Notice 746 Rev April Information About Your Notice, Penalty and Interest

Understanding Notice 746 Rev April

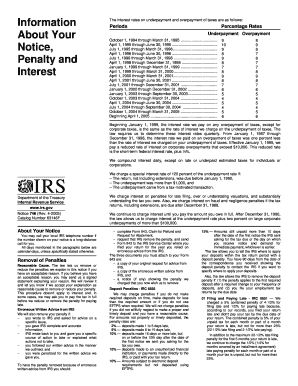

Notice 746 Rev April is an important document issued by the IRS that provides taxpayers with essential information regarding their tax notices, penalties, and interest. This notice typically outlines the reasons for penalties, the amount due, and the interest accrued on unpaid taxes. It serves as a formal communication from the IRS, ensuring that taxpayers are aware of their obligations and any potential consequences of non-compliance.

How to Utilize Notice 746 Rev April

To effectively use Notice 746 Rev April, taxpayers should carefully review the details provided within the notice. This includes understanding the specific penalties assessed and the interest rates applicable to their situation. Taxpayers can use this information to assess their tax liability and determine the best course of action, whether it involves making a payment, disputing the notice, or seeking assistance from a tax professional.

Obtaining Notice 746 Rev April

Taxpayers can obtain Notice 746 Rev April directly from the IRS, either through their online account or by contacting the IRS customer service. It is crucial to ensure that the notice is the most current version, as updates may occur. Keeping a copy of this notice is essential for personal records and for any future correspondence with the IRS regarding tax obligations.

Key Elements of Notice 746 Rev April

Notice 746 Rev April includes several key elements that are vital for taxpayers to understand:

- Taxpayer Information: This section contains the taxpayer's name, address, and taxpayer identification number.

- Penalty Details: The notice outlines the specific penalties assessed, including the reasons for these penalties.

- Interest Accrued: It provides information on the interest charged on unpaid balances.

- Payment Instructions: Clear guidance on how to make payments or respond to the notice is included.

Penalties for Non-Compliance with Notice 746 Rev April

Failing to comply with the requirements outlined in Notice 746 Rev April can lead to additional penalties and interest. The IRS may take further action, including wage garnishments or liens, if the taxpayer does not address the notice promptly. Understanding these potential consequences is crucial for managing tax obligations effectively.

Filing Deadlines and Important Dates Related to Notice 746 Rev April

Notice 746 Rev April will typically specify important deadlines for responding or making payments. Taxpayers should pay close attention to these dates to avoid additional penalties. Keeping a calendar of these deadlines can help ensure timely compliance with IRS requirements.

Quick guide on how to complete notice 746 rev april information about your notice penalty and interest

Easily prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Steps to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools provided to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Notice 746 Rev April Information About Your Notice, Penalty And Interest

Create this form in 5 minutes!

How to create an eSignature for the notice 746 rev april information about your notice penalty and interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Notice 746 Rev April Information About Your Notice, Penalty And Interest?

Notice 746 Rev April Information About Your Notice, Penalty And Interest is a document that outlines the details regarding any penalties or interest that may apply to a taxpayer. It helps individuals understand their tax obligations and the reason for any additional charges. This notice is crucial for ensuring compliance and addressing any potential tax liabilities.

-

How can airSlate SignNow assist with handling Notice 746 Rev April Information About Your Notice, Penalty And Interest?

airSlate SignNow offers an efficient way to electronically sign and send documents related to the Notice 746 Rev April Information About Your Notice, Penalty And Interest. Our platform simplifies the process of managing your tax documents, ensuring you meet deadlines and stay organized in your correspondence with tax authorities.

-

What features does airSlate SignNow provide that enhance the management of documents like Notice 746 Rev April?

AirSlate SignNow provides features such as customizable templates, secure eSignature capabilities, and cloud storage that enhance document management. These features enable users to easily prepare, send, and track documents associated with the Notice 746 Rev April Information About Your Notice, Penalty And Interest, making the process seamless and secure.

-

What are the pricing options for using airSlate SignNow to manage documents related to taxes?

AirSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you're a solo entrepreneur or a large organization, you can choose a plan that fits your needs for managing documents like Notice 746 Rev April Information About Your Notice, Penalty And Interest. Check our website for detailed pricing information and any promotional offers.

-

Is airSlate SignNow compliant with legal regulations for signing documents like Notice 746 Rev April?

Yes, airSlate SignNow complies with all relevant legal regulations for electronic signatures, making our platform a reliable choice for signing documents such as Notice 746 Rev April Information About Your Notice, Penalty And Interest. Our compliance with e-signature laws ensures that your signed documents are legally binding and recognized by authorities.

-

Can I integrate airSlate SignNow with other tools I use for tax management?

Absolutely! AirSlate SignNow offers integrations with various software tools, enhancing your tax management workflow. Whether you use accounting software or other tax-related applications, you can seamlessly integrate them with our platform to better handle documents like Notice 746 Rev April Information About Your Notice, Penalty And Interest.

-

How does using airSlate SignNow benefit my business when dealing with tax notices?

Using airSlate SignNow streamlines the process of managing tax notices, such as Notice 746 Rev April Information About Your Notice, Penalty And Interest, which saves you time and reduces stress. Our platform ensures that documents are efficiently processed, securely stored, and easily accessible, allowing you to focus on your business operations without tax-related distractions.

Get more for Notice 746 Rev April Information About Your Notice, Penalty And Interest

- Nys gfdc booklet form

- Guest parking pass guest parking pass guest sheffield towne form

- Common ground prior authorization form

- Gar 2 form

- Peru trade promotion agreement certificate of origin form

- Field coaching report template form

- Membership application form ap private hospital ampamp nursing

- Embrace the chaos pdf form

Find out other Notice 746 Rev April Information About Your Notice, Penalty And Interest

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment