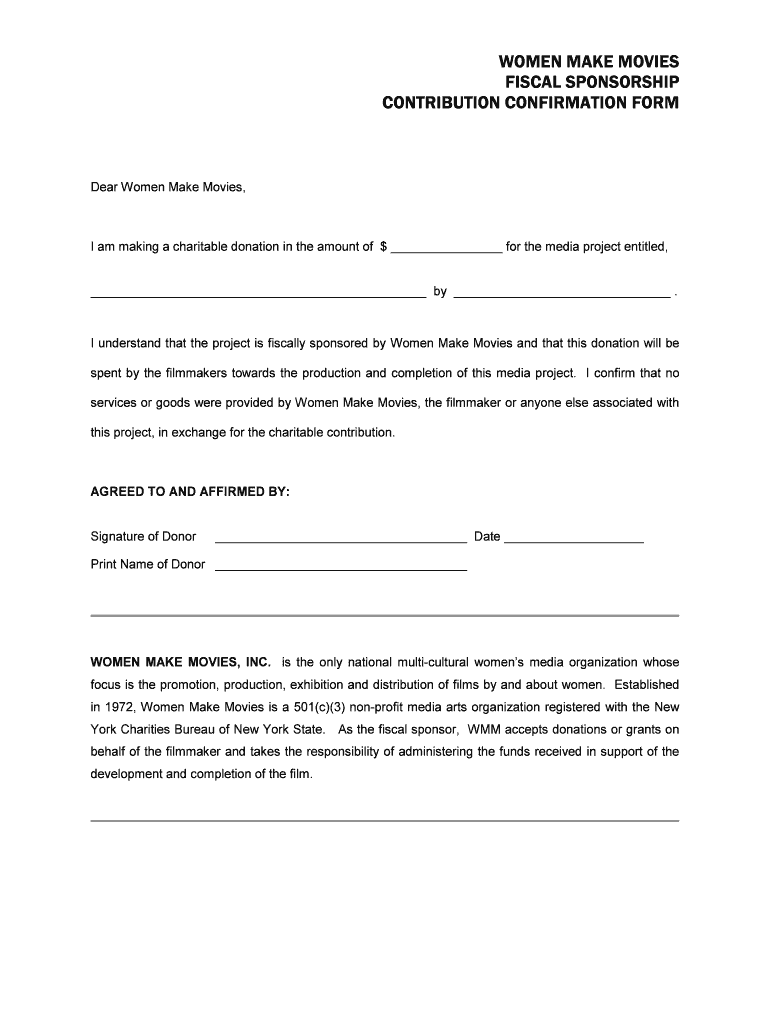

Contribution Confirmation Form

What is the Contribution Confirmation Form

The Contribution Confirmation Form is a crucial document used to verify and confirm contributions made to various organizations, often for tax purposes. This form serves as proof of the amount contributed, the date of the contribution, and the recipient organization. It is particularly important for individuals and businesses that wish to claim tax deductions for charitable donations or other contributions. By providing detailed information, the form ensures transparency and compliance with IRS regulations.

How to use the Contribution Confirmation Form

Using the Contribution Confirmation Form involves several straightforward steps. First, gather all necessary information regarding the contribution, including the recipient organization’s details, the amount donated, and the date of the contribution. Next, fill out the form accurately, ensuring that all fields are completed. After filling out the form, review it for any errors before submission. This form can be submitted electronically or printed and mailed, depending on the requirements of the recipient organization.

Steps to complete the Contribution Confirmation Form

Completing the Contribution Confirmation Form requires attention to detail. Follow these steps for accurate completion:

- Begin by entering your personal information, including your name and contact details.

- Provide the name and address of the organization receiving the contribution.

- Specify the amount of the contribution and the date it was made.

- If applicable, include any additional information required by the organization, such as a description of the contribution.

- Review the form for accuracy, ensuring all information is correct.

- Sign and date the form to validate it.

Legal use of the Contribution Confirmation Form

The Contribution Confirmation Form holds legal significance, particularly for tax purposes. It serves as documentation that can be requested by the IRS during audits or reviews. To ensure its legal validity, it is essential to complete the form accurately and retain a copy for personal records. Organizations may also have specific guidelines regarding the use of this form, which should be followed to maintain compliance with legal standards.

Key elements of the Contribution Confirmation Form

Several key elements must be included in the Contribution Confirmation Form to ensure its effectiveness and compliance:

- Donor Information: Name, address, and contact details of the individual or entity making the contribution.

- Recipient Organization: Name and address of the organization receiving the contribution.

- Contribution Amount: The total monetary value or description of non-monetary contributions.

- Date of Contribution: The specific date when the contribution was made.

- Signature: A signature from the donor to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Contribution Confirmation Form. It is essential to ensure that the form meets all IRS requirements to qualify for tax deductions. The IRS may require additional documentation for larger contributions, so it is advisable to keep receipts or other proof of payment. Familiarizing oneself with IRS guidelines helps in understanding the requirements for proper documentation and compliance.

Quick guide on how to complete contribution confirmation form

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your documents quickly without any holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

The easiest method to alter and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Contribution Confirmation Form

Create this form in 5 minutes!

How to create an eSignature for the contribution confirmation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Contribution Confirmation Form?

A Contribution Confirmation Form is a document used to verify and acknowledge contributions made by an individual or organization. With airSlate SignNow, you can easily create and eSign these forms, streamlining your process and ensuring accurate record-keeping.

-

How can I create a Contribution Confirmation Form using airSlate SignNow?

Creating a Contribution Confirmation Form with airSlate SignNow is straightforward. Simply use our intuitive template builder to customize your form, add necessary fields, and invite signers to complete and eSign it, all within a secure environment.

-

Is there a cost associated with using the Contribution Confirmation Form?

airSlate SignNow offers cost-effective solutions tailored to various business needs, including options for creating Contribution Confirmation Forms. Pricing varies based on features and user requirements, allowing you to choose a plan that aligns with your budget and needs.

-

What features does airSlate SignNow offer for Contribution Confirmation Forms?

airSlate SignNow provides a range of features for Contribution Confirmation Forms, including customizable templates, automated workflows, and templates for quick re-use. Additionally, you can track the status of forms and receive notifications once they are signed.

-

What are the benefits of using airSlate SignNow for Contribution Confirmation Forms?

Using airSlate SignNow for your Contribution Confirmation Forms helps enhance efficiency, reduce errors, and save time. With our electronic signing capabilities, you can facilitate quicker approvals and improve overall document management for your organization.

-

Can I integrate airSlate SignNow with other applications for my Contribution Confirmation Forms?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enhancing your workflow for Contribution Confirmation Forms. Whether you are using CRM, project management tools, or other software, you can connect them with airSlate SignNow for a more streamlined experience.

-

Is it secure to use airSlate SignNow for my Contribution Confirmation Forms?

Absolutely, airSlate SignNow prioritizes security and compliance. All Contribution Confirmation Forms are protected with encryption and undergo regular security audits, ensuring that your sensitive data remains safe throughout the signing process.

Get more for Contribution Confirmation Form

Find out other Contribution Confirmation Form

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy