Irs W 4 Withholding Form

Understanding the IRS W-4 Withholding Form

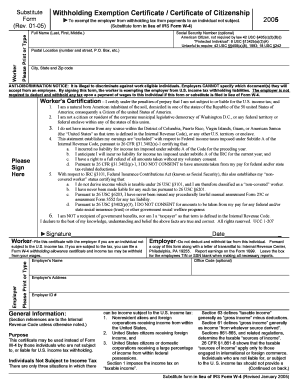

The IRS W-4 exemption form, also known as the W-4 withholding exemption form, is a crucial document for employees in the United States. This form is used to inform employers about the amount of federal income tax to withhold from an employee's paycheck. By accurately completing the W-4, employees can ensure that the correct amount is deducted, helping to avoid overpayment or underpayment of taxes throughout the year.

Steps to Complete the IRS W-4 Withholding Form

Filling out the IRS W-4 exemption form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Follow the instructions to determine the number of allowances you can claim. This may involve considering your dependents, tax credits, and other factors.

- If applicable, complete the additional sections for extra withholding or adjustments based on other income.

- Finally, sign and date the form before submitting it to your employer.

How to Obtain the IRS W-4 Withholding Form

The IRS W-4 exemption form can be easily obtained through several methods:

- Visit the official IRS website to download the form directly.

- Request a physical copy from your employer, as many companies provide this form during the hiring process.

- Check local libraries or community centers, which often have tax forms available during tax season.

Key Elements of the IRS W-4 Withholding Form

Understanding the key elements of the IRS W-4 exemption form is essential for accurate completion:

- Personal Information: This section requires your name, address, and Social Security number.

- Filing Status: Choose your filing status to determine your tax rate.

- Allowances: The number of allowances you claim affects your withholding amount. More allowances mean less tax withheld.

- Additional Withholding: If you expect to owe additional taxes, you can specify an extra amount to be withheld.

Legal Use of the IRS W-4 Withholding Form

The IRS W-4 exemption form is legally binding and must be completed accurately to comply with federal tax laws. Employers are required to withhold the appropriate amount of income tax based on the information provided on the form. Misrepresentation or failure to submit a W-4 can lead to penalties, including fines or increased withholding rates.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines related to the IRS W-4 exemption form:

- New employees should submit their W-4 on or before their first paycheck.

- Any changes to your W-4 should be submitted to your employer as soon as possible, especially after significant life events such as marriage or the birth of a child.

- Review your W-4 annually or whenever your financial situation changes to ensure accurate withholding.

Quick guide on how to complete irs w 4 withholding form

Effortlessly prepare Irs W 4 Withholding Form on any device

Managing documents online has gained immense popularity among both businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Irs W 4 Withholding Form on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Irs W 4 Withholding Form with ease

- Locate Irs W 4 Withholding Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs W 4 Withholding Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs w 4 withholding form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the internal revenue service w4 form?

The internal revenue service w4 form is a tax form used by employees to indicate their tax situation to their employer. By filling out the W-4 correctly, employees ensure that the correct federal income tax is withheld from their paychecks, preventing underpayment or overpayment during tax season.

-

How does airSlate SignNow help with completing the internal revenue service w4?

airSlate SignNow simplifies the process of completing the internal revenue service w4 by providing an intuitive eSigning platform. Users can fill out, sign, and send the W-4 form quickly, making the process efficient and error-free, ensuring compliance with IRS guidelines.

-

What are the pricing plans for using airSlate SignNow with the internal revenue service w4?

airSlate SignNow offers various pricing plans designed to suit businesses of all sizes. Each plan includes comprehensive features that facilitate easy management of documents such as the internal revenue service w4, allowing organizations to choose what best fits their budget and operational needs.

-

Can airSlate SignNow integrate with other software for managing the internal revenue service w4?

Yes, airSlate SignNow can integrate with multiple third-party applications to streamline the document management process. This includes popular accounting and HR software that can help businesses manage their internal revenue service w4 alongside other essential documents.

-

What features does airSlate SignNow provide for the internal revenue service w4?

airSlate SignNow provides an array of features tailored for managing the internal revenue service w4, including customizable templates, multi-party signing, and status tracking. These features ensure that the process is not only user-friendly but also signNowly enhances document workflow efficiency.

-

What are the benefits of using airSlate SignNow for the internal revenue service w4 over traditional methods?

Using airSlate SignNow for the internal revenue service w4 offers numerous benefits over traditional paper methods, including speed, security, and ease of use. With electronic signatures and cloud storage, you can access documents anytime and anywhere, signNowly reducing paperwork and potential errors.

-

Is it safe to use airSlate SignNow for managing the internal revenue service w4?

Absolutely! airSlate SignNow prioritizes security with bank-level encryption and compliance with industry standards. This ensures that your internal revenue service w4 and other sensitive documents are protected throughout the eSigning process.

Get more for Irs W 4 Withholding Form

- Tiaa power of attorney form

- Trial form

- Executive summary community college league of california ccleague form

- New york national grid service form

- Eteeap application form pangasinan state updf

- Creative agency retainer agreement template form

- Creative service agreement template form

- Creative service retainer agreement template form

Find out other Irs W 4 Withholding Form

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter