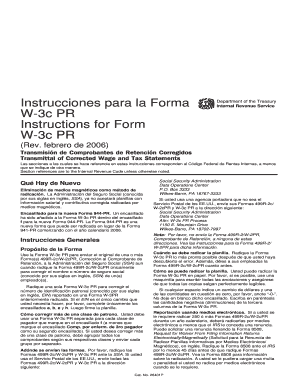

Instructions for Form W 3c PR Rev February Instructions for Form W 3C PR, Transmittal of Corrected Income and Tax Statements Pue

What is the Instructions For Form W-3C PR Rev February

The Instructions For Form W-3C PR Rev February provide essential guidelines for submitting corrected income and tax statements specifically for Puerto Rico. This form is used by employers to transmit corrected copies of Forms W-2c, which report income and tax information for employees. Understanding these instructions is crucial for ensuring compliance with IRS regulations and for accurately reporting any corrections to previously filed information.

Steps to complete the Instructions For Form W-3C PR Rev February

Completing the Instructions For Form W-3C PR involves several key steps. First, gather all necessary information from the original Forms W-2 that require correction. Next, accurately fill out the W-3C PR form, ensuring that all details align with the corrected W-2c forms. Pay close attention to the identification numbers and amounts reported to avoid discrepancies. Finally, review the completed form for accuracy before submission.

Legal use of the Instructions For Form W-3C PR Rev February

The legal use of the Instructions For Form W-3C PR is to ensure compliance with federal tax laws. Employers must use this form when they need to correct previously submitted W-2 forms. Failure to adhere to these instructions can result in penalties from the IRS, including fines for incorrect reporting or failure to file corrected statements in a timely manner.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Instructions For Form W-3C PR. Typically, corrected forms must be filed with the IRS by a specified date, which is usually the end of February for the previous tax year. Employers should also consider any state-specific deadlines that may apply to Puerto Rico to ensure full compliance.

Form Submission Methods (Online / Mail / In-Person)

The Instructions For Form W-3C PR outline several methods for submitting the form. Employers can file the form online through the IRS e-file system, which is often the fastest method. Alternatively, forms can be mailed to the appropriate IRS address, or in some cases, delivered in person. It is essential to choose the method that best suits the employer's needs while ensuring timely submission.

Key elements of the Instructions For Form W-3C PR Rev February

Key elements of the Instructions For Form W-3C PR include detailed guidance on the information required, such as the employer's identification number, employee details, and the specific corrections being made. The instructions also provide clarity on how to properly complete each section of the form to avoid common errors that could lead to delays or penalties.

Quick guide on how to complete instructions for form w 3c pr rev february instructions for form w 3c pr transmittal of corrected income and tax statements

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form W 3c PR Rev February Instructions For Form W 3C PR, Transmittal Of Corrected Income And Tax Statements Pue

Create this form in 5 minutes!

How to create an eSignature for the instructions for form w 3c pr rev february instructions for form w 3c pr transmittal of corrected income and tax statements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form W 3c PR Rev February?

The Instructions For Form W 3c PR Rev February provide detailed guidelines on how to complete the Form W-3C for Puerto Rico. This form is essential for correcting previously filed income and tax statements. Understanding these instructions is crucial for ensuring compliance and accurate reporting.

-

How can airSlate SignNow assist with the Instructions For Form W 3C PR?

airSlate SignNow streamlines the process of completing the Instructions For Form W 3C PR, Transmittal Of Corrected Income And Tax Statements Puerto Rico. Our platform allows you to easily upload and eSign documents while adhering to the required guidelines. This simplifies compliance and ensures that documents are submitted correctly.

-

What are the benefits of using airSlate SignNow for tax corrections?

Using airSlate SignNow for your tax correction needs, including following the Instructions For Form W 3C PR, offers several benefits. Our platform provides a user-friendly interface, saves time with efficient workflows, and helps avoid errors in documentation. This means your Transmittal Of Corrected Income And Tax Statements Puerto Rico can be filed accurately and quickly.

-

Are there any costs associated with using airSlate SignNow for tax forms?

Yes, there are costs associated with using airSlate SignNow, which vary depending on the subscription plan chosen. However, our pricing is designed to be cost-effective, especially for businesses handling complex tax documentation like the Instructions For Form W 3C PR. Investing in our services can save you time and reduce the risk of costly mistakes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers various features for document management, including eSignature capabilities, customizable templates, and audit trails. These tools are crucial when working with important documents like the Instructions For Form W 3C PR, Transmittal Of Corrected Income And Tax Statements Puerto Rico. Our features help you maintain organized, secure, and compliant records.

-

Can airSlate SignNow integrate with other software tools for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software tools. This ensures that you can efficiently manage your workflow while completing tasks such as the Instructions For Form W 3C PR. Our integrations help connect your existing systems, maximizing your productivity with the Transmittal Of Corrected Income And Tax Statements Puerto Rico.

-

What types of businesses benefit from airSlate SignNow's features?

Any business that needs to manage forms and documents, particularly those working with tax forms like the Instructions For Form W 3C PR, can benefit from airSlate SignNow. Our solution is suitable for small businesses, large corporations, and accounting firms alike who require an efficient way to handle corrected income and tax statements in Puerto Rico.

Get more for Instructions For Form W 3c PR Rev February Instructions For Form W 3C PR, Transmittal Of Corrected Income And Tax Statements Pue

Find out other Instructions For Form W 3c PR Rev February Instructions For Form W 3C PR, Transmittal Of Corrected Income And Tax Statements Pue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors