Where to File Your Request it is Important that You File Your Request Using the Address Shown on Your Lien or Levy Notice Form

Understanding the Filing Request Process

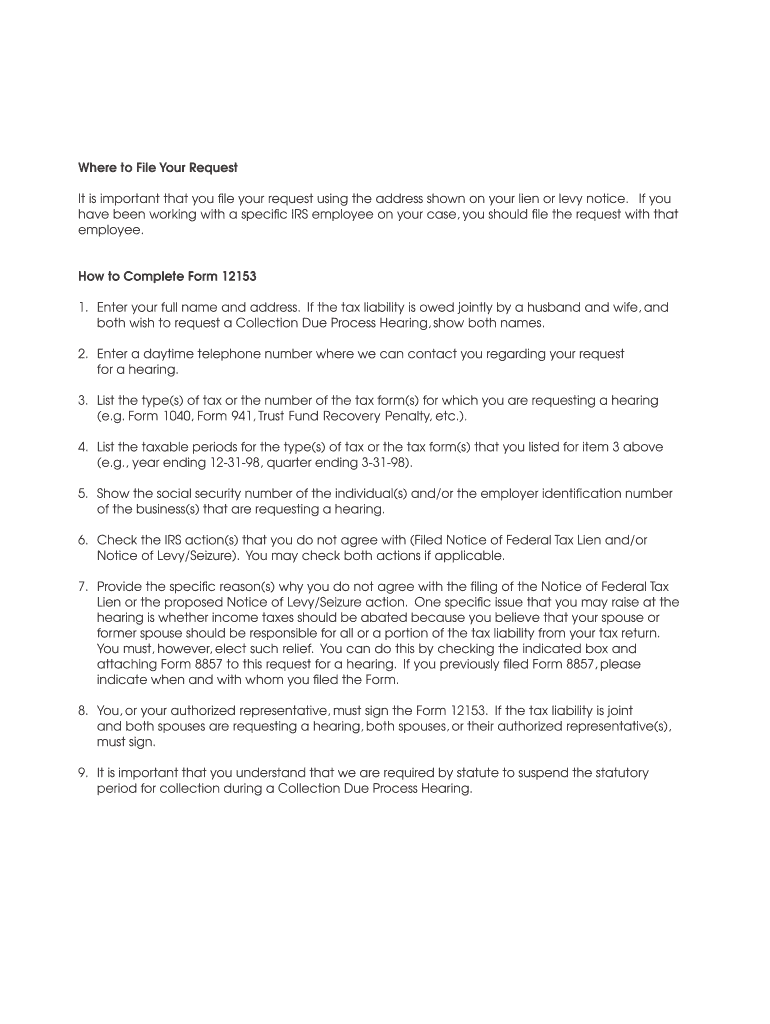

The process of filing your request is crucial, especially when it involves legal matters like liens or levies. It is important that you file your request using the address shown on your lien or levy notice. This ensures that your request is directed to the correct department, facilitating a smoother resolution. Filing at the correct address helps avoid delays and potential complications in processing your request.

Steps to Complete Your Filing Request

Completing your filing request involves several key steps:

- Review your lien or levy notice carefully to identify the specified address.

- Gather all necessary documents that support your request.

- Fill out any required forms accurately, ensuring all information matches what is on your notice.

- Double-check your completed forms for accuracy and completeness.

- Submit your request via the method specified on your notice, whether by mail, online, or in person.

Required Documents for Filing

When filing your request, it is essential to include all required documents. These may include:

- A copy of your lien or levy notice.

- Any supporting documentation that justifies your request.

- Completed forms as specified in the filing instructions.

Ensure that all documents are clear and legible to avoid any processing delays.

Submission Methods for Your Request

You can submit your request using various methods, depending on the guidelines provided in your lien or levy notice. Common submission methods include:

- Mail: Send your completed request and documents to the address listed on your notice.

- Online: If available, use the designated online portal to submit your request electronically.

- In-Person: Visit the appropriate office to file your request directly.

Legal Considerations for Filing

Understanding the legal implications of your filing request is vital. Ensure that you are aware of the following:

- The deadlines for submitting your request, as late filings may result in penalties.

- Your rights regarding the lien or levy, including any options for appeal.

- Potential consequences of non-compliance with filing requirements.

State-Specific Rules for Filing

Filing requirements can vary by state. It is important to familiarize yourself with any state-specific rules that may apply to your situation. This includes:

- Different addresses for filing based on your state.

- Unique forms or additional documentation required in your jurisdiction.

- State-specific deadlines that may differ from federal guidelines.

Quick guide on how to complete where to file your request it is important that you file your request using the address shown on your lien or levy notice

Complete [SKS] effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your documents quickly and without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Where To File Your Request It Is Important That You File Your Request Using The Address Shown On Your Lien Or Levy Notice

Create this form in 5 minutes!

How to create an eSignature for the where to file your request it is important that you file your request using the address shown on your lien or levy notice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of filing your request using the address shown on your lien or levy notice?

Where to file your request is crucial because it ensures that your documents signNow the correct authorities without delays. It is important that you file your request using the address shown on your lien or levy notice to avoid any complications in processing your request.

-

How can airSlate SignNow assist with filing requests related to liens and levies?

airSlate SignNow provides a streamlined platform to easily eSign and send your lien or levy documents securely. By ensuring that you file your request using the address shown on your lien or levy notice, you help increase the chances of timely processing.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as cloud storage, customizable templates, and advanced security measures. These features are designed to simplify your document filing process, particularly when it is important that you file your request using the address shown on your lien or levy notice.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to businesses of all sizes. Regardless of the plan you choose, ensure that you file your request using the address shown on your lien or levy notice to maintain compliance and avoid misunderstandings.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow allows for integrations with various business software, including CRM systems and project management tools. Boost your efficiency by ensuring that when you file your request, it is important that you file your request using the address shown on your lien or levy notice.

-

What support does airSlate SignNow provide for users?

airSlate SignNow offers comprehensive customer support, including live chat, email assistance, and extensive online resources. If you have questions or need help about how to ensure you file your request using the address shown on your lien or levy notice, our support team is here to assist.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. They can efficiently manage their documents and ensure they file their request using the address shown on their lien or levy notice without breaking the bank.

Get more for Where To File Your Request It Is Important That You File Your Request Using The Address Shown On Your Lien Or Levy Notice

- Adult client intake form albany biblical counseling

- Ocular motility worksheet med navy form

- Vantagecare retirement health savings rhs plan benefits reimbursement request form page 1 of 2 complete this form and send with

- Introduction to industrial organization 2nd edition solutions pdf form

- Counting atoms practice form

- Sample letter request for honorarium form

- Prior authorization request form unity health insurance

- Truist power of attorney form

Find out other Where To File Your Request It Is Important That You File Your Request Using The Address Shown On Your Lien Or Levy Notice

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document