steps:

- Gather necessary financial documents, including balance sheets and income statements.

- Fill out the form accurately, ensuring all required sections are completed.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid late penalties.

Legal Use of the Form 500D

The Form 500D serves a legal purpose in the context of corporate financial reporting. It is used to disclose specific financial information to the IRS, ensuring transparency and compliance with federal tax laws. Proper use of this form helps corporations maintain good standing and avoid legal repercussions associated with non-compliance.

Filing Deadlines for Form 500D

Corporations must adhere to specific filing deadlines for the Form 500D. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. It is essential for businesses to mark these dates on their calendars to ensure timely submission and avoid any associated penalties.

Required Documents for Form 500D

To complete the Form 500D, corporations must prepare and submit several supporting documents, including:

- Financial statements, such as income statements and balance sheets.

- Tax identification numbers and other relevant corporate information.

- Any additional documentation requested by the IRS related to financial disclosures.

Obtaining the Form 500D

The Form 500D can be obtained directly from the IRS website or through authorized tax preparation software. It is important to ensure that the most current version of the form is used to comply with the latest tax regulations. Businesses should also verify that they have access to any supplementary materials that may assist in completing the form accurately.

Quick guide on how to complete the with form 500d the corporation may partially or

Prepare [SKS] easily on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to The with Form 500D, The Corporation May Partially Or

Create this form in 5 minutes!

How to create an eSignature for the the with form 500d the corporation may partially or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The with Form 500D, The Corporation May Partially Or, and how can it benefit my business?

The with Form 500D, The Corporation May Partially Or, is a regulatory document that outlines specific obligations for corporations in various contexts. By utilizing airSlate SignNow, businesses can easily manage and eSign this form, ensuring compliance while saving time and reducing administrative burden. This efficiency allows businesses to focus on core activities rather than paperwork.

-

How does airSlate SignNow support the completion of The with Form 500D, The Corporation May Partially Or?

airSlate SignNow provides users with templates and a user-friendly interface to fill out The with Form 500D, The Corporation May Partially Or. This platform allows for electronic signatures, enabling users to quickly and securely execute documents without the hassle of printing or mailing. This streamlines the workflow, facilitating faster transaction completions.

-

What pricing plans does airSlate SignNow offer for businesses needing The with Form 500D, The Corporation May Partially Or?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses requiring The with Form 500D, The Corporation May Partially Or. Plans range from basic to enterprise options, accommodating different volumes of document processing and feature requirements. This flexibility ensures that businesses can choose a plan that fits their budget and operational needs.

-

Are there any features specifically designed for managing The with Form 500D, The Corporation May Partially Or?

Yes, airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking specifically for managing The with Form 500D, The Corporation May Partially Or. These features enhance document management, ensuring that users can access and update their forms seamlessly. Moreover, built-in reminders help users stay compliant with filing deadlines.

-

Does airSlate SignNow integrate with other software for The with Form 500D, The Corporation May Partially Or. operations?

Certainly! airSlate SignNow seamlessly integrates with various business applications such as CRM systems and cloud storage services, enhancing workflows for The with Form 500D, The Corporation May Partially Or. This integration allows for automated data entry and document management, signNowly improving efficiency and accuracy across corporate operations.

-

Can airSlate SignNow help ensure compliance with The with Form 500D, The Corporation May Partially Or. requirements?

Absolutely! airSlate SignNow takes compliance seriously and provides built-in features to help users meet the requirements associated with The with Form 500D, The Corporation May Partially Or. The platform ensures that all electronic signatures comply with regulation standards, providing peace of mind for businesses concerned with legal adherence.

-

Is there a mobile app available for access to The with Form 500D, The Corporation May Partially Or. documents?

Yes, airSlate SignNow offers a mobile app that allows users to access, manage, and eSign The with Form 500D, The Corporation May Partially Or. documents on the go. This convenience ensures that users can stay productive, enabling immediate actions anytime, anywhere, and keeping workflow uninterrupted.

Get more for The with Form 500D, The Corporation May Partially Or

- Flag football stat sheet 450010716 form

- Aae case difficulty assessment form

- Delhi jal board contractor list form

- Operational level agreements with onboarding service providers form

- Domino a300 manual pdf form

- Jiskoot inspec sampler controller form

- Nww form1145 idwr 3804 b

- Surgical tech competency checklist form

Find out other The with Form 500D, The Corporation May Partially Or

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document