Form 8878 SP Fill in Capable IRS E File Signature Authorization for Application for Extension of Time to File Spanish Version

What is the Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

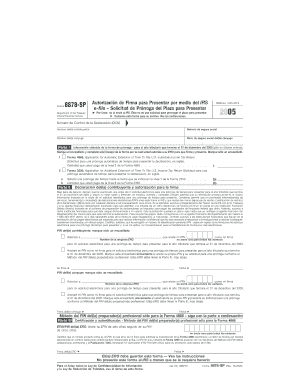

The Form 8878 SP is a critical document used by taxpayers in the United States seeking an extension of time to file their federal tax returns. This form serves as an IRS e-file signature authorization, allowing taxpayers to electronically sign their extension request. The Spanish version is specifically designed for Spanish-speaking individuals, ensuring accessibility and clarity in the filing process. By using this form, taxpayers can request an automatic extension of six months to file their returns, providing them with additional time to prepare their financial documents without incurring late filing penalties.

How to use the Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

To utilize the Form 8878 SP effectively, taxpayers should first ensure they have all necessary information at hand, including personal details and tax identification numbers. The form can be completed digitally, allowing for ease of use and accuracy. Once the form is filled out, it must be submitted electronically through an authorized e-file provider. This process not only streamlines the submission but also ensures that the IRS receives the request promptly. It is essential to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

Completing the Form 8878 SP involves several straightforward steps:

- Gather necessary information, including your name, Social Security number, and the tax year for which you are requesting an extension.

- Access the form through a reliable e-file provider that supports the Spanish version.

- Fill in the required fields accurately, ensuring all information is correct to avoid delays.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the e-file provider.

Following these steps will help ensure a smooth extension request process.

Legal use of the Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

The Form 8878 SP is legally recognized by the IRS as a valid method for requesting an extension of time to file tax returns. By completing and submitting this form, taxpayers are complying with IRS regulations, which allow for an automatic six-month extension. It is important to note that while the extension provides additional time to file, it does not extend the deadline for paying any taxes owed. Taxpayers must ensure they pay any estimated taxes by the original due date to avoid penalties.

Key elements of the Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

Several key elements make up the Form 8878 SP:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Tax Year: The specific tax year for which the extension is being requested.

- Signature Authorization: This section allows the taxpayer to authorize an e-file provider to submit the extension request on their behalf.

- Date: The date on which the form is completed and submitted.

Understanding these elements is crucial for accurate completion and compliance with IRS requirements.

Filing Deadlines / Important Dates

When using the Form 8878 SP, it is essential to be aware of filing deadlines. The form must be submitted by the original due date of the tax return, typically April 15 for most individual taxpayers. If the due date falls on a weekend or holiday, the deadline extends to the next business day. Taxpayers should also note that while the form allows for an extension to file, any taxes owed must still be paid by the original due date to avoid interest and penalties.

Quick guide on how to complete form 8878 sp fill in capable irs e file signature authorization for application for extension of time to file spanish version

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow offers all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your updates.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you select. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

Create this form in 5 minutes!

How to create an eSignature for the form 8878 sp fill in capable irs e file signature authorization for application for extension of time to file spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8878 SP Fill In Capable IRS E file Signature Authorization?

Form 8878 SP Fill In Capable IRS E file Signature Authorization is a document that allows taxpayers to authorize an E-file provider to submit their extension request on their behalf. This Spanish version specifically caters to Spanish-speaking individuals, ensuring compliance with IRS requirements while simplifying the process.

-

How does airSlate SignNow facilitate the completion of Form 8878 SP?

airSlate SignNow offers a user-friendly platform that enables you to easily fill out Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version. Our intuitive interface streamlines the document preparation process, allowing for seamless online signing and submission.

-

What are the benefits of using airSlate SignNow for Form 8878 SP?

Using airSlate SignNow for Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version provides several benefits, including time savings, enhanced security, and increased accessibility. You can manage your documents online, ensuring that everything is done efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Form 8878 SP?

Yes, airSlate SignNow offers various pricing plans designed to fit different needs, including options specifically for managing forms like Form 8878 SP Fill In Capable IRS E file Signature Authorization. Our plans provide flexibility and allow you to choose the features that best suit your business requirements.

-

Can I integrate airSlate SignNow with other applications for easier management?

Absolutely! airSlate SignNow allows seamless integration with a variety of applications and services to enhance your workflow. You can easily connect your tools to efficiently handle Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version with other business processes.

-

How secure is the information submitted through airSlate SignNow?

Security is a top priority for airSlate SignNow. When you fill out and submit Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version, your data is protected by industry-leading encryption and compliance measures, ensuring that your sensitive information remains safe.

-

Can I access Form 8878 SP on mobile devices?

Yes, airSlate SignNow supports mobile access, allowing you to fill out and sign Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version anytime, anywhere. Our mobile-friendly design ensures that you can manage your documents effectively on the go.

Get more for Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

- Dc vacant building response form

- Local government public records destruction log sos wa form

- Suicide risk assessment form 28734117

- Florida blue certificate of medical necessity form

- Ncysa medical waiver nc fusion form

- Noise mitigation form

- Foreign earned income tax worksheet pdf form

- Book review outline pdf form

Find out other Form 8878 SP Fill In Capable IRS E file Signature Authorization For Application For Extension Of Time To File Spanish Version

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself