Form 6729 C Rev September Fill in Capable Quality Return Review Sheet

What is the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

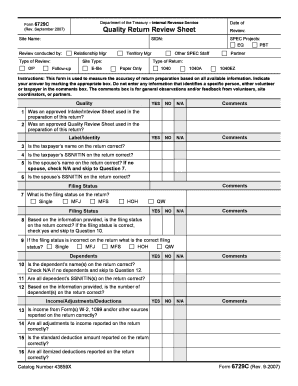

The Form 6729 C Rev September Fill In Capable Quality Return Review Sheet is a specific document used primarily for quality assurance in various business processes. This form is designed to facilitate the review of returns to ensure compliance with applicable standards and regulations. It serves as a checklist to verify that all necessary information has been accurately captured and that the return meets quality expectations. The form is essential for organizations looking to maintain high standards in their reporting and documentation practices.

How to use the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

Using the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet involves several straightforward steps. First, gather all relevant documents and data that pertain to the return being reviewed. Next, fill in the required fields on the form, ensuring that all information is complete and accurate. After completing the form, it should be reviewed by a qualified individual to confirm that all criteria have been met. This process helps in identifying any discrepancies or areas that require correction before final submission.

Steps to complete the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

Completing the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet requires careful attention to detail. The following steps outline the process:

- Collect all necessary documents related to the return.

- Begin filling out the form by entering the required information in each designated field.

- Double-check all entries for accuracy and completeness.

- Have the completed form reviewed by a supervisor or compliance officer.

- Make any necessary adjustments based on feedback received.

- Finalize the form for submission.

Legal use of the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

The legal use of the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet is critical for ensuring compliance with regulatory requirements. Organizations must use this form to document their quality assurance processes, which can be essential during audits or inspections. Proper completion and retention of this form can help mitigate risks associated with non-compliance, including potential penalties or legal repercussions.

Key elements of the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

Key elements of the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet include:

- Identification of the return being reviewed.

- Checklists for verifying compliance with quality standards.

- Sections for comments and notes from reviewers.

- Signature lines for both the preparer and the reviewer.

These elements work together to ensure a comprehensive review process, enhancing the quality and reliability of the returns submitted.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet are crucial for compliance. Organizations should be aware of the specific dates associated with their reporting requirements to avoid penalties. It is advisable to track these deadlines annually, as they may vary depending on the type of return and the governing regulations. Staying informed about these important dates helps ensure timely submissions and adherence to legal obligations.

Quick guide on how to complete form 6729 c rev september fill in capable quality return review sheet

Complete [SKS] effortlessly on any platform

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your files quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and hit the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6729 c rev september fill in capable quality return review sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

The Form 6729 C Rev September Fill In Capable Quality Return Review Sheet is a document designed to streamline the quality review process. It allows users to fill in necessary information and ensure compliance with necessary standards. By using this form, businesses can improve their quality assurance operations.

-

How can airSlate SignNow help with the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

airSlate SignNow provides an efficient platform to eSign and send the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet. Our solution simplifies the document management process, making it easy to compile, fill out, and share your forms quickly and securely.

-

What pricing plans are available for airSlate SignNow when using the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

airSlate SignNow offers various pricing plans suited for different business needs, starting from a basic plan to a comprehensive suite. Our pricing structure ensures that businesses of all sizes can efficiently use the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet at a cost-effective rate. You can review our website for detailed pricing information.

-

What features are included in the airSlate SignNow platform for managing the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

The airSlate SignNow platform includes features such as customizable templates, electronic signatures, and document tracking specifically for the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet. Additionally, users can collaborate in real-time and automate workflows to enhance productivity and ensure accuracy.

-

Are there any benefits of using airSlate SignNow for the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

Using airSlate SignNow for the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet offers substantial benefits, such as reduced processing time and increased efficiency. Our platform ensures secure storage and easy access to your documents, facilitating faster review cycles and compliance with quality standards.

-

Can I integrate other tools with airSlate SignNow when filling out the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

Yes, airSlate SignNow offers integrations with numerous applications, enabling seamless use alongside tools you already use. This allows for enhanced workflows, particularly when managing the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet, so you can keep all your processes connected and efficient.

-

Is it easy to use airSlate SignNow for the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, ensuring that you can quickly navigate and fill out the Form 6729 C Rev September Fill In Capable Quality Return Review Sheet. Our intuitive interface makes the eSigning process straightforward, even for users with minimal technical expertise.

Get more for Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

Find out other Form 6729 C Rev September Fill In Capable Quality Return Review Sheet

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document