8849 Schedule 4081 Form

What is the 8849 Schedule 4081 Form

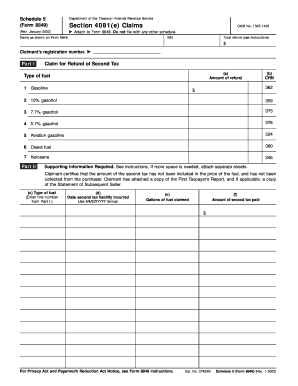

The 8849 Schedule 4081 Form is a tax document utilized by businesses and individuals to claim refunds for certain excise taxes. This form is particularly relevant for those who have incurred excise taxes on fuel used for specific purposes, such as non-highway use. Understanding the purpose of this form is essential for ensuring compliance with IRS regulations while taking advantage of potential tax refunds.

How to use the 8849 Schedule 4081 Form

To effectively use the 8849 Schedule 4081 Form, individuals must first determine their eligibility to claim a refund for excise taxes paid. The form requires detailed information about the taxpayer, including their name, address, and taxpayer identification number. Additionally, users must provide information on the type and amount of fuel consumed, as well as the specific use that justifies the refund claim. Accurate completion of this form is crucial for a successful refund process.

Steps to complete the 8849 Schedule 4081 Form

Completing the 8849 Schedule 4081 Form involves several key steps:

- Gather necessary documentation, including records of fuel purchases and usage.

- Fill out the taxpayer information section accurately.

- Detail the excise taxes paid on fuel, specifying the type of fuel and its usage.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form to the IRS, ensuring it is sent to the correct address based on your location.

Key elements of the 8849 Schedule 4081 Form

Several key elements are essential when filling out the 8849 Schedule 4081 Form:

- Taxpayer Information: This includes the name, address, and taxpayer identification number.

- Fuel Type: Clearly specify the type of fuel for which the refund is being claimed.

- Claim Amount: Accurately report the amount of excise tax paid.

- Usage Details: Provide clear explanations of how the fuel was used, which affects eligibility for the refund.

Filing Deadlines / Important Dates

Filing deadlines for the 8849 Schedule 4081 Form can vary based on the specific tax year and the nature of the claim. Generally, taxpayers should file the form within three years from the date the tax was paid to ensure eligibility for a refund. Staying informed about these deadlines is crucial for maximizing potential refunds and maintaining compliance with IRS regulations.

Form Submission Methods

The 8849 Schedule 4081 Form can be submitted to the IRS through various methods. Taxpayers may choose to file the form electronically or submit a paper version via mail. Electronic filing is often faster and can help ensure that the form is processed more quickly. For paper submissions, it is essential to send the form to the correct IRS address based on the taxpayer's location to avoid delays.

Quick guide on how to complete 8849 schedule 4081 form

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without holdups. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent portions of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 8849 Schedule 4081 Form

Create this form in 5 minutes!

How to create an eSignature for the 8849 schedule 4081 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8849 Schedule 4081 Form?

The 8849 Schedule 4081 Form is a federal tax form used for reporting specific claims for refund of excise taxes. It is essential for businesses looking to reclaim taxes that they have overpaid. Understanding its details can signNowly aid in ensuring accurate tax filings.

-

How can airSlate SignNow assist with the 8849 Schedule 4081 Form?

airSlate SignNow provides a streamlined platform for electronically signing and sending your 8849 Schedule 4081 Form. With our user-friendly interface, you can quickly upload, sign, and send your forms, ensuring that your submissions are both timely and compliant.

-

Is there a cost associated with using airSlate SignNow for the 8849 Schedule 4081 Form?

airSlate SignNow offers competitive pricing plans that cater to various needs, making it cost-effective for handling your 8849 Schedule 4081 Form needs. You can choose from different packages, ensuring you only pay for the features that best suit your business requirements.

-

What are the key features of airSlate SignNow for processing the 8849 Schedule 4081 Form?

Key features of airSlate SignNow include easy eSignature capabilities, document tracking, and secure cloud storage, all of which enhance the management of your 8849 Schedule 4081 Form. Additionally, templates and custom workflows can speed up the preparation and submission processes.

-

Can I integrate airSlate SignNow with other software to manage the 8849 Schedule 4081 Form?

Yes, airSlate SignNow offers integrations with popular business applications and services, enabling seamless workflow management for your 8849 Schedule 4081 Form. This integration capability allows for a more efficient process, linking your eSigning tasks with existing software.

-

Is it secure to handle the 8849 Schedule 4081 Form through airSlate SignNow?

Absolutely, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to ensure that your 8849 Schedule 4081 Form and sensitive information are fully protected during transmission and storage.

-

What benefits can I expect when using airSlate SignNow for the 8849 Schedule 4081 Form?

Using airSlate SignNow for your 8849 Schedule 4081 Form offers numerous benefits, such as faster processing times and reduced paperwork. It simplifies the signing procedure and enhances collaboration among stakeholders, resulting in an overall more efficient filing experience.

Get more for 8849 Schedule 4081 Form

Find out other 8849 Schedule 4081 Form

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself