Fiscal Sponsorship Donation Form New York Live Arts

What is the Fiscal Sponsorship Donation Form New York Live Arts

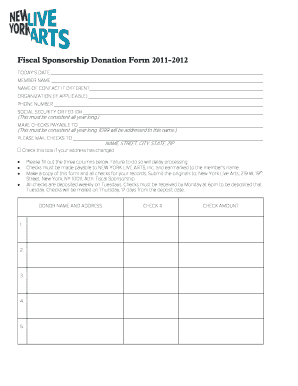

The Fiscal Sponsorship Donation Form for New York Live Arts is a crucial document that allows individuals and organizations to make tax-deductible contributions to projects supported by New York Live Arts. This form serves as a formal agreement between the donor and the fiscal sponsor, ensuring that donations are processed according to IRS regulations. By using this form, donors can support artistic initiatives while benefiting from tax deductions, as contributions made through a fiscal sponsor are often eligible for tax-exempt status.

How to use the Fiscal Sponsorship Donation Form New York Live Arts

Using the Fiscal Sponsorship Donation Form is a straightforward process. Donors should first download the form from the New York Live Arts website or obtain it directly from their office. Once acquired, the form must be filled out with accurate information, including the donor's name, contact details, and the amount of the donation. After completing the form, donors can submit it along with their contribution, ensuring that all necessary details are provided to facilitate proper processing. This form is essential for tracking donations and ensuring compliance with tax regulations.

Steps to complete the Fiscal Sponsorship Donation Form New York Live Arts

Completing the Fiscal Sponsorship Donation Form involves several key steps:

- Download the form from the New York Live Arts website or request a physical copy.

- Fill in the donor's name and contact information accurately.

- Specify the amount of the donation clearly.

- Include any additional information required, such as project designation if applicable.

- Review the form for accuracy before submission.

- Submit the completed form along with the donation, either online, by mail, or in person.

Key elements of the Fiscal Sponsorship Donation Form New York Live Arts

Several key elements are essential to the Fiscal Sponsorship Donation Form. These include:

- Donor Information: Essential details such as name, address, and contact information.

- Donation Amount: The specific amount being donated, which is crucial for tax records.

- Project Designation: Identifying the specific project or initiative the donation supports, if applicable.

- Signature: The donor's signature, which confirms the authenticity of the donation.

- Date: The date when the donation is made, important for record-keeping and tax purposes.

Legal use of the Fiscal Sponsorship Donation Form New York Live Arts

The legal use of the Fiscal Sponsorship Donation Form is governed by IRS regulations regarding charitable contributions. This form must be completed accurately to ensure that donations qualify for tax deductions. Donors should retain a copy of the completed form for their records, as it serves as proof of the donation for tax purposes. Additionally, New York Live Arts must comply with state and federal laws governing fiscal sponsorship to maintain its tax-exempt status and ensure that all donations are handled appropriately.

Form Submission Methods (Online / Mail / In-Person)

Donors have multiple options for submitting the Fiscal Sponsorship Donation Form. These methods include:

- Online Submission: If available, donors can complete and submit the form digitally through the New York Live Arts website.

- Mail: Donors can print the completed form and send it via postal mail to the designated address provided by New York Live Arts.

- In-Person: Donors may also choose to deliver the form directly to the New York Live Arts office, allowing for immediate processing of their donation.

Quick guide on how to complete fiscal sponsorship donation form new york live arts

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to generate, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive data using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Fiscal Sponsorship Donation Form New York Live Arts

Create this form in 5 minutes!

How to create an eSignature for the fiscal sponsorship donation form new york live arts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fiscal Sponsorship Donation Form for New York Live Arts?

A Fiscal Sponsorship Donation Form for New York Live Arts is a document that allows donors to contribute funds to projects while benefiting from the sponsorship of a tax-exempt organization like New York Live Arts. It streamlines the donation process, ensuring compliance and transparency for both the donor and the organization.

-

How do I create a Fiscal Sponsorship Donation Form for New York Live Arts using airSlate SignNow?

Creating a Fiscal Sponsorship Donation Form for New York Live Arts using airSlate SignNow is simple. You can utilize our user-friendly interface to design a custom form, add necessary fields for donor information, and integrate it with your existing workflows for efficient management.

-

What are the costs associated with using airSlate SignNow for the Fiscal Sponsorship Donation Form for New York Live Arts?

The costs for using airSlate SignNow services depend on the selected plan, which provides various features and capabilities. We offer a cost-effective solution that ensures you can efficiently manage your Fiscal Sponsorship Donation Form for New York Live Arts without exceeding your budget.

-

What features does airSlate SignNow offer for managing a Fiscal Sponsorship Donation Form for New York Live Arts?

airSlate SignNow offers several key features to manage your Fiscal Sponsorship Donation Form for New York Live Arts, including customizable templates, electronic signature capabilities, and secure document storage. These features facilitate smooth transactions while ensuring compliance with fiscal sponsorship regulations.

-

Can I track donations made through the Fiscal Sponsorship Donation Form for New York Live Arts?

Yes, with airSlate SignNow, you can easily track all donations made through the Fiscal Sponsorship Donation Form for New York Live Arts. The platform provides detailed insights and reports, allowing you to monitor contributions in real-time, ensuring transparency and accountability.

-

Is it possible to integrate airSlate SignNow with other tools for the Fiscal Sponsorship Donation Form for New York Live Arts?

Absolutely! airSlate SignNow offers seamless integrations with various tools like CRM systems, email marketing services, and accounting software. This allows you to enhance the management of your Fiscal Sponsorship Donation Form for New York Live Arts and streamline overall operations.

-

What benefits does using airSlate SignNow bring to the Fiscal Sponsorship Donation Form for New York Live Arts?

Using airSlate SignNow for your Fiscal Sponsorship Donation Form for New York Live Arts provides numerous benefits, including greater efficiency in document handling, enhanced donor experience through easy signing, and improved compliance with fiscal regulations. This ultimately helps boost your fundraising efforts.

Get more for Fiscal Sponsorship Donation Form New York Live Arts

Find out other Fiscal Sponsorship Donation Form New York Live Arts

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed