Form 5884, Fill in Capable Work Opportunity Credit

What is the Form 5884, Fill In Capable Work Opportunity Credit

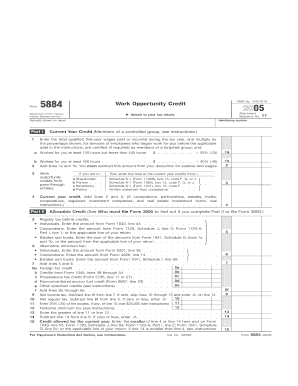

Form 5884 is a tax form used to claim the Work Opportunity Credit (WOC), which is a federal tax incentive aimed at encouraging employers to hire individuals from specific target groups facing significant barriers to employment. This credit can reduce an employer's federal tax liability, making it financially beneficial to hire eligible employees. The form requires detailed information about the business, the qualified employees, and the wages paid to them during their employment period.

How to use the Form 5884, Fill In Capable Work Opportunity Credit

To use Form 5884 effectively, employers must first determine if they have hired individuals from qualifying target groups, such as veterans or individuals receiving certain government assistance. After confirming eligibility, employers should complete the form by providing necessary details, including the number of qualified employees and the wages paid. The completed form is then submitted with the employer's federal tax return to claim the credit. It is essential to retain records of the employees' eligibility for future reference and verification.

Steps to complete the Form 5884, Fill In Capable Work Opportunity Credit

Completing Form 5884 involves several key steps:

- Gather information about the business, including the Employer Identification Number (EIN).

- Identify qualified employees and confirm their eligibility based on the target group criteria.

- Document the wages paid to these employees during the tax year.

- Fill out the form, ensuring all required sections are completed accurately.

- Submit the form along with the federal tax return by the appropriate deadline.

Eligibility Criteria

To qualify for the Work Opportunity Credit, employers must hire individuals from specific target groups. These groups include, but are not limited to, veterans, long-term unemployed individuals, and recipients of certain government assistance programs. Each group has its own eligibility requirements, and employers should verify that the employees meet these criteria before claiming the credit. Proper documentation is essential to support the claims made on Form 5884.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for Form 5884 to ensure they receive the Work Opportunity Credit. The form should be submitted along with the employer's federal tax return, typically due on April fifteenth of the following year. However, if the employer files for an extension, the form must be submitted by the extended deadline. It is crucial to keep track of these dates to avoid missing out on potential tax benefits.

Required Documents

When completing Form 5884, employers should have several documents on hand to ensure accuracy and compliance. These documents include:

- Records of the employees' eligibility, such as documentation of their participation in qualifying programs.

- Payroll records showing wages paid to qualified employees.

- The Employer Identification Number (EIN) for the business.

- Any additional forms or schedules that may be required based on the employer's specific tax situation.

Quick guide on how to complete form 5884 fill in capable work opportunity credit

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, enabling you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to distribute your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5884, Fill In Capable Work Opportunity Credit

Create this form in 5 minutes!

How to create an eSignature for the form 5884 fill in capable work opportunity credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5884, Fill In Capable Work Opportunity Credit?

Form 5884, Fill In Capable Work Opportunity Credit, is a tax form used by employers to claim the Work Opportunity Credit. This credit helps incentivize hiring individuals from certain target groups who face barriers to employment. By using this form, businesses can reduce their tax liability signNowly.

-

How can airSlate SignNow help with Form 5884, Fill In Capable Work Opportunity Credit?

With airSlate SignNow, businesses can easily create, sign, and store documents related to Form 5884, Fill In Capable Work Opportunity Credit. Our user-friendly platform simplifies the process, making it quicker to prepare and submit necessary paperwork. This leads to a more efficient claim process for the Work Opportunity Credit.

-

What features does airSlate SignNow offer for managing Form 5884?

airSlate SignNow provides features like document templates, custom workflows, and secure e-signatures, specifically designed to manage Form 5884, Fill In Capable Work Opportunity Credit. You can streamline the documentation process with automation, reducing time spent on administrative tasks. Our platform ensures compliance and accuracy throughout.

-

Is airSlate SignNow a cost-effective solution for businesses claiming Form 5884?

Yes, airSlate SignNow is a cost-effective solution designed to support businesses of all sizes in managing Form 5884, Fill In Capable Work Opportunity Credit. Our straightforward pricing plans allow you to save on overhead while maximizing your tax credits. Investing in our solution makes financial sense as it enhances your operational efficiency.

-

Can airSlate SignNow integrate with other business software for Form 5884?

Absolutely! airSlate SignNow integrates seamlessly with various business software, enhancing your ability to manage Form 5884, Fill In Capable Work Opportunity Credit. These integrations allow for a smoother workflow, as you can pull data from other applications directly into your documents, ensuring consistency and accuracy.

-

How does airSlate SignNow ensure the security of documents related to Form 5884?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 5884, Fill In Capable Work Opportunity Credit. We use advanced encryption and secure data storage solutions to protect your information. Additionally, our platform is designed to comply with industry standards for data privacy.

-

What support does airSlate SignNow provide for users filling out Form 5884?

airSlate SignNow offers comprehensive customer support for all users completing Form 5884, Fill In Capable Work Opportunity Credit. Our support team is available 24/7 to assist you with any questions or challenges you may face. We also provide tutorials and resources to help guide you through the process.

Get more for Form 5884, Fill In Capable Work Opportunity Credit

Find out other Form 5884, Fill In Capable Work Opportunity Credit

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free