Schedule B Form 990, 990 EZ, or 990 PF Department of the Treasury Internal Revenue Service Schedule of Contributors Supplementar

Understanding the Schedule B Form 990, 990 EZ, or 990 PF

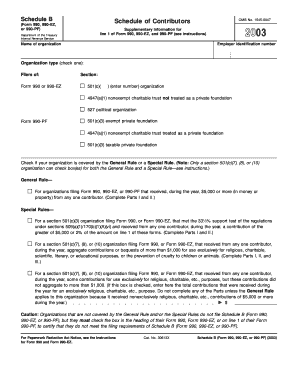

The Schedule B Form 990, 990 EZ, or 990 PF is a crucial document required by the Department of the Treasury Internal Revenue Service. It serves as the Schedule of Contributors, providing supplementary information for Line 1 of Form 990, Form 990 EZ, and Form 990 PF. This form is essential for tax-exempt organizations to report their contributors and ensure compliance with federal regulations. It helps maintain transparency and accountability in the financial activities of non-profit entities.

Steps to Complete the Schedule B Form 990, 990 EZ, or 990 PF

Completing the Schedule B Form involves several key steps:

- Gather necessary information about contributors, including names, addresses, and the amounts contributed.

- Ensure that the total contributions reported match the amounts listed on the primary Form 990, 990 EZ, or 990 PF.

- Fill out the form accurately, following the IRS instructions carefully to avoid errors.

- Review the completed form for any discrepancies before submission.

How to Obtain the Schedule B Form 990, 990 EZ, or 990 PF

The Schedule B Form can be obtained directly from the IRS website or through tax preparation software that supports non-profit tax filings. It is important to ensure that you are using the most current version of the form to comply with the latest IRS guidelines.

Key Elements of the Schedule B Form 990, 990 EZ, or 990 PF

Key elements of the Schedule B Form include:

- Identification of the organization, including its name and Employer Identification Number (EIN).

- Details of each contributor, which may include individual donors, corporations, or foundations.

- The total amount contributed by each donor during the reporting period.

- Any additional notes or explanations required by the IRS for specific contributions.

IRS Guidelines for Completing the Schedule B Form

The IRS provides specific guidelines for completing the Schedule B Form. Organizations must adhere to these instructions to ensure compliance. This includes understanding which contributions need to be reported, how to categorize them, and the importance of accurate record-keeping. Organizations should also be aware of the privacy considerations regarding donor information and follow the IRS rules on disclosure.

Penalties for Non-Compliance with the Schedule B Form

Failure to comply with the requirements of the Schedule B Form can result in significant penalties. The IRS may impose fines for inaccuracies, omissions, or late submissions. Additionally, non-compliance can affect an organization's tax-exempt status. It is essential for organizations to understand these risks and ensure that they complete and file the form correctly and on time.

Quick guide on how to complete schedule b form 990 990 ez or 990 pf department of the treasury internal revenue service schedule of contributors supplementary

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed files, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, through email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementar

Create this form in 5 minutes!

How to create an eSignature for the schedule b form 990 990 ez or 990 pf department of the treasury internal revenue service schedule of contributors supplementary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information?

The Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information is a document required for certain tax-exempt organizations. It provides detailed information about contributions received by the organization, ensuring transparency and compliance with IRS regulations. Understanding this form is crucial for proper financial reporting and maintaining tax-exempt status.

-

How can airSlate SignNow help with completing the Schedule B Form 990?

airSlate SignNow offers a streamlined eSigning and document management solution that simplifies the process of completing the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information. With easy-to-use tools, you can fill out and send this form electronically, saving time and minimizing errors. Our platform ensures that your submissions are organized and securely stored.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and audit trails to enhance your document management process. Specifically for the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information, these features ensure that all necessary data is captured accurately. Our platform is designed to simplify tax document management for organizations.

-

Is airSlate SignNow cost-effective for small organizations needing to file the Schedule B Form 990?

Yes, airSlate SignNow is a cost-effective solution particularly for small organizations that need to file the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information. Our pricing plans are flexible and designed to accommodate varying budget sizes while providing essential features for efficient document management and eSigning.

-

Can I integrate airSlate SignNow with other accounting software for filing the Schedule B Form 990?

Absolutely! airSlate SignNow supports integration with various accounting and financial software solutions. This means you can seamlessly transfer data needed for the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information, streamlining your filing process and maintaining accuracy throughout your operations.

-

What are the benefits of eSigning the Schedule B Form 990 with airSlate SignNow?

eSigning the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information with airSlate SignNow offers several benefits, including time savings, enhanced security, and a legally binding signature. Our platform helps ensure that your documents are completed quickly and efficiently, reducing the hassle of traditional paper processes.

-

How does airSlate SignNow ensure the security of sensitive data on the Schedule B Form 990?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive data found in the Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementary Information. Our platform ensures that your documents are stored securely and accessed only by authorized users, providing peace of mind.

Get more for Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementar

- Nj w4 form

- Daycare vacation letter to parents sample form

- Chapter 14 section 2 the age of the railroads answer key form

- Cebuano language objectives living in cebu city amp cebu form

- Certificado de incapacidade form

- Domestic partner affidavit anthem form

- Form 20 60949302

- Coast mountain bus company ltd employee039s incident report form

Find out other Schedule B Form 990, 990 EZ, Or 990 PF Department Of The Treasury Internal Revenue Service Schedule Of Contributors Supplementar

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form