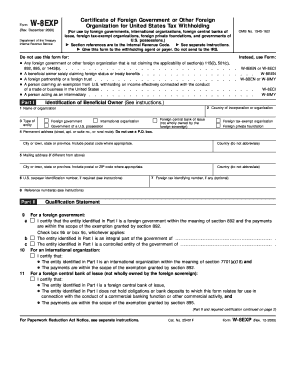

Form W 8EXP Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding for Use by Foreign

Understanding the Form W-8EXP

The Form W-8EXP, known as the Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding, is essential for foreign governments, international organizations, foreign central banks of issue, and foreign tax-exempt organizations. This form certifies that the entity is a foreign government or organization that qualifies for tax exemptions under U.S. tax law. By submitting this form, eligible entities can avoid or reduce withholding tax on certain types of income received from U.S. sources.

How to Use the Form W-8EXP

The Form W-8EXP is used primarily by foreign entities to claim exemption from U.S. withholding tax. To utilize this form, the foreign entity must complete it accurately and submit it to the withholding agent or payer in the United States. It is important to ensure that the information provided is correct and up-to-date, as this will determine the withholding tax rate applied to the income received. The form must be kept on file by the withholding agent for verification purposes.

Steps to Complete the Form W-8EXP

Completing the Form W-8EXP involves several key steps:

- Provide the name of the foreign government or organization.

- Include the country of incorporation or organization.

- List the type of entity, such as a foreign government or international organization.

- Indicate the applicable income type that qualifies for exemption.

- Sign and date the form to validate the information provided.

It is crucial to review the form for accuracy before submission to avoid delays or issues with tax withholding.

Eligibility Criteria for the Form W-8EXP

To be eligible to use the Form W-8EXP, the entity must be a foreign government, international organization, foreign central bank of issue, or a foreign tax-exempt organization. These entities must also meet specific criteria set by the IRS, including being recognized as tax-exempt under U.S. law. Understanding these criteria is vital for ensuring compliance and avoiding unnecessary withholding taxes.

IRS Guidelines for Form W-8EXP

The IRS provides specific guidelines regarding the completion and submission of the Form W-8EXP. These guidelines include instructions on who should complete the form, how to fill it out, and where to send it. The IRS also outlines the types of income that may be exempt from withholding tax based on the information provided in the form. It is essential for entities to familiarize themselves with these guidelines to ensure compliance with U.S. tax laws.

Form Submission Methods

The Form W-8EXP can be submitted through various methods, depending on the preferences of the withholding agent. Common submission methods include:

- Mailing a physical copy of the form to the withholding agent.

- Submitting the form electronically, if the withholding agent allows for digital submissions.

- Providing the form in person, if required by the withholding agent.

Each method has its own advantages, and entities should choose the one that best suits their needs while ensuring timely submission.

Quick guide on how to complete form w 8exp certificate of foreign government or other foreign organization for united states tax withholding for use by

Complete [SKS] seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the proper format and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven task today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or black out sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign

Create this form in 5 minutes!

How to create an eSignature for the form w 8exp certificate of foreign government or other foreign organization for united states tax withholding for use by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization?

The Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations, is a crucial tax document. It certifies that the organization is a foreign entity that qualifies for a reduced rate of withholding tax. This ensures compliance with U.S. tax regulations while facilitating smooth financial transactions.

-

How can airSlate SignNow assist in completing the Form W 8EXP?

With airSlate SignNow, you can easily complete and sign the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations, electronically. Our platform provides intuitive tools to fill out, review, and manage your forms, making the process efficient and user-friendly.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for managing the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations, helps streamline your tax documentation process. Our secure platform ensures your documents are safe and accessible. Additionally, eSigning reduces turnaround times, allowing for quicker compliance with tax obligations.

-

Is there any pricing associated with airSlate SignNow services?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. Our plans include everything you need to efficiently handle forms like the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations,. We also provide a free trial for you to explore our features before making a commitment.

-

What features does airSlate SignNow provide for eSigning documents?

airSlate SignNow offers a suite of powerful features to enhance your eSigning experience. This includes the ability to sign the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations, on any device, templates for quicker document creation, and real-time tracking of document statuses. Our user-friendly interface ensures a smooth signing experience.

-

Can airSlate SignNow integrate with other tools I use?

Absolutely! airSlate SignNow supports integrations with popular business tools and platforms. This means you can seamlessly incorporate the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations, process into your existing workflows, improving efficiency and collaboration across your organization.

-

What support does airSlate SignNow provide for users unfamiliar with the Form W 8EXP?

airSlate SignNow is committed to providing exceptional customer support, especially for users who are new to the Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign Governments, International Organizations, Foreign Central Banks Of Issue, Foreign Tax exempt Organizations,. We offer resources like tutorials, FAQs, and access to a dedicated support team to guide you through the process and ensure you can navigate your forms with confidence.

Get more for Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign

Find out other Form W 8EXP Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding For Use By Foreign

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History