Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e

Understanding Form 990 T for Exempt Organizations

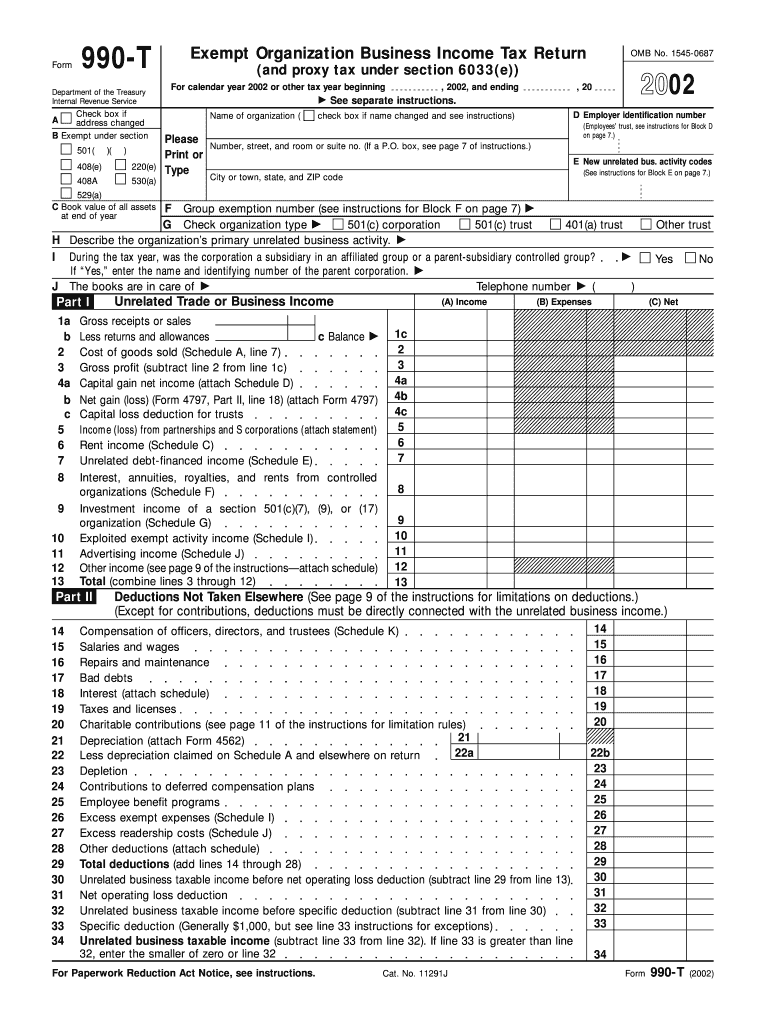

The Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e is a crucial document for tax-exempt organizations in the United States. This form is specifically designed for organizations that generate unrelated business income. It allows these entities to report their business income and pay any applicable taxes. Understanding this form is essential for compliance with IRS regulations, ensuring that organizations maintain their tax-exempt status while fulfilling their tax obligations.

Steps to Complete Form 990 T

Completing Form 990 T involves several key steps to ensure accuracy and compliance. First, organizations must gather all necessary financial information related to their unrelated business income. This includes revenue from activities not substantially related to their exempt purpose. Next, organizations should carefully fill out the form, providing detailed information about their income, expenses, and any deductions they are claiming. It is important to review the form for completeness and accuracy before submission. Finally, organizations should keep a copy of the completed form for their records.

Obtaining Form 990 T

Organizations can obtain the Form 990 T Fill in Version through the IRS website or by contacting the IRS directly. The form is available in a fillable PDF format, making it easy to complete electronically. Additionally, organizations can access instructions and guidelines that accompany the form, which provide valuable information on how to fill it out correctly. It is advisable to download the latest version of the form to ensure compliance with current tax laws.

Key Elements of Form 990 T

Several key elements are essential to understand when filling out Form 990 T. These include the identification section, where the organization provides its name, address, and Employer Identification Number (EIN). The income section details the types of unrelated business income being reported, while the expenses section outlines any deductions that the organization is claiming. Additionally, organizations must report any proxy tax under Section 6033e, which applies to certain political expenditures. Understanding these elements helps ensure accurate reporting and compliance.

Filing Deadlines for Form 990 T

Timely filing of Form 990 T is crucial for tax-exempt organizations. The form is typically due on the fifteenth day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this means the deadline is May fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Organizations may file for an extension if needed, but it is important to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance with Form 990 T

Non-compliance with the filing requirements of Form 990 T can result in significant penalties for tax-exempt organizations. Failure to file the form on time may lead to a penalty of $20 per day, up to a maximum of $10,000. In cases where the organization fails to report unrelated business income, the IRS may impose additional penalties. Organizations should ensure timely and accurate filing to avoid these consequences and maintain their tax-exempt status.

Quick guide on how to complete form 990 t fill in version exempt organization business income tax return and proxy tax under section 6033e

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Alter and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature utilizing the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Create this form in 5 minutes!

How to create an eSignature for the form 990 t fill in version exempt organization business income tax return and proxy tax under section 6033e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e?

The Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e is a tax form used by exempt organizations to report unrelated business income and pay taxes on that income. This form ensures compliance with tax regulations and provides transparency regarding business activities of exempt entities.

-

How does airSlate SignNow help in completing the Form 990 T Fill in Version?

airSlate SignNow streamlines the process of filling out the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e by providing easy-to-use templates and electronic signing capabilities. Our platform allows users to collaborate, fill in information, and securely eSign documents, making tax filing much more efficient.

-

What features does airSlate SignNow offer for Form 990 T completion?

airSlate SignNow offers features such as customizable templates, real-time collaboration, advanced eSigning, and secure document storage specifically tailored for the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e. These features simplify the document preparation process and help organizations manage their tax obligations effectively.

-

Is there a cost involved in using airSlate SignNow for Form 990 T?

Yes, using airSlate SignNow for the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e involves a subscription fee. However, our pricing is competitive and designed to provide value by offering an efficient and user-friendly solution to manage your tax forms and eSignatures.

-

Can I integrate airSlate SignNow with other software to help with Form 990 T?

Absolutely! airSlate SignNow integrates seamlessly with various business applications and tools that can assist with the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e. This enables users to automate workflows, sync data, and streamline processes between platforms for enhanced productivity.

-

What benefits can I expect from using airSlate SignNow for Form 990 T?

By using airSlate SignNow for the Form 990 T Fill in Version, users can expect several benefits, including time savings from efficient document processing, improved accuracy with automated data entry, and enhanced compliance through organized record keeping. Our platform also enhances the overall user experience with easy navigation and support.

-

How secure is my information when using airSlate SignNow for Form 990 T?

The security of your information is a top priority at airSlate SignNow. When completing the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e, all data is encrypted and stored securely, ensuring compliance with privacy regulations and safeguarding sensitive information.

Get more for Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- Critical elements analysis guide creag part b form

- Epa form 7520 11 rev 8 01 annual disposalinjection deq state ok

- Medicationtreatment consent form grps

- Companies house sr01 form

- Cfs 600 form

- Certification of compliance with driver license requirements form

- Vaaru card form

- Alfred music theory book 3 pdf form

Find out other Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document