Form 9325 Rev November Fill in Capable

Understanding the Form 9325

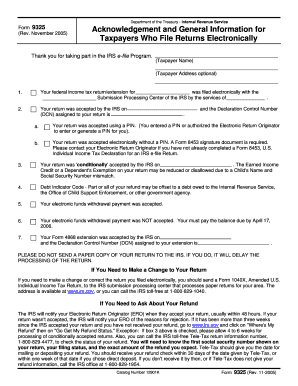

The Form 9325, also known as the "Acknowledge of Receipt of Return," is a document used by the Internal Revenue Service (IRS) to confirm the receipt of tax returns. This form is essential for taxpayers who wish to ensure that their submitted tax documents have been officially recorded by the IRS. It serves as a verification tool, providing peace of mind to individuals and businesses during the tax filing process.

Steps to Complete the Form 9325

Completing the Form 9325 involves a straightforward process. Here are the key steps:

- Gather necessary information, such as your name, Social Security number, and details of the tax return being submitted.

- Fill in the required fields accurately, ensuring that all information matches your tax return.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate its authenticity.

By following these steps, you can ensure that your Form 9325 is completed correctly and submitted in a timely manner.

How to Obtain the Form 9325

The Form 9325 can be easily obtained through the IRS website or by contacting the IRS directly. It is available in a fillable PDF format, allowing taxpayers to complete the form digitally. Alternatively, you may also request a physical copy by mail if you prefer a paper version. Ensure that you have the most current version of the form, as updates may occur periodically.

Legal Use of the Form 9325

The Form 9325 is legally recognized by the IRS as a valid acknowledgment of receipt for tax returns. It is important for taxpayers to understand that this form does not serve as a confirmation of the accuracy of the tax return but rather as proof that the IRS has received the submission. This distinction is crucial for compliance and record-keeping purposes.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Form 9325. The form should be submitted along with your tax return by the due date, which typically falls on April fifteenth for individual taxpayers. For businesses, deadlines may vary based on the entity type. Keeping track of these dates helps avoid penalties and ensures compliance with IRS regulations.

Form Submission Methods

The Form 9325 can be submitted through various methods, depending on how you file your tax return. If you e-file your tax return, the acknowledgment of receipt is typically generated electronically. For paper submissions, you can include the Form 9325 with your tax return when mailing it to the IRS. Understanding the submission methods is vital for ensuring that your form reaches the IRS promptly and securely.

Quick guide on how to complete 9325 form

Prepare 9325 form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without interruptions. Handle 9325 form across any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign form 9325 with ease

- Access 9325 form and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that task.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and eSign form 9325 to ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 9325 form

Create this form in 5 minutes!

How to create an eSignature for the form 9325

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 9325

-

What is the 9325 form and who needs it?

The 9325 form is a document required for specific business functionalities, often linked to regulatory compliance. Organizations that engage with particular legal or financial processes will need to complete this form accurately to ensure adherence to industry standards.

-

How can airSlate SignNow help with completing the 9325 form?

airSlate SignNow simplifies the process of completing the 9325 form by providing easy-to-use templates and digital signing features. Users can fill out essential fields, add necessary signatures, and send the form securely, streamlining what can often be a complicated process.

-

Is there a cost associated with using airSlate SignNow for the 9325 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. By subscribing to a plan, users gain access to enhanced features for managing the 9325 form and other vital documents efficiently.

-

What features does airSlate SignNow offer for managing the 9325 form?

airSlate SignNow provides a range of features for the 9325 form, including eSignatures, document tracking, and customizable templates. These tools help ensure that your documents are processed correctly and securely while saving time.

-

Can I integrate airSlate SignNow with other applications for the 9325 form?

Absolutely, airSlate SignNow supports integrations with various applications, enhancing the workflow for handling the 9325 form. Whether you need to connect with CRM systems or storage solutions, SignNow can streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the 9325 form over traditional methods?

Using airSlate SignNow for the 9325 form offers numerous advantages over traditional methods, including faster processing times and a reduction in paperwork. The digital platform ensures accuracy and security, resulting in a more efficient workflow for your business.

-

Is airSlate SignNow secure for submitting sensitive 9325 forms?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with regulations such as GDPR. This means that when you submit your sensitive 9325 form through SignNow, your information is protected throughout the process.

Get more for 9325 form

- Switch the complete film viewing questions answer key form

- Condominium resale purchase and sales agreement rhode island rirealtors form

- Ac 3253 s form

- Health care power of attorney wheaton franciscan healthcare form

- Kynect forms khbe i10

- 23rd vis moot claimant memorandum form

- Would you advise dulip to convert his business into a partnership form

- Sampling and analysis plan guidance and template form

Find out other form 9325

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free