Form 5305 R Rev March Fill in Capable

What is the Form 5305 R Rev March Fill In Capable

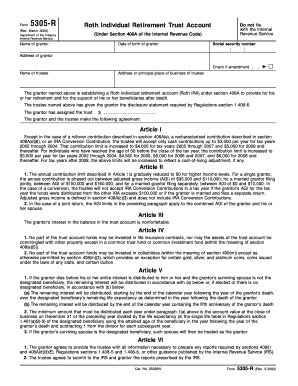

The Form 5305 R Rev March Fill In Capable is an IRS document used for establishing a Simplified Employee Pension (SEP) plan. This form allows employers to create a retirement plan that enables them to make contributions on behalf of their eligible employees. The form is designed to be user-friendly, allowing for easy completion and submission, ensuring compliance with IRS regulations. It is essential for businesses looking to provide retirement benefits while maintaining flexibility in contributions.

How to use the Form 5305 R Rev March Fill In Capable

Using the Form 5305 R Rev March Fill In Capable involves several straightforward steps. First, employers need to fill out the form with the necessary information, including the business name, address, and the type of employees covered under the plan. After completing the form, it should be signed and dated by the employer. The completed form must then be kept on file as part of the plan documentation. It is important to ensure that all details are accurate to avoid any compliance issues with the IRS.

Steps to complete the Form 5305 R Rev March Fill In Capable

Completing the Form 5305 R Rev March Fill In Capable requires careful attention to detail. Follow these steps for successful completion:

- Gather Information: Collect all necessary information about the business and employees.

- Fill Out the Form: Enter the required details, including the employer's name, address, and employee information.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Sign and Date: The employer must sign and date the form to validate it.

- Retain for Records: Keep the completed form on file for future reference and compliance.

Legal use of the Form 5305 R Rev March Fill In Capable

The legal use of the Form 5305 R Rev March Fill In Capable is crucial for establishing a valid SEP plan. By completing and retaining this form, employers comply with IRS requirements, ensuring that contributions made to the plan are tax-deductible. It is important to note that this form must be used in accordance with IRS guidelines, and any deviations could result in penalties or disqualification of the plan. Employers should consult with a tax professional to ensure compliance with all legal obligations.

Key elements of the Form 5305 R Rev March Fill In Capable

Several key elements define the Form 5305 R Rev March Fill In Capable. These include:

- Employer Information: Details regarding the employer's name and address.

- Employee Eligibility: Criteria for which employees are eligible for the SEP plan.

- Contribution Limits: Information on the maximum contributions allowed under the plan.

- Plan Adoption: A statement confirming the employer's adoption of the SEP plan.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5305 R Rev March Fill In Capable are important for compliance. Employers must ensure that the form is completed and retained by the time contributions are made to the SEP plan. Typically, the form should be in place before the employer makes any contributions for a given tax year. It is advisable to review IRS guidelines for specific deadlines related to SEP plans to avoid any potential issues.

Quick guide on how to complete form 5305 r rev march fill in capable

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 R Rev March Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 5305 r rev march fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 R Rev March Fill In Capable and how can it be used?

The Form 5305 R Rev March Fill In Capable is a document designed for easy completion and submission by individuals seeking to establish a retirement plan. By using airSlate SignNow, users can easily fill out and electronically sign this form, streamlining the process of retirement planning. This ensures that all necessary information is submitted accurately and efficiently.

-

Is there a cost associated with using Form 5305 R Rev March Fill In Capable on airSlate SignNow?

While airSlate SignNow offers various pricing plans, the specific cost to use the Form 5305 R Rev March Fill In Capable will depend on the subscription selected. Users can choose from a range of plans designed for individuals and businesses, ensuring a cost-effective solution for filling out and signing important documents like the Form 5305 R.

-

What features does airSlate SignNow offer for completing the Form 5305 R Rev March Fill In Capable?

airSlate SignNow provides many features for completing the Form 5305 R Rev March Fill In Capable, including customizable templates, easy-to-use editing tools, and secure eSignature capabilities. These features enhance the user experience, making it convenient to fill out important forms while ensuring compliance and data security.

-

Can I integrate the Form 5305 R Rev March Fill In Capable with other software?

Yes, airSlate SignNow offers integration with various software applications, allowing users to seamlessly connect their workflows. Whether you are using CRM systems, document management software, or cloud storage solutions, integrating the Form 5305 R Rev March Fill In Capable can help streamline your document processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Form 5305 R Rev March Fill In Capable?

Using airSlate SignNow for the Form 5305 R Rev March Fill In Capable offers numerous benefits, including reduced paperwork, faster processing times, and improved accuracy. The ability to electronically sign and submit forms securely ensures that your retirement planning process is both efficient and compliant.

-

How secure is the information when using the Form 5305 R Rev March Fill In Capable?

airSlate SignNow employs industry-leading security measures to ensure the protection of your information while using the Form 5305 R Rev March Fill In Capable. All data is encrypted during transmission and storage, guaranteeing that your sensitive information remains confidential and secure throughout the signing process.

-

How can I track the status of my Form 5305 R Rev March Fill In Capable submissions?

With airSlate SignNow, users can easily track the status of their Form 5305 R Rev March Fill In Capable submissions. The platform provides real-time updates and notifications, allowing you to know when your documents have been viewed, signed, or completed, ensuring full visibility throughout the process.

Get more for Form 5305 R Rev March Fill In Capable

Find out other Form 5305 R Rev March Fill In Capable

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed