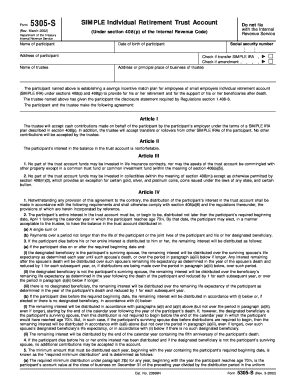

Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

What is the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

The Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account is a standardized document created by the IRS for establishing a SIMPLE IRA. This type of retirement account is designed for small businesses and self-employed individuals, allowing them to offer retirement benefits to their employees. The form outlines the terms and conditions of the SIMPLE IRA, ensuring compliance with IRS regulations. It is crucial for both employers and employees to understand the features and benefits of this retirement plan, which include tax-deferred growth and contribution limits set by the IRS.

How to use the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

Using the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account involves several steps. First, the employer must complete the form, providing necessary information such as the business name, address, and tax identification number. After filling out the form, the employer must distribute it to eligible employees, who can then establish their individual accounts. It is essential to retain a copy of the completed form for record-keeping purposes and to ensure compliance with IRS requirements.

Steps to complete the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

Completing the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account involves a series of straightforward steps:

- Gather necessary information about your business and employees.

- Fill in the employer's details, including name, address, and tax identification number.

- Specify the contribution amounts and any matching contributions offered.

- Provide information regarding the plan year and eligibility criteria for employees.

- Ensure all employees receive a copy of the completed form.

- Keep a signed copy of the form for your records.

Key elements of the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

The key elements of the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account include:

- Employer Information: Details about the business establishing the plan.

- Contribution Limits: Information on the maximum contributions allowed under the SIMPLE IRA guidelines.

- Employee Eligibility: Criteria that determine which employees can participate in the plan.

- Plan Year: The duration for which the plan is effective, typically one calendar year.

- Distribution Rules: Guidelines on how and when employees can withdraw funds from their accounts.

Legal use of the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

The legal use of the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account is governed by IRS regulations. Employers must ensure that they comply with all applicable laws when establishing and maintaining the SIMPLE IRA. This includes adhering to contribution limits, eligibility requirements, and distribution rules. Failure to comply with these regulations can result in penalties, including taxes on excess contributions or disqualification of the plan.

Eligibility Criteria

Eligibility for the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account is determined by specific criteria set forth by the IRS. Generally, eligible employees include those who have received at least $5,000 in compensation during any two preceding years and are expected to earn at least that amount in the current year. Employers must also ensure that they do not maintain another qualified retirement plan to offer this SIMPLE IRA option.

Quick guide on how to complete form 5305 s rev march fill in version simple individual retirement trust account

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most efficient way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

Create this form in 5 minutes!

How to create an eSignature for the form 5305 s rev march fill in version simple individual retirement trust account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

The Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account is a type of retirement account designed for small businesses and their employees. This account offers flexible contributions and tax advantages, making it a popular choice for individuals looking to save for retirement efficiently.

-

How can I fill out the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

Filling out the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account is straightforward with airSlate SignNow. Our platform provides an easy-to-use interface where you can electronically fill and sign the form, ensuring that your information is accurate and securely submitted.

-

What are the benefits of using airSlate SignNow for the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

Using airSlate SignNow for the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our solution simplifies the signing process, allowing you to focus on your retirement planning while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing options tailored to meet the needs of small businesses. You can choose from various plans, ensuring you find the right balance between affordability and functionality for managing your Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account.

-

Can I integrate airSlate SignNow with other financial tools when managing my Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

Absolutely! airSlate SignNow offers seamless integrations with several financial tools and accounting software. This compatibility ensures that you can efficiently manage your Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account alongside your other financial activities without any hassle.

-

What security measures does airSlate SignNow implement for the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

airSlate SignNow prioritizes security with advanced encryption and authentication measures. This ensures that your Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account information remains confidential and protected throughout the entire signing process.

-

How does airSlate SignNow streamline the process of submitting the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account?

airSlate SignNow streamlines the submission process by allowing users to fill out, sign, and submit the Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account electronically. This not only speeds up the process but also reduces the chances of human error and improves overall efficiency.

Get more for Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

Find out other Form 5305 S Rev March Fill in Version SIMPLE Individual Retirement Trust Account

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors