Form 1120 W, Fill in Capable Estimated Tax for Corporations

What is the Form 1120 W, Fill In Capable Estimated Tax For Corporations

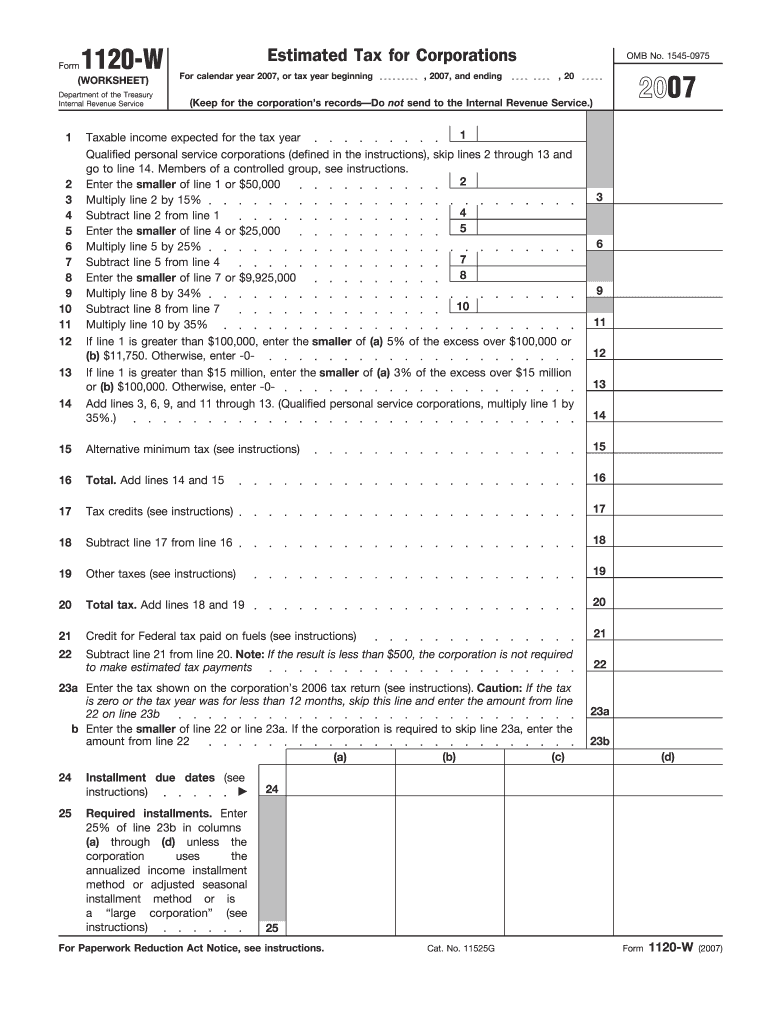

The Form 1120 W is an essential document used by corporations to calculate their estimated tax payments. This form is specifically designed for corporations that expect to owe tax of five hundred dollars or more when they file their annual return. It allows businesses to estimate their tax liability for the current year and helps ensure compliance with federal tax obligations. By accurately completing this form, corporations can avoid underpayment penalties and manage their cash flow effectively.

Steps to complete the Form 1120 W, Fill In Capable Estimated Tax For Corporations

Completing the Form 1120 W involves several key steps:

- Gather financial data: Collect information regarding your corporation’s income, deductions, and credits from the previous year.

- Estimate current year income: Project your corporation's income for the current tax year based on historical data and expected changes.

- Calculate deductions: Determine allowable deductions that can reduce your taxable income, such as business expenses and depreciation.

- Complete the form: Fill in the required fields on the Form 1120 W, including estimated income, deductions, and tax rates.

- Review and verify: Double-check all calculations and ensure that all information is accurate before submission.

How to obtain the Form 1120 W, Fill In Capable Estimated Tax For Corporations

The Form 1120 W can be obtained directly from the Internal Revenue Service (IRS) website. It is available for download in PDF format, allowing for easy access and printing. Additionally, many tax preparation software programs include this form, providing an efficient way to complete it digitally. Corporations may also request a physical copy by contacting the IRS or visiting a local IRS office.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1120 W. These guidelines include instructions on how to estimate taxable income, apply tax rates, and report any applicable credits. It is crucial for corporations to adhere to these guidelines to ensure accuracy and compliance. The IRS also updates these guidelines periodically, so it is advisable to check for the most current information before filing.

Filing Deadlines / Important Dates

Corporations must be aware of several important deadlines related to the Form 1120 W. Typically, estimated tax payments are due quarterly, with specific deadlines falling on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is essential to submit the form and any payments by these deadlines to avoid penalties and interest charges.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 1120 W can result in significant penalties. Corporations that do not make the required estimated tax payments may face underpayment penalties, which can accumulate over time. Additionally, late filing or inaccuracies in reporting can lead to further penalties and interest on unpaid taxes. Understanding these consequences emphasizes the importance of timely and accurate completion of the form.

Quick guide on how to complete form 1120 w fill in capable estimated tax for corporations

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications, streamlining any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 W, Fill In Capable Estimated Tax For Corporations

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w fill in capable estimated tax for corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 W, Fill In Capable Estimated Tax For Corporations?

Form 1120 W is an IRS form that allows corporations to calculate their estimated tax payments. The Fill In Capable feature enables businesses to easily input their financial data, ensuring accurate calculations and compliance with tax laws.

-

How can airSlate SignNow help with Form 1120 W, Fill In Capable Estimated Tax For Corporations?

airSlate SignNow streamlines the process of preparing and submitting Form 1120 W, Fill In Capable Estimated Tax For Corporations. With its electronic signature capabilities, businesses can quickly and securely send documents for signature, reducing the time and hassle involved in tax preparation.

-

What features does airSlate SignNow offer for handling Form 1120 W?

airSlate SignNow offers features such as digital signatures, document templates, and secure cloud storage. These tools make it easy to fill out and manage Form 1120 W, Fill In Capable Estimated Tax For Corporations, enhancing efficiency and accuracy in tax filing.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for prospective customers to explore its features. This includes tools to manage Form 1120 W, Fill In Capable Estimated Tax For Corporations, allowing users to assess the platform's suitability for their business needs before committing to a subscription.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to suit businesses of all sizes. Pricing varies based on features and the number of users, ensuring that users can efficiently manage documents like Form 1120 W, Fill In Capable Estimated Tax For Corporations within their budget.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can be easily integrated with various accounting software platforms. This allows seamless data transfer for managing Form 1120 W, Fill In Capable Estimated Tax For Corporations, making it convenient for businesses to maintain accurate financial records.

-

How does using airSlate SignNow benefit corporate tax filing?

Using airSlate SignNow enhances the tax filing process by providing a secure and efficient platform for managing documents. Specifically, it facilitates the quick preparation of Form 1120 W, Fill In Capable Estimated Tax For Corporations, ultimately saving time and improving compliance with tax requirements.

Get more for Form 1120 W, Fill In Capable Estimated Tax For Corporations

- Usps routing slip form

- All den cub scout requirement chart form

- Cci activity schedule form

- Dental practice chart audit analysis worksheet worksheet for auditing dental practice charts form

- Formulaire dinscription word 19 20 4 ans

- Dance competition form

- Texas sales and use tax resale certificate ok concrete form

- Diz1 form

Find out other Form 1120 W, Fill In Capable Estimated Tax For Corporations

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors