Information About Your Notice, Penalty and Interest

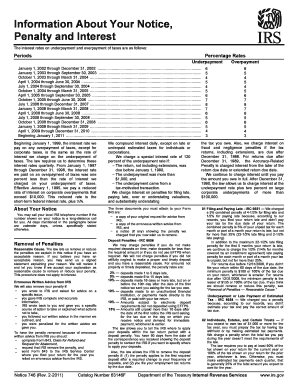

Understanding the Information About Your Notice, Penalty And Interest

The Information About Your Notice, Penalty And Interest form provides essential details regarding any notices received from the IRS or state tax authorities. This form outlines the nature of the penalty, the interest accrued, and the specific reasons for the notice. Understanding this information is crucial for taxpayers to address any outstanding obligations and ensure compliance with tax regulations.

How to Utilize the Information About Your Notice, Penalty And Interest

To effectively use the Information About Your Notice, Penalty And Interest, taxpayers should first carefully read the notice to identify the specific penalties and interest charges. Next, compare the information provided in the notice with your tax records to confirm accuracy. If discrepancies arise, gather supporting documentation to rectify the situation. This form serves as a reference point for understanding your tax responsibilities and any potential actions required.

Obtaining the Information About Your Notice, Penalty And Interest

Taxpayers can obtain the Information About Your Notice, Penalty And Interest by contacting the IRS directly or visiting their official website. Additionally, state tax agencies may provide similar resources for state-specific notices. It is advisable to have your tax identification number and any relevant documentation on hand when making inquiries to streamline the process.

Key Components of the Information About Your Notice, Penalty And Interest

Several key components are included in the Information About Your Notice, Penalty And Interest. These components typically feature:

- Notice Type: Identifies the specific notice issued.

- Penalty Amount: Details the total penalties incurred.

- Interest Charges: Outlines any interest added to the penalty.

- Payment Instructions: Provides guidance on how to settle the amount owed.

- Deadline for Response: Indicates the timeframe within which action must be taken.

Filing Deadlines and Important Dates

It is essential to be aware of filing deadlines and important dates related to the Information About Your Notice, Penalty And Interest. These dates can vary based on the type of notice received. Generally, taxpayers should respond to the notice by the specified deadline to avoid additional penalties or interest. Keeping a calendar of these dates can help ensure compliance and timely responses.

Penalties for Non-Compliance

Failure to address the Information About Your Notice, Penalty And Interest can result in significant penalties. These may include additional interest charges, increased penalties for late payments, or further legal action from tax authorities. Understanding the consequences of non-compliance is crucial for taxpayers to avoid escalating financial burdens.

Quick guide on how to complete information about your notice penalty and interest

Complete [SKS] effortlessly on any device

Managing documents online has gained immense popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to alter and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Information About Your Notice, Penalty And Interest

Create this form in 5 minutes!

How to create an eSignature for the information about your notice penalty and interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of airSlate SignNow in relation to Information About Your Notice, Penalty And Interest?

airSlate SignNow facilitates the electronic signing of documents related to your notice, penalty, and interest. It allows you to ensure that signing important documents is quick and secure, so you can address any compliance-related issues efficiently.

-

How does airSlate SignNow help manage notices related to penalties and interest?

With airSlate SignNow, you can track and manage your notices about penalties and interest conveniently. The platform provides reminders and status updates to ensure you never miss deadlines, keeping you informed and organized.

-

Is there a cost associated with using airSlate SignNow for Information About Your Notice, Penalty And Interest?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Choosing the right plan can help you efficiently handle Information About Your Notice, Penalty And Interest while staying within your budget.

-

What features does airSlate SignNow provide to assist with my information about notices, penalties, and interest?

airSlate SignNow includes features like customizable templates, mobile access, and audit trails. These features ensure that you can manage Information About Your Notice, Penalty And Interest easily and with full accountability.

-

Can I integrate airSlate SignNow with other systems to manage my notices and penalties?

Absolutely! airSlate SignNow offers integrations with popular business applications. This means you can seamlessly manage Information About Your Notice, Penalty And Interest alongside your existing systems.

-

What are the benefits of using airSlate SignNow for notices and penalties?

Using airSlate SignNow increases efficiency and reduces the time spent on manual paperwork. You can effectively handle Information About Your Notice, Penalty And Interest, ensuring your documents are signed and processed quickly.

-

Is airSlate SignNow secure for handling sensitive information regarding notices and penalties?

Yes, security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and safety protocols to protect the Information About Your Notice, Penalty And Interest from unauthorized access.

Get more for Information About Your Notice, Penalty And Interest

Find out other Information About Your Notice, Penalty And Interest

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself