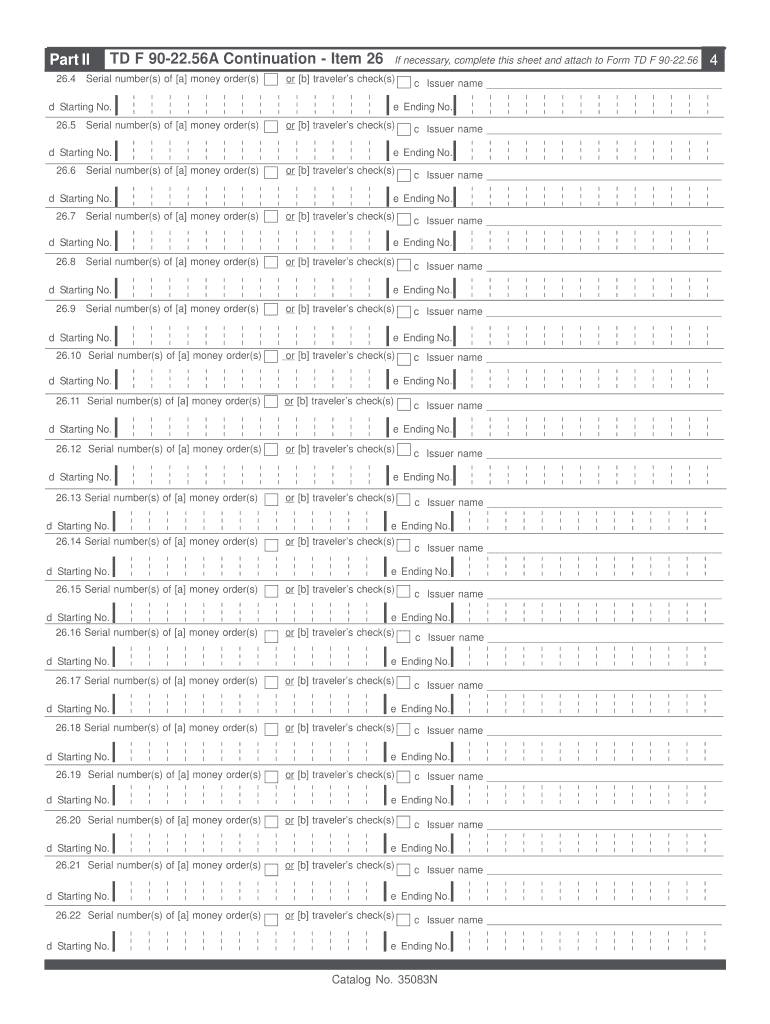

TD F 90 22 56A Rev October Suspicious Activity Report Money Services Business Individual LForm Supplemental Sheet

Understanding the TD F 90 22 56A Rev October Suspicious Activity Report

The TD F 90 22 56A Rev October is a vital document used by financial institutions and money services businesses in the United States to report suspicious activities that may indicate money laundering or fraud. This form is essential for compliance with the Bank Secrecy Act (BSA) and is utilized to help federal authorities track illicit financial activities. By filing this report, businesses contribute to the prevention of financial crimes and the protection of the financial system.

How to Complete the TD F 90 22 56A Rev October Suspicious Activity Report

Completing the TD F 90 22 56A Rev October requires careful attention to detail. The form includes sections for providing information about the suspicious activity, the individuals or entities involved, and the financial institution reporting the activity. Users should ensure that all fields are accurately filled out, including the nature of the suspicious activity, the amount involved, and any relevant dates. It's important to provide as much detail as possible to assist law enforcement in their investigations.

Key Elements of the TD F 90 22 56A Rev October Suspicious Activity Report

The key elements of the TD F 90 22 56A Rev October include:

- Identification of the Reporting Institution: This section requires the name and address of the financial institution submitting the report.

- Details of the Suspicious Activity: A comprehensive description of the suspicious activity, including the type of activity and the circumstances surrounding it.

- Involved Parties: Information about individuals or entities involved in the suspicious activity, including names, addresses, and account numbers.

- Financial Details: Specific details regarding the amounts involved and the transactions that raised suspicion.

Legal Use of the TD F 90 22 56A Rev October Suspicious Activity Report

The TD F 90 22 56A Rev October is legally required under the Bank Secrecy Act for financial institutions and money services businesses. Failing to file this report when suspicious activity is detected can lead to significant penalties, including fines and legal repercussions. It is crucial for organizations to understand their legal obligations and ensure compliance to avoid any potential risks associated with non-compliance.

Form Submission Methods for the TD F 90 22 56A Rev October Suspicious Activity Report

The TD F 90 22 56A Rev October can be submitted through various methods. Organizations may choose to file the report electronically, which is often the preferred method due to its efficiency and speed. Alternatively, the form can be submitted via mail, though this method may result in delays. It is essential for businesses to adhere to submission guidelines and deadlines to ensure timely reporting.

Examples of Using the TD F 90 22 56A Rev October Suspicious Activity Report

Examples of situations where the TD F 90 22 56A Rev October might be used include:

- Unusually large cash transactions that do not fit a customer's profile.

- Frequent wire transfers to high-risk countries without a clear business purpose.

- Transactions involving individuals with known criminal backgrounds or associations.

These examples illustrate the importance of vigilance and the role of financial institutions in detecting and reporting suspicious activities to help maintain the integrity of the financial system.

Quick guide on how to complete td f 90 22 56a rev october suspicious activity report money services business individual lform supplemental sheet

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and maintain outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TD F 90 22 56A Rev October Suspicious Activity Report Money Services Business Individual LForm Supplemental Sheet

Create this form in 5 minutes!

How to create an eSignature for the td f 90 22 56a rev october suspicious activity report money services business individual lform supplemental sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TD F 90 22 56A Rev October Suspicious Activity Report Money Services Business Individual LForm Supplemental Sheet?

The TD F 90 22 56A Rev October Suspicious Activity Report Money Services Business Individual LForm Supplemental Sheet is a necessary document for reporting suspicious transactions in the money services business sector. It helps organizations comply with regulations by documenting any questionable activities. Using airSlate SignNow, businesses can easily complete and sign this form electronically.

-

How can airSlate SignNow help me with the TD F 90 22 56A Rev October Suspicious Activity Report?

airSlate SignNow provides a user-friendly platform to complete the TD F 90 22 56A Rev October Suspicious Activity Report efficiently. With its eSigning features, you can electronically sign and send your report securely, ensuring compliance and minimizing the risk of errors. This streamlines your workflow, allowing you to focus on your core business activities.

-

What are the pricing options for using airSlate SignNow to manage the TD F 90 22 56A Rev October Suspicious Activity Report?

AirSlate SignNow offers various pricing plans tailored to fit different business needs. Depending on your usage and features required for managing the TD F 90 22 56A Rev October Suspicious Activity Report, you can choose from individual or team plans. Each plan is designed to provide cost-effective solutions for efficient document management.

-

Is airSlate SignNow secure for handling sensitive documents like the TD F 90 22 56A Rev October Suspicious Activity Report?

Yes, airSlate SignNow ensures high-level security for all sensitive documents, including the TD F 90 22 56A Rev October Suspicious Activity Report. The platform employs advanced encryption protocols to safeguard your data during transmission and storage, giving you peace of mind when sending and signing important reports.

-

Can I integrate airSlate SignNow with other software for better management of the TD F 90 22 56A Rev October Suspicious Activity Report?

Absolutely! airSlate SignNow offers integrations with various third-party applications, enabling you to manage the TD F 90 22 56A Rev October Suspicious Activity Report seamlessly alongside your existing systems. This enhances productivity and ensures that all relevant data is synchronized across platforms, facilitating better workflow.

-

What features does airSlate SignNow provide for completing the TD F 90 22 56A Rev October Suspicious Activity Report?

airSlate SignNow comes with a variety of features designed to simplify the completion of the TD F 90 22 56A Rev October Suspicious Activity Report. These include templates for easy form filling, eSignature capabilities, and the ability to track document status in real-time. This ensures that you can manage your reports efficiently and effectively.

-

How long does it take to set up airSlate SignNow for the TD F 90 22 56A Rev October Suspicious Activity Report?

Setting up airSlate SignNow is quick and straightforward, often taking just a few minutes. Once registered, you can immediately start using the platform to manage the TD F 90 22 56A Rev October Suspicious Activity Report. Our user-friendly interface makes it easy to navigate and access all necessary tools.

Get more for TD F 90 22 56A Rev October Suspicious Activity Report Money Services Business Individual LForm Supplemental Sheet

Find out other TD F 90 22 56A Rev October Suspicious Activity Report Money Services Business Individual LForm Supplemental Sheet

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors