Form 1099 LS Reportable Life Insurance Sale 2019

What is the Form 1099 LS Reportable Life Insurance Sale

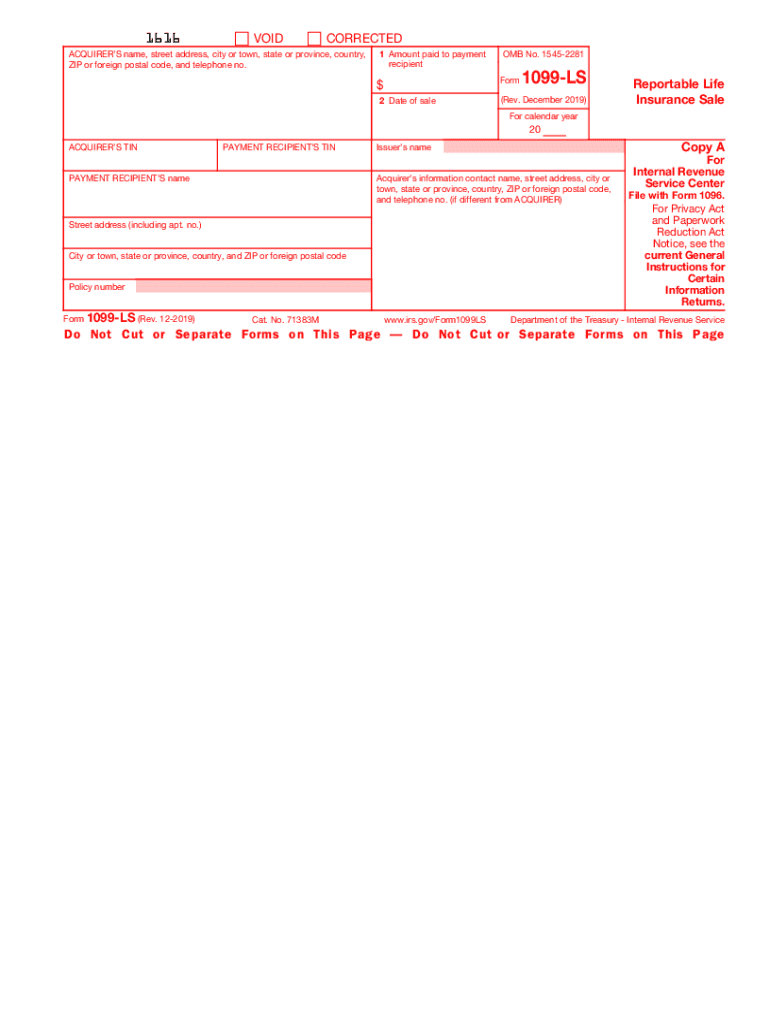

The Form 1099 LS is a tax document used in the United States to report the sale of a life insurance policy. This form is specifically designed for transactions where the policyholder sells their life insurance policy to a third party, which may include an investor or a financial institution. The purpose of this form is to ensure that the Internal Revenue Service (IRS) is informed about the sale, allowing for proper taxation of any gains realized from the transaction. The 1099 LS form captures essential details such as the seller's information, the buyer's information, and the amount received from the sale.

How to use the Form 1099 LS Reportable Life Insurance Sale

To effectively use the Form 1099 LS, the seller of the life insurance policy must complete the form accurately. This involves filling out the seller's name, address, and taxpayer identification number, as well as the buyer's information. Additionally, the form requires the reporting of the gross proceeds from the sale, which is crucial for tax reporting purposes. Once completed, the seller must submit the form to the IRS and provide a copy to the buyer. This ensures both parties have the necessary documentation for their tax filings.

Steps to complete the Form 1099 LS Reportable Life Insurance Sale

Completing the Form 1099 LS involves several key steps:

- Gather necessary information, including the seller's and buyer's details.

- Determine the gross proceeds from the sale of the life insurance policy.

- Fill out the form with accurate and complete information.

- Submit the completed form to the IRS by the specified deadline.

- Provide a copy of the form to the buyer for their records.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 1099 LS. It is essential for sellers to understand the reporting requirements, including the types of transactions that necessitate the use of this form. The IRS mandates that the form be filed for any reportable life insurance sale that occurs during the tax year. Sellers should refer to the IRS instructions for Form 1099 LS to ensure compliance with all regulations and to avoid potential penalties for non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 LS are critical to ensure compliance with IRS regulations. Typically, the form must be submitted to the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Additionally, sellers must provide copies of the form to buyers by the same deadlines. It is important to keep track of these dates to avoid penalties and ensure timely reporting of the sale.

Penalties for Non-Compliance

Failure to file the Form 1099 LS or inaccuracies in the information provided can result in penalties imposed by the IRS. These penalties can vary based on the severity of the non-compliance, including late filing, incorrect information, or failure to provide a copy to the buyer. It is crucial for sellers to ensure that the form is completed accurately and submitted on time to avoid financial repercussions.

Quick guide on how to complete form 1099 ls reportable life insurance sale

Prepare Form 1099 LS Reportable Life Insurance Sale effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Form 1099 LS Reportable Life Insurance Sale on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to alter and electronically sign Form 1099 LS Reportable Life Insurance Sale with ease

- Obtain Form 1099 LS Reportable Life Insurance Sale and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 1099 LS Reportable Life Insurance Sale to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 ls reportable life insurance sale

Create this form in 5 minutes!

How to create an eSignature for the form 1099 ls reportable life insurance sale

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 ls form?

The 1099 ls form is used to report the sale or exchange of certain types of properties. It's crucial for both the seller and the buyer to understand the implications of this form in real estate transactions. Utilizing airSlate SignNow can streamline the process of completing and signing the 1099 ls form, making it easier for all parties involved.

-

How can airSlate SignNow help with the 1099 ls form?

AirSlate SignNow provides a straightforward solution for filling out and eSigning the 1099 ls form. With its intuitive interface, you can easily enter the required information and electronically sign the form. This not only saves time but also ensures that the form is completed accurately and securely.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that help manage documents, including the 1099 ls form. By choosing a plan that fits your budget, you can access powerful eSigning tools without compromising on quality.

-

Is airSlate SignNow secure for handling sensitive documents like the 1099 ls form?

Yes, airSlate SignNow prioritizes security and compliance, especially when handling sensitive documents like the 1099 ls form. The platform uses advanced encryption and security protocols to protect your data, ensuring that your information remains confidential throughout the signing process.

-

Can I integrate airSlate SignNow with other software for managing the 1099 ls form?

Absolutely! AirSlate SignNow easily integrates with various applications to enhance your workflow. This means you can connect it with your accounting or real estate software, allowing for a seamless process when managing the 1099 ls form and other essential documents.

-

What are the benefits of using airSlate SignNow for the 1099 ls form?

Using airSlate SignNow for the 1099 ls form offers numerous benefits, including time savings and increased efficiency. The electronic signing feature allows for quick turnaround times, while the document tracking ensures you never miss a deadline. Additionally, the platform's user-friendly interface simplifies the entire process.

-

How do I get started with airSlate SignNow for the 1099 ls form?

To get started with airSlate SignNow for the 1099 ls form, simply sign up for an account on their website. Once registered, you can begin creating and managing your documents right away. Their intuitive platform will guide you through the necessary steps, making the process hassle-free.

Get more for Form 1099 LS Reportable Life Insurance Sale

Find out other Form 1099 LS Reportable Life Insurance Sale

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation