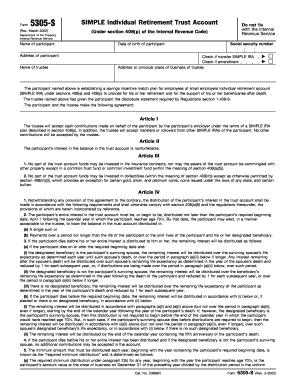

Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

What is the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

The Form 5305 S Rev March is a crucial document used to establish a SIMPLE Individual Retirement Trust Account (SIMPLE IRA). This form is designed for small businesses to offer their employees a retirement savings plan that is straightforward to administer. The SIMPLE IRA allows both employers and employees to contribute funds, providing a tax-advantaged way to save for retirement. This form outlines the terms and conditions of the account, ensuring compliance with IRS regulations.

How to use the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

Using the Form 5305 S Rev March involves several steps. First, the employer must complete the form, providing necessary information such as the business name, address, and the plan year. Once the form is filled out, it should be distributed to eligible employees, who can then establish their accounts. Employees will need to provide their personal information and select their contribution amounts. It is essential to retain a copy of the completed form for record-keeping and compliance purposes.

Steps to complete the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

Completing the Form 5305 S Rev March requires careful attention to detail. Follow these steps:

- Gather necessary information, including the employer's details and employee eligibility.

- Fill out the form, ensuring all sections are completed accurately.

- Distribute the form to eligible employees for their completion.

- Collect completed forms from employees and verify their accuracy.

- Retain copies of all forms for your records and compliance.

Key elements of the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

Several key elements define the Form 5305 S Rev March. These include:

- Eligibility criteria for employees, which typically include those earning a minimum amount and having worked for the employer for a specified duration.

- Contribution limits set by the IRS, which may change annually.

- Employer matching contributions, which are optional but can enhance employee participation.

- Withdrawal rules, including penalties for early withdrawal before a certain age.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 5305 S Rev March and SIMPLE IRAs. Employers must adhere to these guidelines to maintain the tax-advantaged status of the accounts. This includes ensuring that contributions do not exceed the limits set by the IRS and that all eligible employees are given the opportunity to participate. Regular reporting and compliance with IRS regulations are essential to avoid penalties.

Eligibility Criteria

Eligibility for establishing a SIMPLE IRA using the Form 5305 S Rev March is generally based on specific criteria. Employees must have earned at least a minimum amount in the preceding year and must expect to earn a similar amount in the current year. Employers must also meet certain requirements, such as having no more than one hundred employees who earned at least five thousand dollars in the previous year. These criteria help ensure that the plan is accessible and beneficial to all eligible participants.

Quick guide on how to complete form 5305 s rev march simple individual retirement trust account

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without any delays. Handle [SKS] on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-related task today.

How to Easily Modify and eSign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Spotlight important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

Create this form in 5 minutes!

How to create an eSignature for the form 5305 s rev march simple individual retirement trust account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account?

The Form 5305 S Rev March SIMPLE Individual Retirement Trust Account is a document used to create a SIMPLE IRA for eligible individuals. This retirement account allows for tax-deferred contributions, helping you save for retirement effectively. By using this form, you can establish a trust account that complies with IRS regulations.

-

How do I fill out the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account?

To fill out the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account, start by providing information about the trust and the account holder. Ensure all necessary fields are completed and accurate, including beneficiary details. It’s important to review the instructions carefully to ensure compliance with IRS guidelines.

-

What are the benefits of using a Form 5305 S Rev March SIMPLE Individual Retirement Trust Account?

The benefits of using the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account include tax advantages and the ability to save for retirement effectively. Contributions to this account can grow tax-deferred, and employers can match employee contributions, enhancing retirement savings potential. Additionally, it provides flexibility in investment choices.

-

What is the pricing structure for opening a Form 5305 S Rev March SIMPLE Individual Retirement Trust Account?

The pricing for opening a Form 5305 S Rev March SIMPLE Individual Retirement Trust Account typically varies depending on the financial institution chosen. Many providers offer low-cost or no-fee options for setting up the account. It’s essential to compare different institutions to find the best features and pricing structure that meet your needs.

-

Can I integrate the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account with other financial tools?

Yes, the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account can often be integrated with various financial tools to streamline managing your retirement savings. Many financial institutions provide platforms that allow for automatic contributions and tracking of investment performance. This integration can simplify the retirement planning process.

-

Are there any age restrictions for the Form 5305 S Rev March SIMPLE Individual Retirement Trust Account?

Yes, to contribute to a Form 5305 S Rev March SIMPLE Individual Retirement Trust Account, you must be at least 18 years old. This account is designed for individuals looking to save for retirement, so eligibility is primarily based on employment and income. Be sure to check other specific criteria that may apply.

-

How do I withdraw funds from my Form 5305 S Rev March SIMPLE Individual Retirement Trust Account?

Withdrawing funds from your Form 5305 S Rev March SIMPLE Individual Retirement Trust Account can be done, but it may incur penalties if taken before the age of 59½. You typically need to submit a request through your financial institution, and it’s advisable to consult a tax professional to understand the tax implications and penalties involved.

Get more for Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

Find out other Form 5305 S Rev March SIMPLE Individual Retirement Trust Account

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document