Form 2555 Fill in Version Foreign Earned Income

What is the Form 2555 Fill In Version Foreign Earned Income

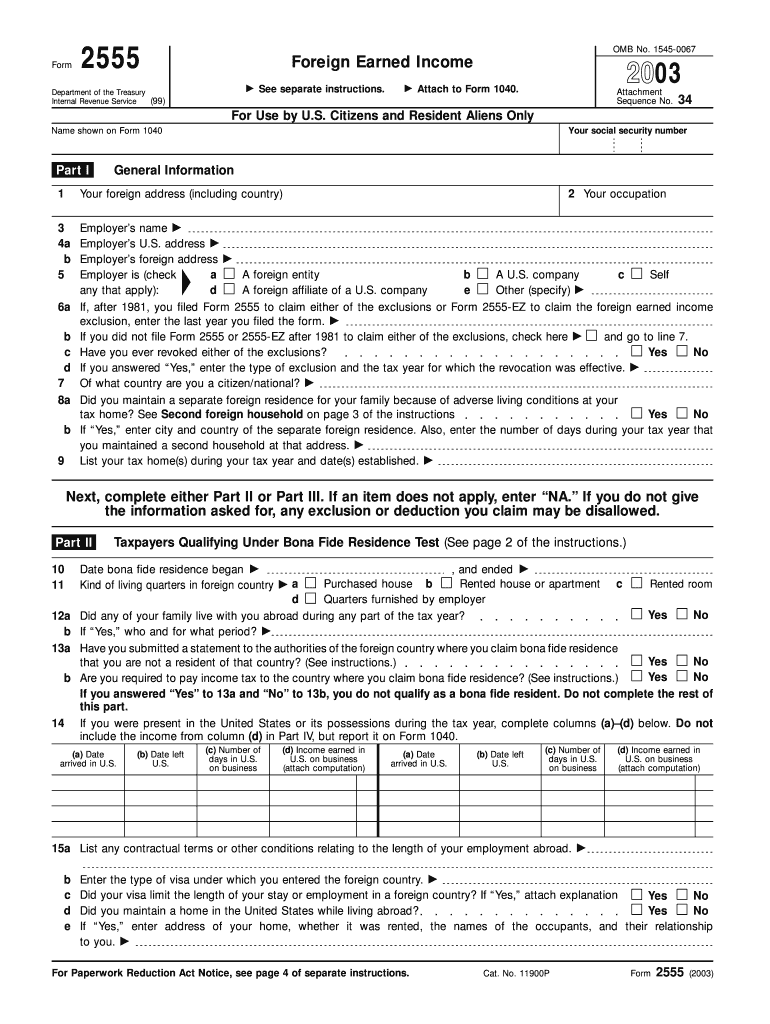

The Form 2555 Fill In Version Foreign Earned Income is a tax form used by U.S. citizens and resident aliens who earn income while living abroad. This form allows individuals to claim the Foreign Earned Income Exclusion, which can reduce their taxable income and potentially lower their overall tax liability. By completing this form, taxpayers can exclude a certain amount of their foreign earnings from U.S. taxation, provided they meet specific eligibility criteria.

How to use the Form 2555 Fill In Version Foreign Earned Income

Using the Form 2555 Fill In Version involves several steps. First, gather all necessary financial documents, including proof of foreign income and residency. Next, fill out the form accurately, ensuring that all income earned abroad is reported. It is important to follow the instructions carefully, as errors can lead to delays or penalties. Once completed, the form should be submitted with your federal tax return to the IRS.

Steps to complete the Form 2555 Fill In Version Foreign Earned Income

Completing the Form 2555 involves a series of methodical steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your foreign earned income in the appropriate section, ensuring all amounts are accurate.

- Indicate your foreign residency status and the dates you lived abroad during the tax year.

- Calculate the exclusion amount based on the IRS guidelines, ensuring you do not exceed the maximum limit.

- Review the form for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using Form 2555, you must meet specific eligibility criteria. These include being a U.S. citizen or resident alien, having foreign earned income, and meeting either the bona fide residence test or the physical presence test. The bona fide residence test requires you to have established a residence in a foreign country for an uninterrupted period that includes an entire tax year. The physical presence test necessitates being physically present in a foreign country for at least 330 full days during a 12-month period.

Filing Deadlines / Important Dates

The deadline for filing Form 2555 coincides with the due date for your federal tax return, typically April 15. However, if you are living abroad, you may qualify for an automatic extension, allowing you to file up to June 15. It is crucial to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Required Documents

When completing Form 2555, certain documents are necessary to support your claims. These typically include:

- Proof of foreign earned income, such as pay stubs or foreign tax returns.

- Documentation of your residency status, like a lease agreement or utility bills.

- Any relevant tax documents from the foreign country where you reside.

Having these documents ready will facilitate a smoother filing process and help substantiate your eligibility for the exclusion.

Quick guide on how to complete form 2555 fill in version foreign earned income

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers designed for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2555 Fill In Version Foreign Earned Income

Create this form in 5 minutes!

How to create an eSignature for the form 2555 fill in version foreign earned income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2555 Fill In Version Foreign Earned Income?

The Form 2555 Fill In Version Foreign Earned Income is a tax form used by U.S. citizens and resident aliens to report their foreign earned income and claim the foreign earned income exclusion. This form allows you to efficiently fill in details regarding your income, residence, and tax benefits directly online.

-

How does airSlate SignNow support the Form 2555 Fill In Version Foreign Earned Income?

airSlate SignNow provides a user-friendly platform that allows you to eSign and send your Form 2555 Fill In Version Foreign Earned Income effortlessly. Our solution is designed to streamline the document process, ensuring that you can quickly complete and submit your tax forms securely.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans based on your needs, ranging from basic to premium features. Our pricing is designed to be cost-effective, allowing access to the Form 2555 Fill In Version Foreign Earned Income functionalities without breaking the bank.

-

Are there any specific features for handling the Form 2555 Fill In Version Foreign Earned Income?

Yes, airSlate SignNow includes features that specifically cater to the completion and electronic signing of the Form 2555 Fill In Version Foreign Earned Income. You can easily input data, save templates, and track the progress of your documents through our platform.

-

How secure is airSlate SignNow for submitting my Form 2555 Fill In Version Foreign Earned Income?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your Form 2555 Fill In Version Foreign Earned Income and other sensitive documents, ensuring that your data remains confidential.

-

Does airSlate SignNow integrate with other software for handling tax documents like the Form 2555 Fill In Version Foreign Earned Income?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software. This integration allows for efficient management of your Form 2555 Fill In Version Foreign Earned Income along with other financial documents, making your workflow more streamlined.

-

Can I access my Form 2555 Fill In Version Foreign Earned Income on mobile devices?

Absolutely! airSlate SignNow is designed to be accessible on mobile devices, letting you complete and eSign your Form 2555 Fill In Version Foreign Earned Income on-the-go. You can manage your documents anytime, anywhere, increasing your productivity.

Get more for Form 2555 Fill In Version Foreign Earned Income

Find out other Form 2555 Fill In Version Foreign Earned Income

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template