Schedule D Form 1120 Fill in Version Capital Gains and Losses

What is the Schedule D Form 1120 Fill in Version Capital Gains And Losses

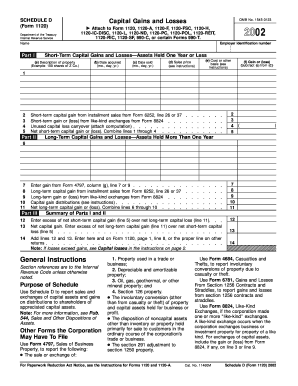

The Schedule D Form 1120 is a tax form used by corporations to report capital gains and losses. This form is essential for accurately calculating the tax implications of transactions involving capital assets, such as stocks, bonds, and real estate. Corporations must complete this form to disclose their capital gains and losses to the Internal Revenue Service (IRS), ensuring compliance with federal tax regulations. The fill-in version allows for easier completion and submission, facilitating the process for businesses managing their capital assets.

How to use the Schedule D Form 1120 Fill in Version Capital Gains And Losses

Using the Schedule D Form 1120 involves several steps to ensure accurate reporting of capital gains and losses. First, gather all relevant financial records, including purchase and sale information for capital assets. Next, complete the form by entering details about each transaction, including dates, amounts, and types of assets. It is important to categorize gains and losses correctly, distinguishing between short-term and long-term transactions. Finally, review the completed form for accuracy before submission to the IRS.

Steps to complete the Schedule D Form 1120 Fill in Version Capital Gains And Losses

Completing the Schedule D Form 1120 requires careful attention to detail. Start by downloading the fill-in version of the form from the IRS website or a trusted source. Follow these steps:

- Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- List all capital asset transactions in the designated sections, including the date acquired, date sold, and proceeds from the sale.

- Calculate the total capital gains and losses, ensuring to separate short-term from long-term transactions.

- Transfer the totals to the appropriate sections of the form and complete any additional required schedules.

- Review the form for completeness and accuracy before finalizing it for submission.

Key elements of the Schedule D Form 1120 Fill in Version Capital Gains And Losses

The Schedule D Form 1120 includes several key elements that are crucial for reporting capital gains and losses effectively. These elements consist of:

- Identification Information: Basic details about the corporation, including its name, address, and EIN.

- Transaction Details: A comprehensive list of each capital asset transaction, including purchase and sale dates, amounts, and types of assets.

- Capital Gains and Losses Calculation: Sections for calculating short-term and long-term gains and losses separately.

- Summary Totals: Final totals that must be reported on the corporation's tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 1120. These guidelines outline the requirements for reporting capital gains and losses, including definitions of short-term and long-term assets. Corporations must adhere to these guidelines to ensure compliance and avoid potential penalties. It is advisable to consult the IRS instructions for the Schedule D Form 1120 for detailed information on reporting requirements and calculations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1120 coincide with the corporation's tax return due date. Generally, corporations must file their tax returns by the fifteenth day of the fourth month after the end of their tax year. For corporations operating on a calendar year, this typically means a deadline of April fifteenth. It is crucial to be aware of any extensions or changes to deadlines that may occur, as these can affect the timely submission of the form.

Quick guide on how to complete schedule d form 1120 fill in version capital gains and losses

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to efficiently create, modify, and eSign your documents without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule D Form 1120 Fill in Version Capital Gains And Losses

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1120 fill in version capital gains and losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

The Schedule D Form 1120 Fill in Version Capital Gains And Losses is a tax form used by corporations to report capital gains and losses. This form helps businesses track their investment incomes and ensure accurate reporting for tax purposes. Using this form correctly can lead to potential tax savings and compliance.

-

How can airSlate SignNow help with completing the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Schedule D Form 1120 Fill in Version Capital Gains And Losses. With customizable templates and eSignature capabilities, airSlate empowers businesses to fill out forms efficiently and securely. This helps streamline the tax filing process, saving you time and reducing errors.

-

What features does airSlate SignNow provide for managing the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

With airSlate SignNow, users can easily manage the Schedule D Form 1120 Fill in Version Capital Gains And Losses through features like document templates, real-time collaboration, and automated workflows. The platform also supports cloud storage for easy access and sharing among team members. These features enhance efficiency and ensure compliance when dealing with important tax documents.

-

Is there a trial period for using airSlate SignNow for the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

Yes, airSlate SignNow typically offers a trial period that allows users to explore the features related to the Schedule D Form 1120 Fill in Version Capital Gains And Losses. This trial gives prospective customers a chance to experience how the platform can benefit their tax filing processes without any financial commitment. Be sure to check the airSlate SignNow website for current offers.

-

Can I integrate airSlate SignNow with accounting software for the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, making it easy to manage your Schedule D Form 1120 Fill in Version Capital Gains And Losses. This integration streamlines data transfer, ensuring that all information is accurate and up-to-date. It enhances your overall tax preparation process by connecting your document management needs with your accounting workflows.

-

What are the benefits of using airSlate SignNow for tax forms like the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

Using airSlate SignNow for tax forms like the Schedule D Form 1120 Fill in Version Capital Gains And Losses offers several advantages, including increased efficiency, enhanced security, and lower costs. The platform’s intuitive design allows users to complete and sign documents quickly, reducing the time spent on administrative tasks. Additionally, the use of electronic signatures ensures compliance and legal validity.

-

Is airSlate SignNow cost-effective for small businesses filing the Schedule D Form 1120 Fill in Version Capital Gains And Losses?

Yes, airSlate SignNow provides a cost-effective solution ideal for small businesses filing their Schedule D Form 1120 Fill in Version Capital Gains And Losses. The pricing plans cater to different business needs, ensuring accessibility without compromising features. This makes it a practical choice for small businesses looking to streamline their tax filing processes affordably.

Get more for Schedule D Form 1120 Fill in Version Capital Gains And Losses

Find out other Schedule D Form 1120 Fill in Version Capital Gains And Losses

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template