Form 13325 Rev August Fill in Capable Statement of Assurance Concerning Civil Rights Compliance for IRS SPEC Partnerships

Understanding the Form 13325 Rev August

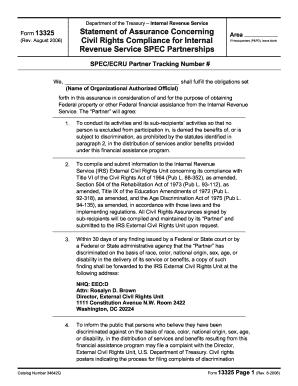

The Form 13325 Rev August, also known as the Statement of Assurance Concerning Civil Rights Compliance for IRS SPEC Partnerships, is a crucial document used to affirm compliance with civil rights laws. This form is specifically designed for partnerships participating in the IRS's Stakeholder Partnerships, Education, and Communication (SPEC) program. It ensures that these partnerships adhere to federal civil rights laws, promoting fair treatment and equal opportunity in their operations.

Steps to Complete the Form 13325 Rev August

Completing the Form 13325 Rev August involves several key steps:

- Begin by downloading the form from the IRS website or obtaining it through your partnership's administrative office.

- Carefully read the instructions provided with the form to understand the requirements and necessary information.

- Fill in the required fields, including the partnership's name, address, and contact information.

- Provide details regarding the partnership's compliance with civil rights laws, ensuring accuracy and honesty.

- Review the completed form for any errors or omissions before submission.

Obtaining the Form 13325 Rev August

The Form 13325 Rev August can be obtained through various methods. It is available for download on the official IRS website, where users can find the most current version of the form. Additionally, partnerships may request physical copies from their local IRS office or through their partnership's administrative resources. It is essential to ensure that the correct version of the form is used to avoid any compliance issues.

Key Elements of the Form 13325 Rev August

Several critical elements must be included in the Form 13325 Rev August:

- Partnership Information: This includes the legal name, address, and contact details of the partnership.

- Compliance Statement: A declaration affirming the partnership's commitment to uphold civil rights laws.

- Signature: The form must be signed by an authorized representative of the partnership, confirming the accuracy of the information provided.

Legal Use of the Form 13325 Rev August

The Form 13325 Rev August serves a legal purpose by documenting a partnership's commitment to civil rights compliance. This form is often required for partnerships involved in federal programs or contracts, ensuring they meet the necessary legal standards. Failure to submit this form or providing false information can result in penalties, including loss of funding or eligibility for federal programs.

IRS Guidelines for the Form 13325 Rev August

The IRS provides specific guidelines for completing and submitting the Form 13325 Rev August. Partnerships must ensure they follow these guidelines closely to maintain compliance. This includes adhering to deadlines for submission, ensuring that all information is accurate and complete, and keeping a copy of the submitted form for their records. Partnerships should regularly review IRS updates to stay informed about any changes to the form or its requirements.

Quick guide on how to complete form 13325 rev august fill in capable statement of assurance concerning civil rights compliance for irs spec partnerships

Complete [SKS] easily on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and safely keep it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

The simplest way to alter and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13325 rev august fill in capable statement of assurance concerning civil rights compliance for irs spec partnerships

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships?

The Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships is a declaration required for entities participating in IRS programs. This form ensures compliance with civil rights laws and demonstrates your organization's commitment to non-discriminatory practices. It's essential for maintaining participation in IRS SPEC partnerships.

-

How can airSlate SignNow help me manage the Form 13325 Rev August Fill In Capable Statement Of Assurance?

airSlate SignNow offers an efficient platform for managing the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships. Our user-friendly features allow businesses to fill, sign, and send the form electronically, streamlining the process. This ensures you stay compliant while saving time and reducing paperwork.

-

What are the pricing plans for using airSlate SignNow for Form 13325 Rev August?

airSlate SignNow provides flexible pricing plans tailored for various business needs. Each plan includes features to help you complete the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships efficiently. We offer competitive pricing to ensure you receive the best value for your electronic signing and document management needs.

-

Are there any integration options available with airSlate SignNow when working with Form 13325 Rev August?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your document management experience. You can connect your existing workflows with tools such as CRM systems, cloud storage, and productivity applications, making it easier to manage the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships across platforms.

-

What are the key features of airSlate SignNow that support the Form 13325 Rev August?

airSlate SignNow includes features like customizable templates, secure e-signatures, and real-time tracking that specifically support the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships. These features enhance document management, making it easy to ensure you’ve met all requirements and deadlines in the compliance process.

-

Can I collaborate with my team on the Form 13325 Rev August using airSlate SignNow?

Absolutely! airSlate SignNow allows for collaborative editing and sharing, making it easy for your team to work together on the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships. Team members can leave comments, track changes, and ensure everyone is on the same page, facilitating a smooth completion process.

-

Is there customer support available for using airSlate SignNow with Form 13325 Rev August?

Yes, airSlate SignNow offers robust customer support to assist with any questions about the Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships. Our support team is available through multiple channels, ensuring you receive prompt assistance whenever you need help navigating our platform.

Get more for Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships

Find out other Form 13325 Rev August Fill In Capable Statement Of Assurance Concerning Civil Rights Compliance For IRS SPEC Partnerships

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors