Form 990 BL Rev June Fill in Capable Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related

What is the Form 990 BL Rev June Fill In Capable Information And Initial Excise Tax Return For Black Lung Benefit Trusts And Certain Related Persons

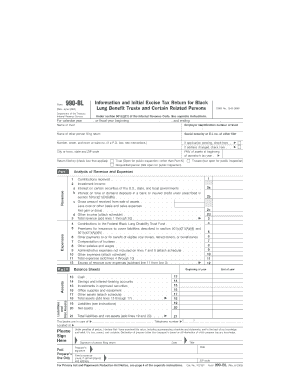

The Form 990 BL Rev June is a specialized tax form used by Black Lung Benefit Trusts and certain related persons to report their financial activities and calculate any applicable excise taxes. This form is essential for ensuring compliance with Internal Revenue Service (IRS) regulations regarding the management and distribution of funds related to black lung benefits. It provides a structured format for organizations to disclose their financial information, including income, expenses, and tax liabilities.

How to use the Form 990 BL Rev June Fill In Capable Information And Initial Excise Tax Return For Black Lung Benefit Trusts And Certain Related Persons

Using the Form 990 BL Rev June requires careful attention to detail. Organizations must fill out the form accurately, providing all required information about their financial operations. This includes reporting income generated, detailing expenditures, and calculating any excise taxes owed. It is advisable to review the IRS guidelines to ensure all sections of the form are completed correctly. Additionally, organizations should keep a copy of the submitted form for their records, as it may be needed for future reference or audits.

Steps to complete the Form 990 BL Rev June Fill In Capable Information And Initial Excise Tax Return For Black Lung Benefit Trusts And Certain Related Persons

Completing the Form 990 BL Rev June involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill in the organization’s identifying information, including name, address, and Employer Identification Number (EIN).

- Report all income sources and amounts accurately.

- Detail all expenditures related to the trust’s operations.

- Calculate the excise tax based on the reported information.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of the Form 990 BL Rev June is crucial to avoid penalties. The IRS requires that this form be submitted by the fifteenth day of the fifth month following the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. It is advisable to mark this date on your calendar and prepare the necessary documentation well in advance to ensure compliance.

Penalties for Non-Compliance

Failure to file the Form 990 BL Rev June on time can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, if the form is not filed correctly or is incomplete, the IRS may reject it, leading to further complications. It is essential for organizations to understand the importance of compliance and take proactive steps to meet all filing requirements.

Eligibility Criteria

Eligibility to use the Form 990 BL Rev June is typically limited to Black Lung Benefit Trusts and certain related persons as defined by IRS regulations. Organizations must ensure they meet the specific criteria outlined by the IRS to qualify for this form. This includes being established for the purpose of providing benefits to individuals suffering from black lung disease and adhering to the relevant federal guidelines regarding trust operations.

Quick guide on how to complete form 990 bl rev june fill in capable information and initial excise tax return for black lung benefit trusts and certain

Prepare [SKS] effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and then click on the Done button to save your edits.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 BL Rev June Fill In Capable Information And Initial Excise Tax Return For Black Lung Benefit Trusts And Certain Related

Create this form in 5 minutes!

How to create an eSignature for the form 990 bl rev june fill in capable information and initial excise tax return for black lung benefit trusts and certain

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 BL Rev June, and why is it essential for Black Lung Benefit Trusts?

The Form 990 BL Rev June is a specialized tax form required for Black Lung Benefit Trusts to report their financial activities and compliance. This form helps organizations accurately disclose their income and expenses, ensuring they meet regulatory requirements. Filling in the Form 990 BL Rev June is crucial for maintaining transparency and accountability in financial reporting.

-

How can airSlate SignNow help with the Form 990 BL Rev June process?

airSlate SignNow offers features that streamline the process of filling out and submitting the Form 990 BL Rev June. With its user-friendly interface, you can easily eSign documents and ensure that all necessary information is accurately captured. This efficiency ultimately helps Black Lung Benefit Trusts save time and avoid errors in their submissions.

-

Is airSlate SignNow a cost-effective solution for managing Form 990 BL Rev June submissions?

Yes, airSlate SignNow is designed to offer a cost-effective solution for managing the Form 990 BL Rev June submissions. By utilizing our platform, organizations can reduce overhead costs associated with traditional paper-based processes. Our affordable pricing plans ensure that even smaller trusts can access robust features for their tax reporting needs.

-

Can I track the status of my Form 990 BL Rev June submission with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form 990 BL Rev June submission. You’ll receive notifications when documents are opened, signed, or completed, giving you peace of mind and control over your important filings.

-

What integrations does airSlate SignNow offer for managing tax forms like the Form 990 BL Rev June?

airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage forms like the Form 990 BL Rev June. This connectivity enables you to synchronize data and automate workflows, reducing the effort required to complete tax documentation. By using these integrations, you can enhance the efficiency of your reporting processes.

-

What benefits does airSlate SignNow offer for organizations filing the Form 990 BL Rev June?

Using airSlate SignNow for the Form 990 BL Rev June provides numerous benefits, including enhanced accessibility, time savings, and reduced errors. The platform allows for easy sharing and collaboration, ensuring all stakeholders can contribute to the completion of the form. Additionally, electronic signatures simplify the approval process, expediting your submission timeline.

-

Is it easy to learn how to use airSlate SignNow for the Form 990 BL Rev June?

Yes, airSlate SignNow is known for its intuitive design, making it easy to learn and use for the Form 990 BL Rev June. Our platform includes helpful resources, such as tutorials and customer support, to assist you in navigating the features. This ease of use enables organizations to quickly adapt to the system for their filing needs.

Get more for Form 990 BL Rev June Fill In Capable Information And Initial Excise Tax Return For Black Lung Benefit Trusts And Certain Related

Find out other Form 990 BL Rev June Fill In Capable Information And Initial Excise Tax Return For Black Lung Benefit Trusts And Certain Related

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed