Form 1065 B U

What is the Form 1065 B U

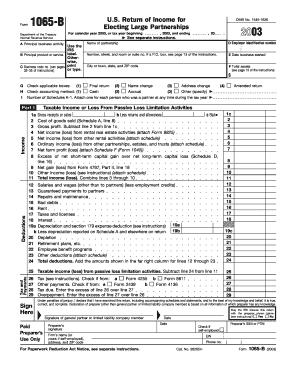

The Form 1065 B U is a tax document used by partnerships to report income, deductions, gains, and losses from their operations. This form is specifically designed for partnerships that are classified as "B" entities under IRS regulations. It provides the IRS with essential information about the partnership's financial activities and ensures compliance with federal tax laws. Each partner in the partnership receives a Schedule K-1, which details their share of the income, deductions, and credits, allowing them to report this information on their personal tax returns.

How to obtain the Form 1065 B U

To obtain the Form 1065 B U, you can visit the official IRS website, where the form is available for download in PDF format. Additionally, you can request a physical copy by contacting the IRS directly or visiting a local IRS office. Some tax preparation software also includes the Form 1065 B U, making it easier for partnerships to complete their filings electronically.

Steps to complete the Form 1065 B U

Completing the Form 1065 B U involves several key steps:

- Gather all necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report the partnership’s income and deductions on the appropriate lines of the form.

- Calculate the total income, deductions, and any credits that apply.

- Ensure that each partner's share of income and deductions is accurately reported on the attached Schedule K-1.

- Review the completed form for accuracy before submission.

Legal use of the Form 1065 B U

The Form 1065 B U is legally required for partnerships to report their financial activities to the IRS. Failure to file this form can result in penalties and interest on unpaid taxes. It is important for partnerships to understand their obligations under federal tax law and to ensure that they file the form accurately and on time. Proper use of the form helps maintain transparency and compliance with tax regulations.

Filing Deadlines / Important Dates

The filing deadline for the Form 1065 B U is typically March 15 of the year following the tax year being reported. If the partnership requires additional time, it may file for an extension, which can extend the deadline by six months. It is crucial for partnerships to be aware of these deadlines to avoid penalties and ensure timely compliance with tax obligations.

Key elements of the Form 1065 B U

Key elements of the Form 1065 B U include:

- Partnership Information: Basic details about the partnership, including name, address, and EIN.

- Income Section: Reporting of total income earned by the partnership.

- Deductions Section: Listing of all allowable deductions that reduce taxable income.

- Schedule K-1: Individual partner allocations of income, deductions, and credits.

- Signature Section: Certification of the accuracy of the information provided on the form.

Quick guide on how to complete form 1065 b u

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any hassles. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow has specifically designed for this purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B U

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 B U, and why is it important for my business?

Form 1065 B U is a tax form that allows partnerships to report their income and expenses to the IRS. It is important for your business as it helps ensure compliance with tax laws and avoid potential penalties. Using airSlate SignNow, you can easily prepare and manage this form electronically.

-

How does airSlate SignNow simplify the process of completing Form 1065 B U?

airSlate SignNow simplifies the completion of Form 1065 B U by providing easy-to-use templates and real-time collaboration features. Users can fill out the form, gather signatures, and make edits all in one secure platform, reducing the overall time spent on tax preparation.

-

What are the pricing options for airSlate SignNow when dealing with Form 1065 B U?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you’re a small business or a large enterprise, you can choose a plan that suits your budget while gaining access to features specifically for managing forms like Form 1065 B U.

-

Can I integrate airSlate SignNow with other accounting software for Form 1065 B U?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, making it easy to sync data relevant to Form 1065 B U. This integration helps ensure accuracy and save time by eliminating the need for manual data entry.

-

What security features does airSlate SignNow provide for Form 1065 B U?

airSlate SignNow prioritizes the security of your documents, including Form 1065 B U. With encryption, secure storage, and compliance with regulations like GDPR, you can trust that your sensitive tax information is well-protected.

-

How can airSlate SignNow improve my team's collaboration on Form 1065 B U?

airSlate SignNow enhances collaboration by allowing multiple users to access, edit, and sign Form 1065 B U in real-time. Notifications and comments keep everyone informed, ensuring that all team members are on the same page throughout the completion process.

-

Are there mobile options available for managing Form 1065 B U with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, enabling you to manage Form 1065 B U from your smartphone or tablet. This flexibility allows you to complete and sign documents on-the-go, ensuring your business operations remain efficient.

Get more for Form 1065 B U

Find out other Form 1065 B U

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile