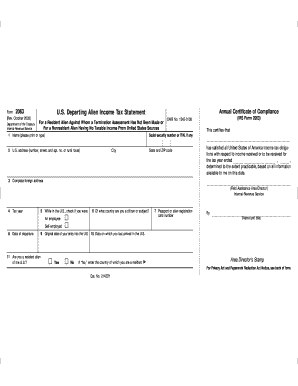

Form 2063 Rev October Fill in Capable U S Departing Alien Income Tax Statement

What is the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

The Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement is a tax document specifically designed for non-resident aliens who are departing the United States. This form is used to report income earned in the U.S. and to ensure compliance with tax obligations before leaving the country. It serves as a declaration of income and tax liabilities, allowing the Internal Revenue Service (IRS) to accurately assess any taxes owed by the individual. Understanding this form is crucial for departing aliens to avoid potential penalties and ensure a smooth exit from the U.S.

How to use the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

Using the Form 2063 Rev October requires careful attention to detail. First, individuals must gather all relevant income documentation, including W-2s, 1099s, and any other income records. Next, fill out the form accurately, ensuring that all required fields are completed. This includes personal information, income details, and tax calculations. Once the form is completed, it must be submitted to the IRS as part of the tax filing process. It is advisable to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

Completing the Form 2063 Rev October involves several key steps:

- Collect all necessary financial documents, such as income statements and tax forms.

- Begin filling out the form with accurate personal information, including your name, address, and taxpayer identification number.

- Report all sources of income earned while in the U.S., ensuring that amounts are correctly calculated.

- Complete any applicable deductions or credits that may apply to your situation.

- Review the entire form for accuracy before submission.

- Submit the completed form to the IRS by the designated deadline.

Key elements of the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

The Form 2063 Rev October contains several key elements that are essential for accurate reporting:

- Personal Information: This includes the taxpayer's name, address, and identification number.

- Income Reporting: Details of all income earned in the U.S. must be accurately reported.

- Deductions and Credits: Any applicable deductions or tax credits should be included to reduce tax liability.

- Signature: The form must be signed and dated to validate the information provided.

Legal use of the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

The Form 2063 Rev October is legally required for non-resident aliens who have earned income in the U.S. and are planning to leave the country. Failing to complete this form can result in penalties, including fines and complications with future U.S. entry. It is important for individuals to understand their legal obligations and ensure compliance with IRS regulations when using this form. Proper use of the form not only fulfills legal requirements but also protects the taxpayer's rights and interests.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2063 Rev October are crucial for compliance. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for the previous tax year. However, for departing aliens, it is essential to check for any specific deadlines that may apply based on individual circumstances. Late submissions can result in penalties, so it is advisable to file as early as possible to avoid complications.

Quick guide on how to complete form 2063 rev october fill in capable u s departing alien income tax statement

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed documents, as you can easily obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few taps from your chosen device. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

Create this form in 5 minutes!

How to create an eSignature for the form 2063 rev october fill in capable u s departing alien income tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement?

The Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement is a crucial document for nonresident aliens who need to report income earned in the United States. This form simplifies the tax filing process, ensuring compliance with IRS regulations while providing a clear structure for reporting taxable income.

-

How can airSlate SignNow help me with the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement?

airSlate SignNow offers an intuitive platform for creating, signing, and managing the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement electronically. With our eSign features, you can easily fill out, sign, and share this essential tax statement securely from anywhere.

-

What are the pricing options for using airSlate SignNow to complete the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement?

airSlate SignNow provides flexible pricing plans to cater to different needs and budgets. Our affordable plans are designed to ensure you can electronically manage the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement without breaking the bank.

-

Is the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement easy to fill out?

Yes, the airSlate SignNow platform simplifies the process of filling out the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement. Our user-friendly interface guides you through each step, ensuring that you can easily provide the required information without any hassle.

-

Can I store completed Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statements on airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store your completed Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statements in the cloud. This feature ensures easy access and organization for future reference or audits.

-

Does airSlate SignNow integrate with other tools I use for tax preparation?

Yes, airSlate SignNow offers seamless integrations with various tax preparation software and business tools. This capability allows you to enhance your efficiency when working with the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement and other documentation.

-

What are the benefits of using airSlate SignNow for the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement?

Using airSlate SignNow for the Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement offers numerous benefits including increased efficiency, enhanced security, and compliance with legal requirements. Our platform ensures that your documents are managed properly, saving you time and effort.

Get more for Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

- Omntec oel8000ii troubleshooting form

- Learn db2 in 21 days pdf form

- Wsib form 3947a

- Science fair evaluation sheet form

- Privacy act consent form

- Instructor evaluation form 42147653

- Commonwealth of massachusetts request for verification of taxation reporting information substitute w 9 form

- State form 11274r30 11 12

Find out other Form 2063 Rev October Fill In Capable U S Departing Alien Income Tax Statement

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later