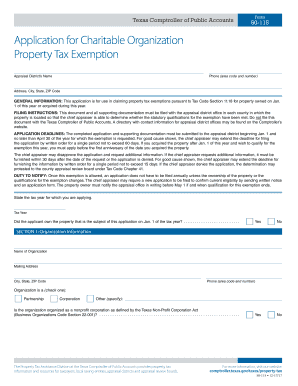

GENERAL INFORMATION This Application is for Use in Claiming Property Tax Exemptions Pursuant to Tax Code Section 11 2017-2026

Understanding Texas Property Tax Exemption

The Texas property tax exemption is a provision that allows certain property owners in Texas to reduce their property tax burden. This exemption is available under specific conditions outlined in the Texas Tax Code, particularly Section 11. Various categories of exemptions exist, including those for homeowners, disabled individuals, and veterans. Each exemption type has its own eligibility criteria and application process, making it essential for property owners to understand which exemptions they may qualify for.

Eligibility Criteria for Texas Property Tax Exemption

To qualify for a Texas property tax exemption, applicants must meet specific criteria based on the type of exemption they seek. Common eligibility factors include:

- Ownership of the property, meaning the applicant must be the legal owner.

- Primary residence status, as many exemptions apply only to properties used as the owner's main home.

- Age or disability status for certain exemptions aimed at senior citizens or individuals with disabilities.

- Veteran status for exemptions available to veterans and their surviving spouses.

Understanding these criteria is crucial for property owners to ensure they apply for the correct exemptions and maximize their tax savings.

Steps to Complete the Texas Property Tax Exemption Application

Filing for a Texas property tax exemption involves a series of steps to ensure the application is completed accurately. Here is a general outline of the process:

- Determine the type of exemption for which you are eligible.

- Gather necessary documentation, such as proof of ownership and identification.

- Obtain the Texas property tax exemption form, which can be accessed through local appraisal district offices or online.

- Complete the form, ensuring all required information is filled out accurately.

- Submit the application by the specified deadline, either online, by mail, or in person at the local appraisal district.

Following these steps can help streamline the application process and reduce the likelihood of errors that could delay approval.

Required Documents for Application

When applying for a Texas property tax exemption, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving property ownership, like a deed or tax statement.

- For disability exemptions, medical documentation may be necessary.

- Veteran status verification, which could include a DD-214 form or other military documentation.

Having these documents ready can facilitate a smoother application process and help ensure that all necessary information is provided.

Form Submission Methods

Submitting the Texas property tax exemption form can be done through various methods, depending on the local appraisal district's policies. Common submission options include:

- Online submission via the local appraisal district's website, if available.

- Mailing the completed form to the appropriate appraisal district office.

- In-person submission at the local appraisal district office during business hours.

Choosing the right submission method can help ensure that your application is processed in a timely manner.

Approval Time for Texas Property Tax Exemption Applications

The approval time for Texas property tax exemption applications can vary based on several factors, including the volume of applications received and the specific appraisal district's processing times. Typically, applicants can expect to receive a decision within a few weeks to a couple of months after submission. It is advisable to follow up with the appraisal district if you have not received notification of your application status within a reasonable timeframe.

Create this form in 5 minutes or less

Find and fill out the correct general information this application is for use in claiming property tax exemptions pursuant to tax code section 11

Create this form in 5 minutes!

How to create an eSignature for the general information this application is for use in claiming property tax exemptions pursuant to tax code section 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas property tax exemption?

A Texas property tax exemption reduces the amount of property tax you owe, making it a valuable benefit for eligible homeowners. This exemption can signNowly lower your tax bill, allowing you to allocate those savings elsewhere. Understanding the specifics of the Texas property tax exemption is crucial for maximizing your financial benefits.

-

Who qualifies for a Texas property tax exemption?

Eligibility for a Texas property tax exemption typically includes homeowners who meet certain criteria, such as age, disability status, or veteran status. Additionally, properties used for specific purposes, like agricultural use, may also qualify. It's important to review the requirements to ensure you can take advantage of the Texas property tax exemption.

-

How do I apply for a Texas property tax exemption?

To apply for a Texas property tax exemption, you need to complete the appropriate application form and submit it to your local appraisal district. The application process may vary slightly depending on the type of exemption you are seeking. Ensure you gather all necessary documentation to support your claim for the Texas property tax exemption.

-

What are the benefits of a Texas property tax exemption?

The primary benefit of a Texas property tax exemption is the reduction in your property tax liability, which can lead to signNow savings. This exemption can also enhance your financial stability, allowing you to invest in other areas of your life. Understanding the benefits of the Texas property tax exemption can help you make informed decisions about your property.

-

Can I use airSlate SignNow to manage my Texas property tax exemption documents?

Yes, airSlate SignNow provides an efficient platform for managing all your Texas property tax exemption documents. With our easy-to-use eSigning features, you can quickly send, sign, and store your exemption applications securely. This streamlines the process and ensures you meet all deadlines related to your Texas property tax exemption.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including eSigning, document templates, and secure cloud storage, all designed to simplify your document management. These features are particularly useful for handling applications related to the Texas property tax exemption. By utilizing these tools, you can ensure a smooth and efficient process.

-

Is airSlate SignNow cost-effective for managing Texas property tax exemption applications?

Absolutely! airSlate SignNow is a cost-effective solution for managing your Texas property tax exemption applications. Our pricing plans are designed to fit various budgets, ensuring that you can access essential document management tools without breaking the bank. This affordability makes it easier for you to focus on maximizing your tax benefits.

Get more for GENERAL INFORMATION This Application Is For Use In Claiming Property Tax Exemptions Pursuant To Tax Code Section 11

- Consort checklist of information to include when reporting a randomized trial a

- 103 c 3 day notice to pay rent or move out san francisco form

- E c 8 0575a heavy vehicle pre mobilisation checklist docx form

- Assignment form dean graziosi

- Re commitment form

- Cocolife bldg form

- Federal trade commission ftc consumer complaint form federal trade commission ftc consumer complaint form connectx

Find out other GENERAL INFORMATION This Application Is For Use In Claiming Property Tax Exemptions Pursuant To Tax Code Section 11

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer