Form 8849 Schedule 3 Rev February Fill in Capable

What is the Form 8849 Schedule 3 Rev February Fill In Capable

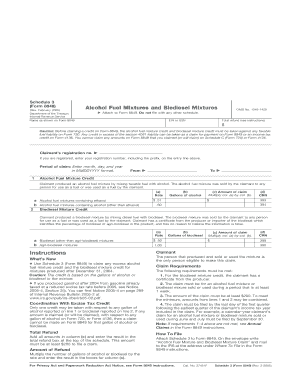

The Form 8849 Schedule 3 Rev February is a specific IRS form used for claiming refunds of certain excise taxes. This form is particularly relevant for taxpayers who have overpaid these taxes and seek reimbursement. It is designed to facilitate the refund process for various excise taxes, including those related to fuel and certain environmental fees. Understanding the purpose of this form is essential for ensuring compliance and maximizing potential refunds.

Steps to complete the Form 8849 Schedule 3 Rev February Fill In Capable

Completing the Form 8849 Schedule 3 involves several important steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary documentation related to the excise taxes you are claiming. This includes receipts, invoices, and any previous tax filings that support your claim. Next, fill in your personal information, including your name, address, and taxpayer identification number. Then, accurately report the amounts of excise tax you are claiming for refund in the designated sections. Finally, review the form for completeness and accuracy before submitting it to the IRS.

How to obtain the Form 8849 Schedule 3 Rev February Fill In Capable

The Form 8849 Schedule 3 can be obtained directly from the IRS website. It is available for download in PDF format, allowing you to print and fill it out manually. Alternatively, you can also access it through various tax preparation software that includes IRS forms. Ensure that you are using the most current version of the form to avoid any issues during the filing process.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 8849 Schedule 3. These guidelines include instructions on eligibility for refunds, the types of excise taxes that can be claimed, and the required supporting documentation. It is crucial to adhere to these guidelines to ensure that your claim is processed efficiently and accurately. Additionally, the IRS outlines the timeframe for processing refunds, which can vary depending on the complexity of the claim.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8849 Schedule 3 are critical to ensure timely processing of refund claims. Generally, claims for refunds must be filed within three years from the date of the tax payment. It is essential to keep track of these deadlines to avoid missing out on potential refunds. Additionally, the IRS may have specific deadlines for certain types of excise taxes, which should be reviewed carefully.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Form 8849 Schedule 3 can result in penalties. These penalties may include fines for late submissions or inaccuracies in the information provided. It is important to ensure that all information is accurate and submitted on time to avoid these penalties. Understanding the potential consequences of non-compliance can help taxpayers take the necessary steps to protect themselves.

Quick guide on how to complete form 8849 schedule 3 rev february fill in capable

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The Easiest Way to Modify and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8849 Schedule 3 Rev February Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 8849 schedule 3 rev february fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8849 Schedule 3 Rev February Fill In Capable used for?

Form 8849 Schedule 3 Rev February Fill In Capable is specifically designed for claiming refunds of excise taxes. Businesses use this form to detail their requests for refunds related to certain items and situations including fuel, which helps them manage tax liabilities effectively.

-

How does airSlate SignNow support the completion of Form 8849 Schedule 3 Rev February Fill In Capable?

AirSlate SignNow provides an intuitive platform that allows users to fill in Form 8849 Schedule 3 Rev February Fill In Capable digitally. The software streamlines the process, ensuring compliance and accuracy while minimizing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8849 Schedule 3 Rev February Fill In Capable?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a cost, the platform delivers a cost-effective solution for electronically signing and managing documents, including Form 8849 Schedule 3 Rev February Fill In Capable.

-

Can I integrate airSlate SignNow with other applications while filling Form 8849 Schedule 3 Rev February Fill In Capable?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to connect with accounting software or other tools. This enhances the document handling process while filling out Form 8849 Schedule 3 Rev February Fill In Capable.

-

What are the benefits of using airSlate SignNow for Form 8849 Schedule 3 Rev February Fill In Capable?

Using airSlate SignNow for Form 8849 Schedule 3 Rev February Fill In Capable provides businesses with efficiency and security in document management. The platform enhances collaboration, reduces paper waste, and ensures that documents are securely stored and easily accessible.

-

Can I track the status of my Form 8849 Schedule 3 Rev February Fill In Capable submissions?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your submissions for Form 8849 Schedule 3 Rev February Fill In Capable. You will receive notifications and updates throughout the signing process, ensuring transparency.

-

How user-friendly is the airSlate SignNow platform for filling out Form 8849 Schedule 3 Rev February Fill In Capable?

The airSlate SignNow platform is designed to be user-friendly, making it easy for anyone to fill out Form 8849 Schedule 3 Rev February Fill In Capable. With a simple interface, users can navigate through the necessary steps without extensive training.

Get more for Form 8849 Schedule 3 Rev February Fill In Capable

Find out other Form 8849 Schedule 3 Rev February Fill In Capable

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document