Under Section 408p of the Internal Revenue Code Form

Understanding the Under Section 408p Of The Internal Revenue Code

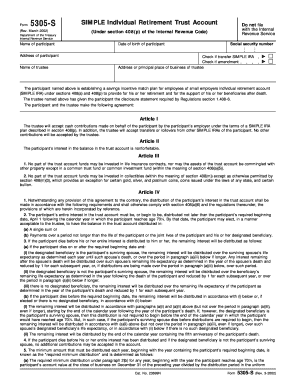

The Under Section 408p of the Internal Revenue Code pertains to specific provisions regarding individual retirement accounts (IRAs). This section allows for the establishment of certain types of retirement accounts that can provide tax advantages to individuals saving for retirement. Under this section, individuals may be eligible to contribute to IRAs with unique features, such as the ability to roll over funds from other retirement accounts without incurring tax penalties. Understanding the nuances of this section is crucial for effective retirement planning.

How to Utilize the Under Section 408p Of The Internal Revenue Code

To effectively use the provisions under Section 408p, individuals should first determine their eligibility based on income and filing status. Once eligibility is established, individuals can open an IRA that complies with the requirements set forth in this section. It is recommended to consult with a tax professional to ensure compliance with all IRS regulations and to maximize the tax benefits associated with these accounts. Proper documentation of contributions and withdrawals is essential for maintaining the tax-advantaged status of the account.

Steps to Complete the Under Section 408p Of The Internal Revenue Code

Completing the necessary steps under Section 408p involves several key actions:

- Determine eligibility based on income limits and filing status.

- Select an appropriate financial institution to open the IRA.

- Complete the required application forms provided by the institution.

- Make contributions within the allowed limits, ensuring proper documentation.

- Maintain records of all transactions to support tax filings.

Legal Use of the Under Section 408p Of The Internal Revenue Code

The legal use of Section 408p is defined by the IRS guidelines, which outline permissible contributions, distributions, and rollover rules. It is vital for individuals to adhere to these guidelines to avoid penalties. Engaging in prohibited transactions, such as using IRA funds for personal benefit outside of retirement purposes, can lead to severe tax consequences. Understanding these legal frameworks ensures that individuals can take full advantage of the benefits while remaining compliant with federal regulations.

Required Documents for Under Section 408p Of The Internal Revenue Code

When establishing an IRA under Section 408p, individuals must prepare several key documents:

- Proof of identity, such as a driver's license or Social Security card.

- Income documentation to verify eligibility, including W-2 forms or tax returns.

- Completed application forms from the financial institution.

- Records of any previous retirement accounts if rolling over funds.

Filing Deadlines and Important Dates

Filing deadlines related to Section 408p are critical for maintaining tax advantages. Contributions to an IRA must typically be made by the tax filing deadline, which is usually April 15 of the following year. It is important to stay informed about any changes to these dates, as they can affect eligibility for tax deductions. Keeping track of these deadlines will help individuals maximize their retirement savings and avoid unnecessary penalties.

Quick guide on how to complete under section 408p of the internal revenue code

Complete [SKS] effortlessly on any device

Online document management has gained traction among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest method to update and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Under Section 408p Of The Internal Revenue Code

Create this form in 5 minutes!

How to create an eSignature for the under section 408p of the internal revenue code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Under Section 408p Of The Internal Revenue Code for document signing?

Under Section 408p Of The Internal Revenue Code, there are specific guidelines regarding the tax implications of certain retirement plans. Understanding these provisions is crucial for businesses that are creating documents related to these plans. airSlate SignNow can help ensure that all necessary compliance measures are met in your documentation process.

-

How does airSlate SignNow support businesses dealing with documents related to Under Section 408p Of The Internal Revenue Code?

airSlate SignNow provides a user-friendly platform that simplifies the signing and management of documents aligned with Under Section 408p Of The Internal Revenue Code. With features designed for compliance, you can easily create, send, and store necessary documentation. This empowers businesses to operate efficiently while ensuring legal adherence.

-

Are there any specific features in airSlate SignNow that cater to compliance with Under Section 408p Of The Internal Revenue Code?

Yes, airSlate SignNow includes multiple features aimed at ensuring compliance with legal guidelines, including those under Under Section 408p Of The Internal Revenue Code. The platform offers audit trails, customizable templates, and secure storage, which are essential for maintaining the integrity of compliance documentation. These features support your business's need to stay within legal boundaries.

-

Is airSlate SignNow a cost-effective solution for handling documents related to Under Section 408p Of The Internal Revenue Code?

Yes, airSlate SignNow is designed to be cost-effective for businesses needing to handle documents related to Under Section 408p Of The Internal Revenue Code. The transparent pricing model allows you to choose the plan that best fits your needs without hidden fees. This affordability makes it accessible for businesses of all sizes.

-

Can airSlate SignNow integrate with other software for better handling of Under Section 408p Of The Internal Revenue Code-related documents?

Absolutely! airSlate SignNow supports integrations with numerous applications, which can enhance the document management process for materials associated with Under Section 408p Of The Internal Revenue Code. This allows for seamless workflows and improved efficiency as you manage your documents across different platforms.

-

What benefits can businesses expect from using airSlate SignNow for documentation under Under Section 408p Of The Internal Revenue Code?

Businesses can expect several benefits, including streamlined workflows, reduced processing times, and enhanced compliance with regulations under Under Section 408p Of The Internal Revenue Code. The platform enables easy e-signatures and document tracking, thus improving overall productivity. This ensures that your focus remains on your core business operations rather than paperwork.

-

How easy is it to start using airSlate SignNow for documents related to Under Section 408p Of The Internal Revenue Code?

Getting started with airSlate SignNow is incredibly easy, even for documents related to Under Section 408p Of The Internal Revenue Code. The intuitive interface guides you through the setup process, allowing you to create templates and send documents for e-signatures within minutes. Plus, resources and support are available to help you as needed.

Get more for Under Section 408p Of The Internal Revenue Code

- Tree removal agreement between neighbors form

- Ocd symptoms checklist pdf form

- Ingress form sample

- Nhs reference request form template 472289751

- Authorized agent form city of venice

- Klein isd address affidavit form

- Restaurantbar service refusal form food service warehouse

- Perpetual license transfer form

Find out other Under Section 408p Of The Internal Revenue Code

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors