This Note is to Inform the University Community that W2 Forms Fordham

Understanding the Fordham W-2 Form

The Fordham W-2 form is a crucial document for employees of Fordham University, providing essential information about their annual wages and the taxes withheld from their paychecks. This form is used to report income to the Internal Revenue Service (IRS) and is necessary for filing personal income tax returns. It includes details such as the employee's total earnings, Social Security wages, Medicare wages, and federal and state tax withholdings.

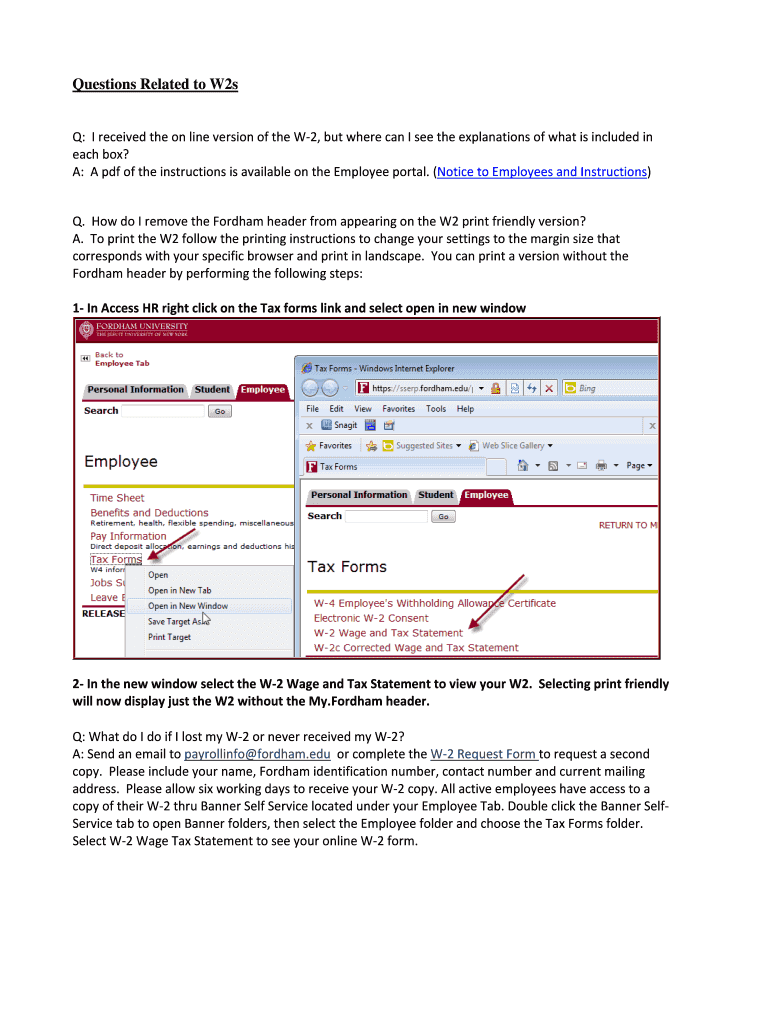

How to Obtain the Fordham W-2 Form

Employees can typically access their Fordham W-2 forms through the university's payroll or human resources department. The forms may be distributed electronically via a secure online portal or mailed directly to the employee's address. It is important for employees to ensure that their contact information is up to date to receive their W-2 forms promptly.

Steps to Complete the Fordham W-2 Form

Completing the Fordham W-2 form involves several steps. First, employees should verify their personal information, including name, address, and Social Security number, to ensure accuracy. Next, they should review the reported earnings and tax withholdings for correctness. If any discrepancies are found, employees should contact the payroll department for corrections. Finally, once verified, employees can use the information on the W-2 form to accurately complete their tax returns.

Legal Use of the Fordham W-2 Form

The Fordham W-2 form is legally required for reporting income and tax withholdings to the IRS. Employees must use this form when filing their federal and state tax returns to ensure compliance with tax laws. Accurate reporting is essential to avoid potential penalties or issues with the IRS. Employers are also obligated to provide this form to their employees by January 31 of each year.

Filing Deadlines and Important Dates

Employees should be aware of key deadlines related to the Fordham W-2 form. The IRS requires that employers send out W-2 forms by January 31 each year. Additionally, employees must file their tax returns by April 15. Being mindful of these dates helps ensure timely compliance with tax obligations and avoids late fees.

Penalties for Non-Compliance

Failure to file the Fordham W-2 form correctly or on time can result in penalties for both employees and employers. Employees may face fines from the IRS for incorrect or late filings. Employers are also subject to penalties if they fail to provide accurate W-2 forms to their employees or do not file them with the IRS on time. Understanding these consequences underscores the importance of proper handling of the W-2 form.

Quick guide on how to complete fordham w2

Prepare fordham w2 effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage fordham w2 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and electronically sign fordham w2 without hassle

- Find fordham w2 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign fordham w2 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to fordham w2

Create this form in 5 minutes!

How to create an eSignature for the fordham w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask fordham w2

-

What is the Fordham W2, and how can I access it?

The Fordham W2 is a tax form provided by Fordham University that summarizes an employee's earnings and tax withholdings for the year. To access your Fordham W2, log in to the Fordham University online portal where you can securely download the form and keep track of your tax documents.

-

How does airSlate SignNow simplify the process of handling Fordham W2 forms?

airSlate SignNow streamlines the electronic signing and distribution of Fordham W2 forms by providing an easy-to-use platform for both employers and employees. This saves time and reduces the likelihood of errors, ensuring that your Fordham W2 is delivered accurately and on time.

-

What features does airSlate SignNow offer for managing Fordham W2 documents?

airSlate SignNow offers features like eSignature, document templates, and secure storage, which are crucial for managing Fordham W2 documents efficiently. These features enable users to send, sign, and store important tax documents securely, making the process much more efficient.

-

Is there a cost associated with using airSlate SignNow for Fordham W2 management?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your requirements for managing Fordham W2 forms, you can choose a plan that fits your budget while taking advantage of the platform's robust features.

-

Can I integrate airSlate SignNow with other tools for better management of Fordham W2 forms?

Absolutely! airSlate SignNow supports integration with a variety of applications and services, making it easier to manage Fordham W2 forms alongside your existing tools. Popular integrations include CRM systems, cloud storage services, and payroll software.

-

What are the benefits of using airSlate SignNow for sending Fordham W2 forms?

Using airSlate SignNow to send Fordham W2 forms provides several benefits, including enhanced security, reduced processing time, and improved user experience. By leveraging electronic signatures, you can streamline your workflow and ensure a more efficient tax filing process.

-

Is airSlate SignNow compliant with regulations for handling Fordham W2 forms?

Yes, airSlate SignNow is fully compliant with federal and state regulations for handling sensitive documents such as Fordham W2 forms. It utilizes industry-standard security measures to protect user data and ensure that all electronic signatures are legally binding.

Get more for fordham w2

Find out other fordham w2

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy