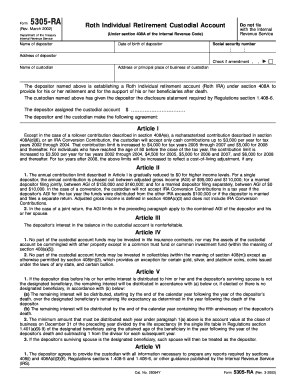

March Department of the Treasury Internal Revenue Service Roth Individual Retirement Custodial Account under Section 408A of the Form

Understanding the Roth Individual Retirement Custodial Account

The Roth Individual Retirement Custodial Account, as outlined under Section 408A of the Internal Revenue Code, is a tax-advantaged retirement savings option. This type of account allows individuals to contribute after-tax income, which can grow tax-free over time. Withdrawals made during retirement are also tax-free, provided certain conditions are met. It is essential for depositors to understand that while contributions can be made at any age, the account must be established before the individual reaches age seventy and a half to avoid penalties.

Steps to Complete the Roth Individual Retirement Custodial Account Form

Completing the form for a Roth Individual Retirement Custodial Account involves several important steps. First, gather necessary personal information, including your date of birth and Social Security number. Next, provide details about the account, such as the name of the financial institution managing the account. Ensure that all information is accurate to avoid processing delays. Finally, review the form for completeness and sign it, acknowledging that you will not file this form with the Internal Revenue Service.

Eligibility Criteria for the Roth Individual Retirement Custodial Account

To qualify for a Roth Individual Retirement Custodial Account, individuals must meet specific eligibility criteria. Primarily, there are income limits that determine how much can be contributed. For the tax year, individuals with a modified adjusted gross income below a certain threshold can contribute the maximum amount. Additionally, it is required that the account holder has earned income, which can include wages, salaries, or self-employment income.

Required Documents for Establishing the Roth Individual Retirement Custodial Account

When establishing a Roth Individual Retirement Custodial Account, certain documents are required. These typically include a government-issued photo ID, such as a driver's license or passport, to verify identity. Additionally, proof of income may be necessary, which can be shown through recent pay stubs or tax returns. Financial institutions may also require a completed application form specific to their institution, detailing the account type and beneficiary information.

IRS Guidelines for Roth Individual Retirement Custodial Accounts

The Internal Revenue Service provides specific guidelines regarding the management and contributions to Roth Individual Retirement Custodial Accounts. According to IRS regulations, contributions must be made in cash and cannot exceed the annual contribution limit. Additionally, the IRS mandates that account holders must maintain records of contributions and withdrawals to ensure compliance with tax laws. Understanding these guidelines is crucial for effective account management and to avoid potential penalties.

Filing Deadlines and Important Dates for Roth Accounts

Filing deadlines for contributions to a Roth Individual Retirement Custodial Account are crucial for account holders to observe. Generally, contributions for a tax year must be made by the tax filing deadline, which is typically April fifteenth of the following year. It is important to keep track of these dates to maximize contributions and ensure compliance with IRS regulations. Additionally, account holders should be aware of any changes in tax laws that may affect their contributions and withdrawals.

Quick guide on how to complete march department of the treasury internal revenue service roth individual retirement custodial account under section 408a of

Manage [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Handle [SKS] using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to commence.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools available from airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign [SKS] and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the march department of the treasury internal revenue service roth individual retirement custodial account under section 408a of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account under Section 408A of the Internal Revenue Code?

The March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account under Section 408A of the Internal Revenue Code allows individuals to save for retirement with unique tax benefits. Contributions are made after taxes, and qualified withdrawals in retirement are tax-free. This account type helps in building long-term wealth with flexible investment options.

-

How can I open a March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account?

To open a March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account, select a qualified custodian or financial institution that caters to these accounts. Complete the required paperwork and provide personal information such as the date of birth of the depositor, and ensure you do not file with the Internal Revenue Service name submissions without accurate information.

-

What are the contribution limits for a March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account?

The contribution limits for a March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account are subject to annual IRS guidelines. For individuals under 50, the limit is typically $6,000 per year, while those aged 50 and above can contribute up to $7,000. It is essential to adhere to these limits to avoid penalties.

-

Are there any tax benefits associated with the March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account?

Yes, the March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account offers signNow tax benefits. Contributions are made with after-tax dollars, allowing the investments to grow tax-free and providing tax-free withdrawals in retirement. This is an appealing option for those seeking to optimize their tax strategy.

-

Can I withdraw funds from my March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account anytime?

You can withdraw contributions from your March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account at any time without penalties. However, earnings may be subject to taxes and penalties if withdrawn before the account meets the qualified distribution requirements. Always consult a tax advisor before making withdrawals.

-

What types of investments can I make with a March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account?

A March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account allows a wide range of investment options including stocks, bonds, mutual funds, and ETFs. The flexibility of investment choices can help you tailor your retirement strategy to fit your financial goals effectively.

-

How does airSlate SignNow assist with managing documents related to the March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account?

airSlate SignNow empowers you to easily send, sign, and manage documents related to your March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account. With its cost-effective solution and user-friendly interface, you can streamline the paperwork required, ensuring compliance and efficient management.

Get more for March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account Under Section 408A Of The

- Report form for tuberculin test tb test alexandria city public

- Listing presentation script form

- Westcol online application form

- Sample proposed judgment new york form

- Tempo dynamics mood style smyser elementary school smyser form

- Kaiser permanente authorization for use or disclosure form

- Sexual assault supplemental report form

- Department of health ri form

Find out other March Department Of The Treasury Internal Revenue Service Roth Individual Retirement Custodial Account Under Section 408A Of The

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation