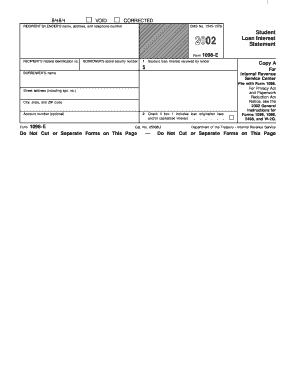

Form 1098 E Fill in Version Student Loan Interest Statement

What is the Form 1098-E: Student Loan Interest Statement

The Form 1098-E is a tax document used to report the amount of interest paid on student loans during the tax year. This form is essential for taxpayers who have taken out student loans and wish to claim the student loan interest deduction on their federal tax returns. The form is issued by lenders to borrowers and includes key information such as the borrower’s name, the lender’s information, and the total interest paid. Understanding this form is crucial for accurately reporting your financial situation to the IRS.

How to Use the Form 1098-E

Using the Form 1098-E involves several steps. First, ensure you receive the form from your lender, typically by January 31 of the following year. Review the form for accuracy, checking that your name, Social Security number, and the reported interest amount are correct. When preparing your tax return, you will need to enter the amount of interest reported on the 1098-E into the appropriate section of your tax software or forms. This deduction can help reduce your taxable income, making it important to utilize this form correctly.

Steps to Complete the Form 1098-E

Completing the Form 1098-E is straightforward. Follow these steps:

- Obtain the form from your lender, ensuring it includes your correct information.

- Verify the total interest amount reported; this should match your records.

- Enter the interest amount on your tax return in the section designated for student loan interest deductions.

- Keep a copy of the form for your records, as you may need it if the IRS requests documentation.

Who Issues the Form 1098-E

The Form 1098-E is issued by the lender or loan servicer to whom you have made payments on your student loans. This can include banks, credit unions, or other financial institutions that provide student loans. It is important to ensure that you receive this form from all lenders if you have multiple loans, as each lender is responsible for reporting the interest paid on their specific loans.

IRS Guidelines for the Form 1098-E

The IRS provides specific guidelines regarding the use of Form 1098-E. Taxpayers can deduct the interest paid on qualified student loans, up to a maximum of $2,500 per year, depending on income levels. The IRS requires that the interest be paid during the tax year for which the deduction is claimed. Additionally, to qualify for the deduction, the taxpayer must meet certain eligibility criteria, including income limits and filing status.

Filing Deadlines for the Form 1098-E

Filing deadlines for the Form 1098-E align with general tax filing deadlines. Lenders must send out this form to borrowers by January 31 of the year following the tax year in which interest was paid. Taxpayers typically need to file their tax returns by April 15, unless an extension is requested. It is crucial to keep these dates in mind to ensure compliance and to take advantage of the student loan interest deduction.

Quick guide on how to complete where do i enter 1098 e in lacerte

Complete where do i enter 1098 e in lacerte effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and secure it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without hindrances. Handle where to enter 1098 e in lacerte on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The most effective way to modify and eSign where do i enter 1098 e in lacerte with ease

- Obtain where to input 1098 e in lacerte and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign where to enter 1098 e in lacerte and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where to enter 1098 e in lacerte

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask where to input 1098 e in lacerte

-

Where to enter 1098 e in Lacerte software?

To enter the 1098 e in Lacerte, navigate to the 'Income' section on the left-hand menu. Then select 'Other Income' and find the appropriate field to input the details of your 1098 e. Remember, entering this information correctly will ensure accurate tax filings.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a variety of features including eSignature, document templates, and real-time notifications. These tools simplify the process of obtaining electronic signatures, including essential tax documents like the 1098 e. With its user-friendly interface, businesses can efficiently manage their paperwork.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is designed to be an affordable and easy-to-use solution for small businesses. It helps save time and money on document workflows, which is particularly beneficial for tax documents like the 1098 e. Its cost-effective pricing model ensures accessibility for organizations of all sizes.

-

How does airSlate SignNow integrate with other tools?

airSlate SignNow integrates seamlessly with various software applications including CRMs, accounting systems, and cloud storage platforms. This allows users to manage their documents, including tax forms like the 1098 e, in one cohesive system. Such integrations enhance productivity and streamline workflows.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, like the 1098 e, ensures a swift and secure signing process. It eliminates the need for physical paperwork, reduces errors, and provides a clear audit trail. This can signNowly simplify your tax preparation and filing experience.

-

How can I track document status in airSlate SignNow?

To track the status of your documents, including the 1098 e, you can use the dashboard feature in airSlate SignNow. It provides real-time updates on whether documents have been viewed, signed, or need further action. This gives users peace of mind knowing their important documents are being handled promptly.

-

What security measures does airSlate SignNow employ?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your sensitive information. This is crucial when handling documents like the 1098 e, which can contain personal and financial data. You can ensure that your documents are safe and compliant.

Get more for where to enter 1098 e in lacerte

Find out other where do i enter 1098 e in lacerte

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online