Form 8554 Rev April

What is the Form 8554 Rev April

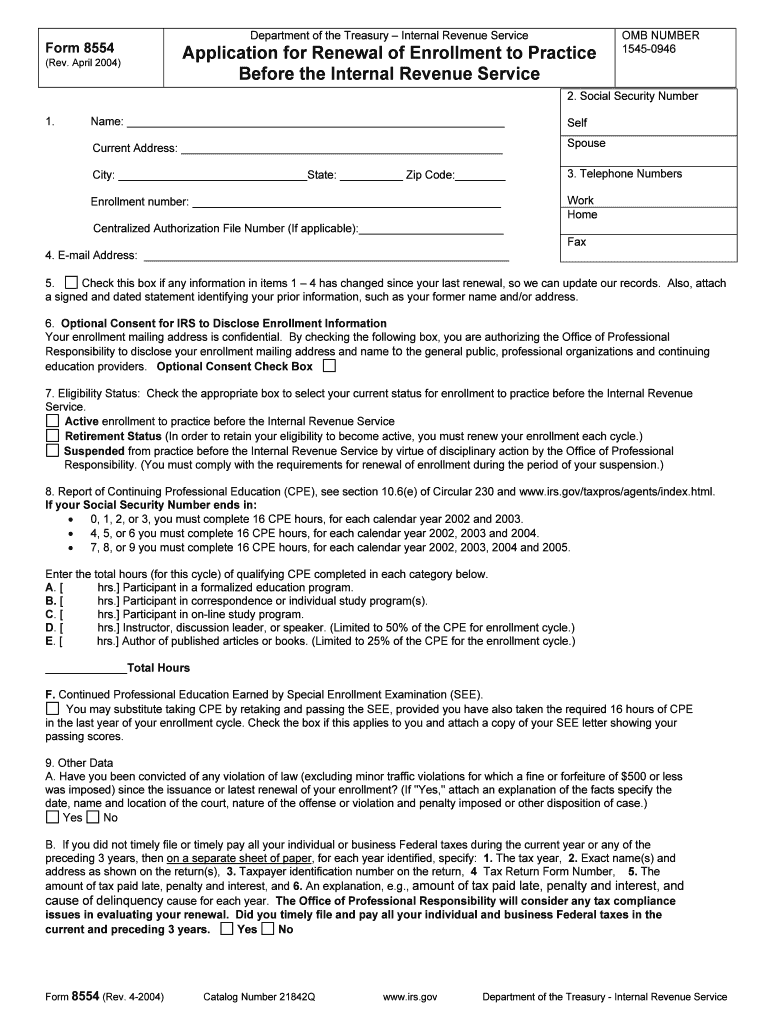

The Form 8554 Rev April is a tax form used by certain organizations to apply for or renew their status as tax-exempt entities with the Internal Revenue Service (IRS). This form is specifically designed for organizations that qualify under Section 501(c)(3) of the Internal Revenue Code. It serves as a formal request to maintain or obtain tax-exempt status, which allows eligible organizations to operate without paying federal income tax on their earnings.

How to use the Form 8554 Rev April

To use the Form 8554 Rev April, organizations must first ensure they meet the eligibility criteria set by the IRS. After confirming eligibility, the organization should complete the form by providing accurate information regarding its activities, governance, and finances. It is crucial to follow the instructions provided by the IRS carefully to avoid any errors that could delay the processing of the application. Once completed, the form must be submitted to the appropriate IRS address as indicated in the instructions.

Steps to complete the Form 8554 Rev April

Completing the Form 8554 Rev April involves several key steps:

- Review the eligibility requirements outlined by the IRS for tax-exempt status.

- Gather necessary documentation, including financial statements and organizational bylaws.

- Fill out the form accurately, ensuring all sections are completed as required.

- Double-check for any errors or omissions before submission.

- Submit the form to the IRS by the specified deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8554 Rev April are critical to maintaining tax-exempt status. Organizations must submit the form by the due date specified by the IRS, which is typically aligned with the organization’s fiscal year. Failure to file on time may result in penalties or loss of tax-exempt status. It is advisable to keep track of these important dates and set reminders to ensure timely submission.

Legal use of the Form 8554 Rev April

The legal use of the Form 8554 Rev April is governed by IRS regulations. Organizations must use this form to apply for or renew their tax-exempt status, and it must be completed in accordance with IRS guidelines. Misuse of the form or providing false information can lead to severe penalties, including revocation of tax-exempt status. Therefore, it is essential for organizations to understand the legal implications and ensure compliance with all requirements when using this form.

Key elements of the Form 8554 Rev April

Key elements of the Form 8554 Rev April include:

- Identification of the organization, including name, address, and Employer Identification Number (EIN).

- Description of the organization's activities and purpose.

- Financial information, including revenue and expenses.

- Governance structure, detailing the board of directors and key personnel.

- Signature of an authorized representative certifying the accuracy of the information provided.

Quick guide on how to complete form 8554 rev april

Finish [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without hindrances. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure superb communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8554 Rev April

Create this form in 5 minutes!

How to create an eSignature for the form 8554 rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8554 Rev April and why is it important?

Form 8554 Rev April is a crucial tax document utilized by businesses to ensure compliance with IRS regulations. It helps organizations manage the necessary reporting for their tax-related activities efficiently. Understanding this form is essential for maintaining good standing with tax laws.

-

How does airSlate SignNow help with Form 8554 Rev April?

airSlate SignNow simplifies the process of signing and managing Form 8554 Rev April through its easy-to-use platform. Users can easily send this form for eSignature, ensuring a quick turnaround and compliance. This streamlines the submission of critical tax documents.

-

Is there a cost associated with using airSlate SignNow for Form 8554 Rev April?

airSlate SignNow offers a cost-effective solution for managing Form 8554 Rev April, with various pricing plans based on your business needs. The plans are designed to be budget-friendly, ensuring that companies of all sizes can benefit from our services. Explore our website for detailed pricing info.

-

What features does airSlate SignNow offer for managing Form 8554 Rev April?

With airSlate SignNow, you gain access to features like customizable templates, eSignature capabilities, and document management tools specifically for Form 8554 Rev April. These features enable seamless collaboration and enhance efficiency in your documentation process. Plus, you can track the status of all sent forms in real time.

-

Can airSlate SignNow integrate with my existing systems for Form 8554 Rev April?

Yes, airSlate SignNow seamlessly integrates with various applications to support the management of Form 8554 Rev April. Popular integrations include cloud storage services and CRM systems, making it easier to manage documents across platforms. This flexibility allows users to work within their preferred environments.

-

What benefits do I gain from using airSlate SignNow for Form 8554 Rev April?

By using airSlate SignNow for Form 8554 Rev April, you enhance efficiency and reduce turnaround time for document signing. The platform also ensures that your documents are secure and legally binding, providing peace of mind for all parties involved. These benefits signNowly contribute to smoother operations.

-

Is airSlate SignNow compliant with eSignature laws for Form 8554 Rev April?

Absolutely! airSlate SignNow complies with all relevant eSignature laws, ensuring that Form 8554 Rev April signed through our platform holds legal validity. This compliance means you can confidently use our service for all your electronic signing needs, including sensitive tax documents.

Get more for Form 8554 Rev April

Find out other Form 8554 Rev April

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter