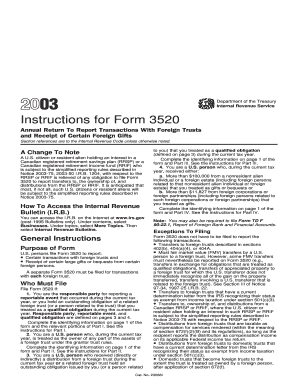

Instructions for Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts

Understanding Form 3520

The Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts is a crucial document for U.S. taxpayers involved with foreign trusts or who receive significant gifts from foreign sources. This form is designed to ensure compliance with U.S. tax laws regarding foreign transactions. It provides detailed guidelines on reporting requirements, helping taxpayers avoid potential penalties and legal issues. Understanding the purpose of this form is essential for anyone who has financial dealings with foreign trusts or gifts, as it outlines the necessary steps to fulfill IRS obligations.

Steps to Complete the Form

Completing the Form 3520 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to foreign trusts or gifts. This may include trust agreements, financial statements, and records of any gifts received. Next, carefully read the instructions provided with the form, as they detail how to report various transactions. Fill out the form accurately, ensuring all required information is included. Finally, review your completed form for any errors before submission. Adhering to these steps can help streamline the filing process and reduce the likelihood of mistakes.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with Form 3520. Generally, the form must be submitted by the due date of your income tax return, including extensions. For most taxpayers, this means the form is due on April 15. However, if you are granted an extension for your tax return, the deadline for Form 3520 also extends accordingly. Missing the deadline can result in significant penalties, so it is advisable to mark these dates on your calendar and plan your filing accordingly.

Required Documents for Submission

When preparing to file Form 3520, certain documents are essential to support your claims. These documents may include:

- Trust agreements that outline the terms and conditions of foreign trusts.

- Financial statements from the trust, detailing its assets and transactions.

- Records of any foreign gifts received, including the amount and source.

- Previous tax returns that may provide context for your current filing.

Having these documents readily available can facilitate a smoother filing process and help ensure that all necessary information is reported accurately.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of Form 3520 can lead to substantial penalties. The IRS imposes a penalty of up to $10,000 for failing to file the form or for filing it late. Additionally, if the IRS determines that the failure to report was due to willful neglect, the penalties can increase significantly. It is crucial to understand these potential consequences and take the necessary steps to file the form accurately and on time to avoid financial repercussions.

Digital Submission Options

Submitting Form 3520 can be done through various methods, including digital options. While the IRS does not currently allow for electronic filing of Form 3520, you can complete the form digitally using software that supports tax forms. After completing the form, it must be printed and mailed to the appropriate IRS address. Ensuring that you keep a copy of the completed form for your records is also recommended. Digital tools can help streamline the process of filling out the form, making it easier to manage your tax obligations.

Quick guide on how to complete instructions for form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Highlight essential parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts?

The Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts are crucial for understanding how to properly report foreign transactions and gifts to the IRS. This form ensures compliance with U.S. tax laws regarding foreign trusts, which can be complex and require thorough documentation.

-

How can airSlate SignNow assist in completing the Instructions For Form 3520?

airSlate SignNow provides an efficient platform that streamlines the process of eSigning and sending your completed Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts. With user-friendly tools, you can easily add signatures and manage your documents securely, saving time and effort.

-

What features does airSlate SignNow offer for managing documents related to Form 3520?

airSlate SignNow offers a variety of features for managing documents including templates, real-time collaboration, and advanced form customization which is particularly beneficial for properly filling out the Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts. These features help ensure that you can complete your documentation seamlessly.

-

Are there any costs associated with using airSlate SignNow for the Instructions For Form 3520?

Yes, airSlate SignNow operates on a subscription model, offering different pricing tiers to suit various business needs. Each plan provides a range of features designed to simplify the completion of critical documents, including the Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts.

-

What are the benefits of using airSlate SignNow for the Instructions For Form 3520?

Using airSlate SignNow for the Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts offers benefits such as enhanced document security, easy tracking of signatures, and quick access to your files from any device. These advantages ensure that your filing is both efficient and secure.

-

Can I integrate airSlate SignNow with other applications for better workflow?

Yes, airSlate SignNow can be integrated with a variety of applications, enhancing workflow efficiency. This means you can easily share your Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts with different platforms, streamlining the documentation process further.

-

Is support available for using airSlate SignNow for tax forms like Form 3520?

Absolutely! airSlate SignNow offers customer support to help users navigate the complexities of their documents, including the Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts. Their team is available to answer questions and provide guidance as needed.

Get more for Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

- Fiche ouverture de compte client form

- Private school clearance for teachers form

- 10th english slow learners study material form

- Address change form 41883892

- Standard municipal home rule affidavit of exempt sale form

- Equitable life supplementary form

- Aya healthcare physical form

- Form 15cb filled sample

Find out other Instructions For Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online