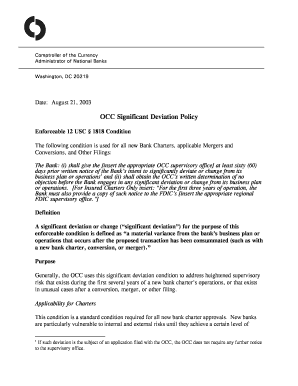

OCC Significant Deviation Policy Form

Understanding the OCC Significant Deviation Policy

The OCC Significant Deviation Policy is a regulatory framework designed to ensure that financial institutions maintain adequate risk management practices. This policy outlines the circumstances under which a deviation from established operational norms is considered significant enough to warrant attention from the Office of the Comptroller of the Currency (OCC). Understanding this policy is crucial for institutions to align their operations with regulatory expectations and manage potential risks effectively.

Steps to Utilize the OCC Significant Deviation Policy

To effectively use the OCC Significant Deviation Policy, institutions should follow a systematic approach:

- Identify potential deviations in operational practices that may impact risk management.

- Assess the significance of these deviations based on established criteria set forth by the OCC.

- Document the findings and rationale for any deviations that are deemed significant.

- Communicate with relevant stakeholders within the institution to ensure awareness and compliance.

- Implement corrective measures as necessary to align with the policy requirements.

Key Components of the OCC Significant Deviation Policy

The OCC Significant Deviation Policy includes several key elements that institutions must consider:

- Definition of Significant Deviation: Clear criteria that define what constitutes a significant deviation from standard practices.

- Reporting Requirements: Guidelines on how and when to report significant deviations to the OCC.

- Risk Assessment: Framework for evaluating the risks associated with deviations and their potential impact on the institution.

- Corrective Actions: Recommendations for actions to mitigate risks arising from significant deviations.

Legal Considerations for the OCC Significant Deviation Policy

Compliance with the OCC Significant Deviation Policy is not just a best practice; it is a legal requirement for financial institutions. Institutions must ensure that their operations adhere to the policy to avoid regulatory penalties. Legal implications may include fines, restrictions on operations, or increased scrutiny from regulators. It is essential for institutions to stay informed about any changes to the policy to maintain compliance.

Examples of Applying the OCC Significant Deviation Policy

Understanding practical applications of the OCC Significant Deviation Policy can help institutions navigate compliance challenges. For instance:

- A bank may discover that its loan underwriting process has deviated from its established guidelines due to changes in market conditions. This deviation must be assessed for significance and reported if it meets the OCC criteria.

- A financial institution might implement a new technology that alters its risk assessment processes. If this change significantly deviates from previous methodologies, it must be documented and evaluated.

Required Documentation for Compliance

To comply with the OCC Significant Deviation Policy, institutions need to maintain thorough documentation. This includes:

- Records of identified deviations and their assessments.

- Documentation of communications with stakeholders regarding significant deviations.

- Evidence of corrective actions taken in response to significant deviations.

Proper documentation not only aids in compliance but also serves as a valuable resource for audits and reviews by regulatory bodies.

Quick guide on how to complete occ significant deviation policy

Complete [SKS] effortlessly on any device

Web-based document management has increasingly gained traction among organizations and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed paperwork, as you can access the correct form and safely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and ease any document-oriented process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to OCC Significant Deviation Policy

Create this form in 5 minutes!

How to create an eSignature for the occ significant deviation policy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OCC signNow Deviation Policy?

The OCC signNow Deviation Policy refers to guidelines set by the Office of the Comptroller of the Currency concerning substantial deviations from established standards in banking practices. Understanding this policy is crucial for financial institutions to maintain compliance with regulations.

-

How does airSlate SignNow help with OCC signNow Deviation Policy compliance?

airSlate SignNow assists businesses in complying with the OCC signNow Deviation Policy by providing a secure and efficient way to manage documentation. Our eSigning solution ensures that all necessary documents are signed and stored correctly, reducing the risk of non-compliance.

-

What features make airSlate SignNow ideal for OCC signNow Deviation Policy management?

AirSlate SignNow offers features such as customizable templates, audit trails, and secure signing capabilities that are essential for managing the OCC signNow Deviation Policy. These features ensure all documents are properly documented and can be quickly retrieved when needed.

-

Are there any specific integrations available for OCC signNow Deviation Policy tracking?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems, which helps in tracking compliance with the OCC signNow Deviation Policy. These integrations streamline the documentation process, ensuring that all relevant information is easily accessible.

-

What is the pricing structure for airSlate SignNow regarding OCC signNow Deviation Policy solutions?

AirSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes. These plans include features that support compliance with the OCC signNow Deviation Policy, ensuring that companies can find a solution that fits their budget and needs.

-

What benefits does airSlate SignNow provide for managing OCC signNow Deviation Policy documentation?

By using airSlate SignNow for managing documentation related to the OCC signNow Deviation Policy, businesses can save time, reduce errors, and improve overall efficiency. The platform's automated workflows help streamline document management and ensure adherence to regulations.

-

How can I get started with airSlate SignNow for OCC signNow Deviation Policy needs?

Getting started with airSlate SignNow for your OCC signNow Deviation Policy needs is simple. You can sign up for a free trial on our website, which allows you to explore all features tailored for efficient document management and compliance.

Get more for OCC Significant Deviation Policy

- Bpmt admission start date in mharstare form

- Consumer loan application form 100058174

- Express scripts prior authorization form pdf 29123638

- Certification statement sample form

- Certificate of employers liability insurance amanda bla whizzbangpop co form

- Sis assessment pa form

- Stranger at the pentagon pdf form

- Corporate internet banking amendment form 77161012

Find out other OCC Significant Deviation Policy

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter