Form 5434 a Uncle Fed's Tax*Board

What is the Form 5434 A Uncle Fed's Tax*Board

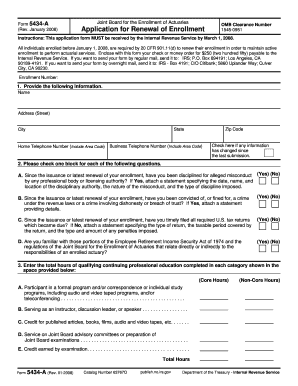

The Form 5434 A Uncle Fed's Tax*Board is a tax-related document used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is designed to collect data necessary for tax assessments. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoidance of penalties.

How to use the Form 5434 A Uncle Fed's Tax*Board

Using the Form 5434 A Uncle Fed's Tax*Board involves several steps. First, gather all necessary financial documents and information relevant to your tax situation. This may include income statements, expense records, and any other documentation required for accurate reporting. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it thoroughly to check for any errors or omissions before submission.

Steps to complete the Form 5434 A Uncle Fed's Tax*Board

Completing the Form 5434 A Uncle Fed's Tax*Board requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details on your income sources and any deductions you plan to claim.

- Double-check all entries for accuracy, ensuring that all calculations are correct.

- Sign and date the form before submission.

Legal use of the Form 5434 A Uncle Fed's Tax*Board

The Form 5434 A Uncle Fed's Tax*Board must be used in accordance with IRS regulations. It is legally binding, and any inaccuracies or omissions can lead to penalties or legal repercussions. Taxpayers are responsible for ensuring that the information provided is truthful and complete. Understanding the legal implications of this form is vital for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5434 A Uncle Fed's Tax*Board vary depending on the taxpayer's situation. Generally, individuals must submit their forms by April fifteenth of the tax year. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about these dates to avoid late fees and penalties associated with non-compliance.

Who Issues the Form

The Form 5434 A Uncle Fed's Tax*Board is issued by the Internal Revenue Service (IRS). The IRS is the federal agency responsible for tax collection and enforcement of tax laws in the United States. Taxpayers should ensure they are using the most current version of the form, as updates may occur periodically.

Quick guide on how to complete form 5434 a uncle feds taxboard

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your alterations.

- Choose how you’d like to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5434 A Uncle Fed's Tax*Board

Create this form in 5 minutes!

How to create an eSignature for the form 5434 a uncle feds taxboard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5434 A Uncle Fed's Tax*Board?

Form 5434 A Uncle Fed's Tax*Board is a tax document that helps businesses comply with federal tax regulations. It provides essential information for tax processing and is crucial for maintaining transparent financial records. Using airSlate SignNow can streamline the eSigning process for this form, making it easier to submit.

-

How can airSlate SignNow assist with Form 5434 A Uncle Fed's Tax*Board?

airSlate SignNow simplifies the process of sending and eSigning Form 5434 A Uncle Fed's Tax*Board. Our platform allows you to create, manage, and sign this form securely online, ensuring that you meet deadlines effortlessly. Additionally, it offers robust tracking features to monitor your document's status.

-

What are the pricing plans available for using airSlate SignNow for Form 5434 A Uncle Fed's Tax*Board?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, ensuring affordability for all users. Depending on your usage and team size, you can choose a monthly or annual subscription that fits your budget. Each plan provides full access to tools necessary for managing Form 5434 A Uncle Fed's Tax*Board efficiently.

-

What key features does airSlate SignNow offer for eSigning Form 5434 A Uncle Fed's Tax*Board?

With airSlate SignNow, you benefit from features like customizable templates, automated workflows, and real-time notifications for your Form 5434 A Uncle Fed's Tax*Board. The user-friendly interface ensures that even non-tech-savvy users can navigate the platform with ease. Secure cloud storage also keeps all your signed documents safe and accessible.

-

Is it possible to integrate airSlate SignNow with other software for managing Form 5434 A Uncle Fed's Tax*Board?

Yes, airSlate SignNow offers seamless integrations with various software applications and platforms to enhance your workflow for Form 5434 A Uncle Fed's Tax*Board. Whether you use CRMs, accounting software, or document management systems, our platform can be easily connected to streamline your processes. This flexibility helps you maintain efficiency and organization.

-

How does airSlate SignNow enhance document security for Form 5434 A Uncle Fed's Tax*Board?

airSlate SignNow prioritizes document security with industry-standard encryption and secure access controls. When handling sensitive information such as Form 5434 A Uncle Fed's Tax*Board, our platform ensures that only authorized users can access the documents. Additionally, all transactions are logged, providing an audit trail for compliance.

-

What benefits can businesses expect from using airSlate SignNow for Form 5434 A Uncle Fed's Tax*Board?

Using airSlate SignNow for Form 5434 A Uncle Fed's Tax*Board offers numerous benefits, including improved efficiency, faster turnaround times, and reduced paperwork. It allows businesses to focus on their core operations while ensuring compliance with tax regulations. This cost-effective solution ultimately saves time and resources.

Get more for Form 5434 A Uncle Fed's Tax*Board

Find out other Form 5434 A Uncle Fed's Tax*Board

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy