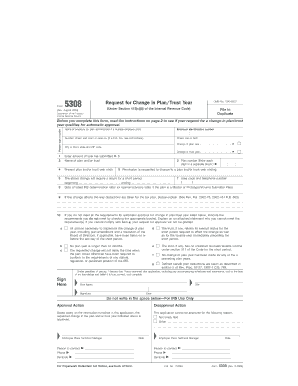

Form 5308 Rev 8 Request for Change in PlanTrust Year

What is the Form 5308 Rev 8 Request For Change In PlanTrust Year

The Form 5308 Rev 8 is a document used by plan administrators to request a change in the plan year for a qualified retirement plan. This form is essential for ensuring compliance with IRS regulations regarding plan years, which can affect the timing of contributions and distributions. By submitting this form, administrators can align their plan year with the calendar year or another fiscal year, depending on their organizational needs.

How to use the Form 5308 Rev 8 Request For Change In PlanTrust Year

Using the Form 5308 Rev 8 involves several steps. First, ensure that you have the most recent version of the form. Next, fill out the required information, including the plan name, employer identification number, and the current plan year. It is important to specify the new plan year you wish to adopt. Once completed, submit the form to the IRS as part of your compliance obligations. Ensure you keep a copy for your records.

Steps to complete the Form 5308 Rev 8 Request For Change In PlanTrust Year

Completing the Form 5308 Rev 8 involves the following steps:

- Obtain the latest version of the form from the IRS website.

- Fill in the plan name and employer identification number accurately.

- Indicate the current plan year and the desired new plan year.

- Review the form for accuracy and completeness.

- Submit the completed form to the IRS by the required deadline.

Legal use of the Form 5308 Rev 8 Request For Change In PlanTrust Year

The legal use of the Form 5308 Rev 8 is governed by IRS regulations. It is crucial for plan administrators to understand that submitting this form is a formal request to change the plan year, which must comply with the Internal Revenue Code. Failure to properly use this form can result in penalties or complications with plan compliance, potentially affecting the tax status of the retirement plan.

Filing Deadlines / Important Dates

When using the Form 5308 Rev 8, it is important to be aware of specific filing deadlines. Generally, the form should be submitted by the last day of the current plan year to ensure that the change takes effect for the following year. Keeping track of these dates is essential for maintaining compliance and avoiding any disruptions in plan operations.

Required Documents

To complete the Form 5308 Rev 8, you may need to gather several documents, including:

- The current plan document.

- Records of previous plan years.

- Any amendments or changes made to the plan.

Having these documents on hand can help ensure that the form is filled out accurately and in compliance with IRS requirements.

Quick guide on how to complete form 5308 rev 8 request for change in plantrust year

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5308 Rev 8 Request For Change In PlanTrust Year

Create this form in 5 minutes!

How to create an eSignature for the form 5308 rev 8 request for change in plantrust year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5308 Rev 8 Request For Change In PlanTrust Year?

Form 5308 Rev 8 Request For Change In PlanTrust Year is a document utilized by plan administrators to request changes related to their PlanTrust year. By using airSlate SignNow, businesses can efficiently eSign and send this form, ensuring compliance and proper documentation.

-

How can airSlate SignNow help with completing Form 5308 Rev 8 Request For Change In PlanTrust Year?

airSlate SignNow streamlines the process of completing Form 5308 Rev 8 Request For Change In PlanTrust Year by providing an intuitive interface for document preparation and signing. The platform also offers templates that simplify data entry and speed up the submission process.

-

Is there a cost associated with using airSlate SignNow for Form 5308 Rev 8 Request For Change In PlanTrust Year?

Yes, airSlate SignNow offers several pricing plans designed to accommodate different business needs, making it a cost-effective solution for handling documents like Form 5308 Rev 8 Request For Change In PlanTrust Year. You can explore our plans to find one that matches your budget and usage requirements.

-

What features does airSlate SignNow offer for handling Form 5308 Rev 8 Request For Change In PlanTrust Year?

The airSlate SignNow platform provides features such as document templates, customizable signing workflows, and secure cloud storage, all of which are essential for managing Form 5308 Rev 8 Request For Change In PlanTrust Year. These tools enhance efficiency and ensure secure handling of sensitive documents.

-

Can airSlate SignNow integrate with other software for managing Form 5308 Rev 8 Request For Change In PlanTrust Year?

Absolutely! airSlate SignNow offers seamless integrations with various applications to streamline the document management process for Form 5308 Rev 8 Request For Change In PlanTrust Year. This allows users to easily connect their existing software tools, enhancing overall productivity.

-

How secure is airSlate SignNow when handling sensitive documents like Form 5308 Rev 8 Request For Change In PlanTrust Year?

AirSlate SignNow prioritizes security by utilizing advanced encryption protocols and compliance measures to protect documents, including Form 5308 Rev 8 Request For Change In PlanTrust Year. This ensures your data remains confidential and secure throughout the signing process.

-

What benefits can businesses expect from using airSlate SignNow for Form 5308 Rev 8 Request For Change In PlanTrust Year?

Businesses leveraging airSlate SignNow for Form 5308 Rev 8 Request For Change In PlanTrust Year can expect increased efficiency, reduced turnaround times, and improved compliance. The ease of eSigning ensures timely responses, which can signNowly enhance operational workflows.

Get more for Form 5308 Rev 8 Request For Change In PlanTrust Year

Find out other Form 5308 Rev 8 Request For Change In PlanTrust Year

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later