Form 12153 Rev January Fill in Capable

What is the Form 12153 Rev January Fill In Capable

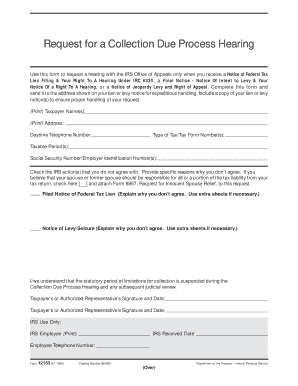

The Form 12153 Rev January Fill In Capable is a document utilized by taxpayers in the United States to formally request a hearing regarding a proposed levy by the Internal Revenue Service (IRS). This form allows individuals to contest the IRS's decision to levy their assets, offering them a chance to present their case and potentially resolve the issue without further penalties. It is essential for taxpayers who believe that the levy is unjust or that they have valid reasons to challenge it.

How to use the Form 12153 Rev January Fill In Capable

Using the Form 12153 Rev January Fill In Capable involves several straightforward steps. First, ensure you have the correct version of the form, which is designed to be filled out electronically. Begin by providing your personal information, including your name, address, and taxpayer identification number. Next, clearly state the reasons for your request for a hearing. Be specific about the circumstances surrounding the proposed levy and include any supporting documentation that may strengthen your case. After completing the form, review it carefully for accuracy before submission.

Steps to complete the Form 12153 Rev January Fill In Capable

Completing the Form 12153 Rev January Fill In Capable requires attention to detail. Follow these steps:

- Download the form from a reliable source or access it through the IRS website.

- Fill in your personal information accurately in the designated fields.

- Explain your reasons for requesting a hearing, ensuring clarity and conciseness.

- Attach any necessary documentation that supports your claims.

- Sign and date the form to validate your request.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the Form 12153 Rev January Fill In Capable

The legal use of the Form 12153 Rev January Fill In Capable is crucial for taxpayers seeking to protect their rights against IRS levies. By submitting this form, individuals formally invoke their right to a hearing, as stipulated under the Internal Revenue Code. It is important to understand that this form must be submitted within a specific timeframe following the IRS's notice of levy to ensure that the request is considered valid. Failure to adhere to these legal requirements may result in the loss of the opportunity to contest the levy.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12153 Rev January Fill In Capable are critical to ensure your request is heard. Generally, taxpayers must submit the form within thirty days from the date of the IRS notice of levy. Missing this deadline may result in the automatic enforcement of the levy, making it essential to act promptly. It is advisable to keep track of all relevant dates and maintain documentation of your submission for future reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 12153 Rev January Fill In Capable can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the IRS e-services platform, depending on their eligibility.

- Mail: The completed form can be mailed to the address specified in the IRS notice of levy. Ensure that you send it via a trackable method to confirm delivery.

- In-Person: Taxpayers may also choose to deliver the form in person at their local IRS office, which can facilitate immediate confirmation of receipt.

Quick guide on how to complete form 12153 rev january fill in capable

Prepare [SKS] easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the proper format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 12153 Rev January Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 12153 rev january fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 12153 Rev January Fill In Capable?

Form 12153 Rev January Fill In Capable is a document that allows taxpayers to request a collection due process hearing. This form is essential for individuals who disagree with the IRS's actions regarding their tax liabilities. Using airSlate SignNow, you can easily fill in, send, and eSign this form efficiently.

-

How can airSlate SignNow help with Form 12153 Rev January Fill In Capable?

airSlate SignNow provides a user-friendly interface that allows you to fill in Form 12153 Rev January Fill In Capable digitally. This feature eliminates the hassle of printing and scanning, streamlining your process. With easy eSigning options, you'll ensure timely submissions to the IRS.

-

Is there a cost associated with using airSlate SignNow for Form 12153 Rev January Fill In Capable?

Yes, airSlate SignNow offers different pricing plans tailored to various business needs. You can choose a plan that suits your budget and requirements for handling Form 12153 Rev January Fill In Capable. The pricing is competitive and includes features designed to enhance your document signing experience.

-

What features does airSlate SignNow offer for handling Form 12153 Rev January Fill In Capable?

airSlate SignNow includes a variety of features for Form 12153 Rev January Fill In Capable, such as customizable templates, automated workflows, and real-time tracking. These features help streamline your document management process and ensure that you never miss an important deadline. The platform is designed to enhance efficiency in document handling.

-

Can airSlate SignNow integrate with other tools for Form 12153 Rev January Fill In Capable?

Absolutely! airSlate SignNow integrates seamlessly with various applications and services to facilitate the process of using Form 12153 Rev January Fill In Capable. This includes integration with CRM systems, cloud storage solutions, and email platforms, making document management more efficient across your tools.

-

What are the benefits of using airSlate SignNow for Form 12153 Rev January Fill In Capable?

Using airSlate SignNow for Form 12153 Rev January Fill In Capable offers signNow benefits, including improved speed and accuracy. It reduces the chances of errors while filling the form and allows for faster response times with eSigning. This ensures you stay compliant with IRS requirements without unnecessary delays.

-

Is airSlate SignNow secure for handling Form 12153 Rev January Fill In Capable?

Yes, airSlate SignNow employs high-level security measures to protect your data while managing Form 12153 Rev January Fill In Capable. With encryption technology and advanced authentication protocols, your sensitive information remains confidential and secure during the signing process. You can trust airSlate SignNow for your document security needs.

Get more for Form 12153 Rev January Fill In Capable

Find out other Form 12153 Rev January Fill In Capable

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure