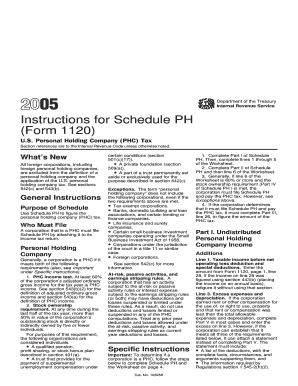

Instructions for Form 1120 Schedule PH Instructions for Schedule PH Form 1120, U S Personal Holding Company PHC Tax

Understanding Form 1120 Schedule PH

The Instructions For Form 1120 Schedule PH provide essential guidance for U.S. Personal Holding Companies (PHCs). This form is used to report income, deductions, and tax liability for corporations that meet specific criteria set by the Internal Revenue Service (IRS). A PHC is typically defined by its income sources and asset composition, which must adhere to the regulations outlined in the tax code. Understanding the purpose of this form is crucial for compliance and accurate reporting.

Steps to Complete Form 1120 Schedule PH

Completing Form 1120 Schedule PH involves several steps to ensure accuracy and compliance. First, gather all necessary financial information, including income statements and balance sheets. Next, fill out the form sections, which require details on income, deductions, and tax calculations. Pay special attention to the income sources, as they determine PHC status. After completing the form, review it for errors and ensure all required signatures are present before submission.

Key Elements of Form 1120 Schedule PH

Form 1120 Schedule PH includes several key elements that must be accurately reported. These elements encompass gross income, allowable deductions, and the calculation of the PHC tax. Additionally, the form requires details on the corporation's ownership structure and any distributions made to shareholders. Understanding these components is vital for determining the tax liability and ensuring compliance with IRS regulations.

IRS Guidelines for Form 1120 Schedule PH

The IRS provides specific guidelines for completing Form 1120 Schedule PH. These guidelines include instructions on how to classify income, what deductions are permissible, and how to calculate the PHC tax. It is essential to follow these guidelines closely to avoid penalties and ensure that the form is filed correctly. The IRS also updates these guidelines periodically, so staying informed about any changes is important for accurate reporting.

Filing Deadlines for Form 1120 Schedule PH

Filing deadlines for Form 1120 Schedule PH are crucial for compliance. Generally, the form must be filed on or before the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on March 15. If additional time is needed, corporations may file for an extension, but it is important to understand the implications of such extensions on tax liabilities.

Penalties for Non-Compliance with Form 1120 Schedule PH

Failure to comply with the filing requirements for Form 1120 Schedule PH can result in significant penalties. The IRS imposes fines for late filings, inaccurate information, and failure to pay the required tax. Understanding these penalties can help corporations avoid costly mistakes and ensure timely and accurate submissions. It is advisable to consult with a tax professional if there are uncertainties regarding compliance.

Quick guide on how to complete instructions for form 1120 schedule ph instructions for schedule ph form 1120 u s personal holding company phc tax

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without any holdups. Manage [SKS] from any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information carefully and click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure exceptional communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 1120 Schedule PH Instructions For Schedule PH Form 1120, U S Personal Holding Company PHC Tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1120 schedule ph instructions for schedule ph form 1120 u s personal holding company phc tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 1120 Schedule PH?

The Instructions For Form 1120 Schedule PH provide detailed guidelines on how to properly complete Schedule PH for a U.S. Personal Holding Company (PHC) tax return. These instructions help ensure compliance and correct reporting of any 'personal holding company' income and deductions.

-

How can airSlate SignNow assist with filling out Schedule PH for Form 1120?

airSlate SignNow simplifies the process of completing the Instructions For Form 1120 Schedule PH by allowing users to easily fill out and eSign necessary documents online. Its user-friendly interface makes it easier to follow the required steps for Schedule PH compliance.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you get features like eSigning, document sharing, and customizable templates specifically designed to streamline processes such as completing the Instructions For Form 1120 Schedule PH. These features enhance the efficiency and accuracy of your tax form management.

-

Are there any integration options available with airSlate SignNow?

Yes, airSlate SignNow offers various integrations with popular tools and platforms, ensuring that your workflow is seamless when dealing with the Instructions For Form 1120 Schedule PH. This allows for a more connected experience across documents and services.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow has flexible pricing plans tailored to meet various business needs and budgets. Whether you're handling the Instructions For Form 1120 Schedule PH for a single entity or a larger organization, there's a plan that can accommodate your needs.

-

Can airSlate SignNow be used for other tax forms beyond Schedule PH?

Absolutely! airSlate SignNow supports a wide range of tax forms and documents, not just the Instructions For Form 1120 Schedule PH. This versatility makes it a valuable tool for businesses dealing with various tax documentation and compliance needs.

-

What benefits can I expect from using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including speed, accuracy, and enhanced security. This is particularly important for complex tax documentation such as the Instructions For Form 1120 Schedule PH, where precision is crucial.

Get more for Instructions For Form 1120 Schedule PH Instructions For Schedule PH Form 1120, U S Personal Holding Company PHC Tax

Find out other Instructions For Form 1120 Schedule PH Instructions For Schedule PH Form 1120, U S Personal Holding Company PHC Tax

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile