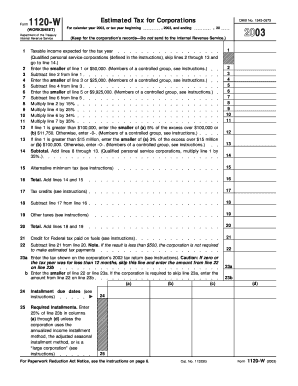

Form 1120 W Estimated Tax for Corporations for Calendar Year , or Tax Year Beginning , , and Ending , 20 OMB No

What is the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

The Form 1120 W is used by corporations to calculate and report their estimated tax payments for a specified calendar year or tax year. This form is essential for corporations to ensure they meet their tax obligations throughout the year, rather than paying a lump sum at the end of the tax year. By using this form, corporations can estimate their tax liability based on their expected income, deductions, and credits, allowing for more manageable cash flow and compliance with IRS regulations.

How to use the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

To effectively use Form 1120 W, corporations should first gather necessary financial information, including projected income, deductions, and credits for the year. The form requires inputting this data to calculate the estimated tax liability. Corporations must then determine the payment schedule, which typically involves making quarterly payments. It is important to keep accurate records of these payments and any changes in projected income throughout the year, as this may affect future payments.

Steps to complete the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

Completing Form 1120 W involves several key steps:

- Gather financial data, including income projections and allowable deductions.

- Fill out the form by entering the estimated income, deductions, and credits in the appropriate sections.

- Calculate the estimated tax liability based on the information provided.

- Determine the payment schedule, typically divided into four quarterly payments.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing Form 1120 W. Generally, the first estimated tax payment is due on the fifteenth day of the fourth month of the tax year. Subsequent payments are typically due on the fifteenth day of the sixth, ninth, and twelfth months. It is crucial for corporations to mark these dates on their calendars to avoid penalties for late payments.

IRS Guidelines

The IRS provides detailed guidelines for completing and submitting Form 1120 W. Corporations should refer to the IRS instructions accompanying the form for specific requirements regarding income calculations, allowable deductions, and credits. Adhering to these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Penalties for Non-Compliance

Failure to file Form 1120 W or make timely estimated tax payments can result in significant penalties. The IRS may impose a penalty for underpayment of estimated taxes, which is calculated based on the amount of tax owed and the duration of the underpayment. Additionally, late filing can lead to interest charges on the unpaid tax amount. Corporations should prioritize compliance to avoid these financial repercussions.

Quick guide on how to complete form 1120 w estimated tax for corporations for calendar year or tax year beginning and ending 20 omb no 1662340

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Edit and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w estimated tax for corporations for calendar year or tax year beginning and ending 20 omb no 1662340

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No.?

Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No. is a form used by corporations to estimate their tax liability for the year. This form is crucial for ensuring that corporations pay their estimated taxes timely and avoid penalties. Utilizing this form helps businesses manage their cash flow and meet their tax obligations effectively.

-

How can airSlate SignNow help with Form 1120 W Estimated Tax For Corporations?

airSlate SignNow offers an intuitive platform that allows businesses to send and eSign Form 1120 W Estimated Tax For Corporations. This streamlines the process of preparing and submitting the form, ensuring that all necessary signatures are captured quickly and securely. Additionally, airSlate SignNow provides a safe and efficient way to keep digital records of submitted forms.

-

What are the pricing options for using airSlate SignNow to manage my tax forms?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. Whether you are a small business or a large corporation, you can choose a plan that includes essential features for managing Form 1120 W Estimated Tax For Corporations. With competitive pricing, airSlate SignNow ensures that you receive great value for your document management and eSigning needs.

-

Does airSlate SignNow integrate with other financial software?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software, making it easy to manage Form 1120 W Estimated Tax For Corporations within your existing workflow. Integrations can help eliminate duplicate data entry and streamline the process of tax preparation. This means you can focus more on your business and less on paperwork.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including Form 1120 W Estimated Tax For Corporations, provides signNow benefits such as increased efficiency, secure eSigning, and centralized document management. The platform simplifies the process of preparing and sending forms, reducing time spent on administrative tasks. With features like templates and reminders, you can ensure that your tax submissions are always up-to-date.

-

Is it easy to collaborate on Form 1120 W with team members using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate effortlessly on Form 1120 W Estimated Tax For Corporations. You can share documents with your team, track who has signed, and receive real-time updates. This collaborative feature enhances communication and ensures that all team members are aligned and informed.

-

How secure is my data when using airSlate SignNow for tax forms?

airSlate SignNow prioritizes the security of your data, implementing robust security measures and encryption to protect sensitive information such as Form 1120 W Estimated Tax For Corporations. With compliance to industry standards, you can be confident that your documents remain confidential and secure. Regular audits and updates ensure the platform adheres to the latest security protocols.

Get more for Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

Find out other Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors