State and Local Forms

Understanding State and Local Forms

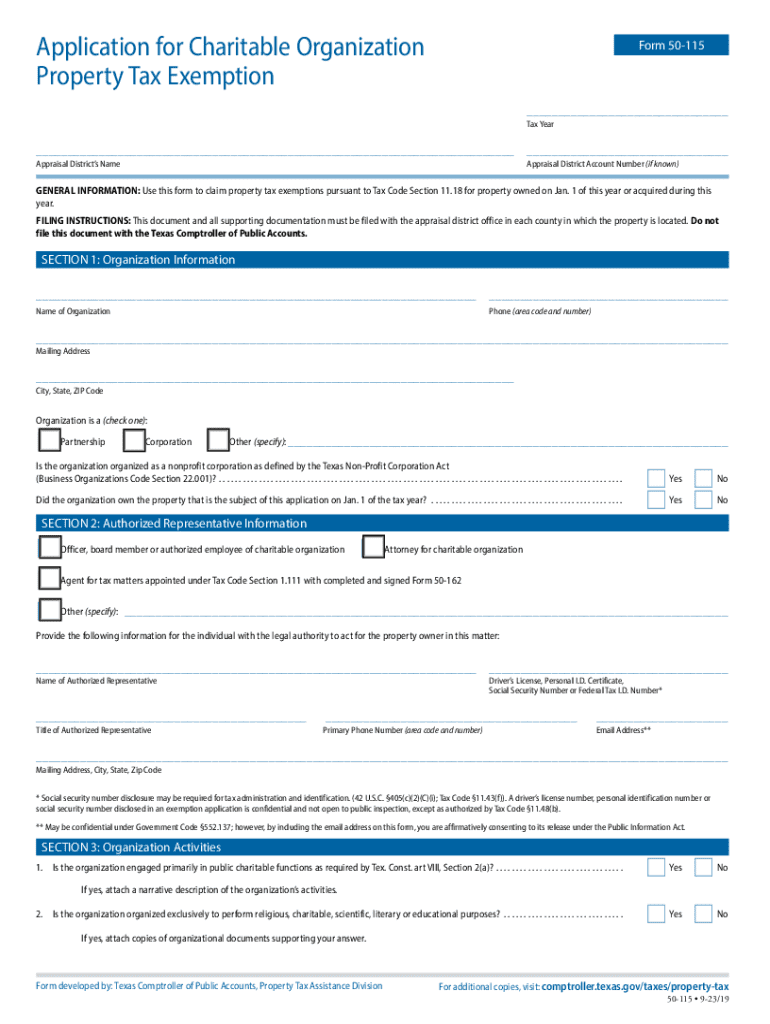

State and local forms are essential documents used for various administrative, legal, and tax-related purposes across different jurisdictions in the United States. These forms can vary significantly depending on the state or locality, reflecting specific regulations and requirements. They may include tax forms, permits, licenses, or applications necessary for compliance with state and local laws. Understanding the purpose and requirements of these forms is crucial for individuals and businesses to ensure proper filing and adherence to legal obligations.

How to Use State and Local Forms Effectively

Using state and local forms effectively involves understanding their specific requirements and following the outlined instructions carefully. Each form typically comes with guidelines that detail how to fill it out, what information is required, and where to submit it. It is important to read these instructions thoroughly to avoid common mistakes that could lead to delays or rejections. Utilizing digital tools, such as signNow, can streamline the process by allowing users to fill out, sign, and submit forms electronically, ensuring a more efficient experience.

Obtaining State and Local Forms

State and local forms can be obtained from various sources, including official government websites, local offices, or through direct requests to relevant agencies. Many states provide downloadable versions of their forms online, making it easy for users to access the necessary documents. Additionally, local offices may offer physical copies for those who prefer to fill them out by hand. It is advisable to ensure that the most current version of the form is used, as outdated forms may not be accepted.

Steps to Complete State and Local Forms

Completing state and local forms requires attention to detail and adherence to specific guidelines. Here are general steps to follow:

- Gather necessary information, such as identification numbers, addresses, and relevant dates.

- Read the instructions provided with the form carefully to understand what is required.

- Fill out the form completely, ensuring all fields are answered accurately.

- Review the completed form for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to the provided instructions, whether online, by mail, or in person.

Legal Use of State and Local Forms

State and local forms must be used in accordance with the laws and regulations governing their specific purpose. Failure to comply with legal requirements can result in penalties, including fines or legal action. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to serious consequences. Understanding the legal implications of these forms is vital for both individuals and businesses to maintain compliance and avoid potential pitfalls.

Examples of Common State and Local Forms

There are numerous types of state and local forms that serve various functions. Some common examples include:

- W-9: Request for Taxpayer Identification Number and Certification

- State tax return forms

- Business license applications

- Building permit applications

- Voter registration forms

Each of these forms has specific requirements and deadlines that must be adhered to for successful processing.

Filing Deadlines and Important Dates

Filing deadlines for state and local forms can vary widely depending on the type of form and jurisdiction. It is crucial to be aware of these deadlines to avoid penalties or late fees. Many tax-related forms have specific due dates, often aligned with federal tax deadlines, while other forms may have unique submission timelines. Keeping a calendar of important dates can help ensure timely compliance with all filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct state and local forms

Create this form in 5 minutes!

How to create an eSignature for the state and local forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are State And Local Forms?

State And Local Forms are specific documents required by various state and local governments for compliance and regulatory purposes. These forms can include permits, licenses, and tax documents. airSlate SignNow simplifies the process of managing these forms by allowing users to create, send, and eSign them efficiently.

-

How does airSlate SignNow help with State And Local Forms?

airSlate SignNow provides a user-friendly platform that enables businesses to easily create and manage State And Local Forms. With features like customizable templates and electronic signatures, users can streamline their document workflows. This not only saves time but also ensures compliance with local regulations.

-

What is the pricing structure for using airSlate SignNow for State And Local Forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Users can choose from monthly or annual subscriptions, with options that include features specifically designed for managing State And Local Forms. This cost-effective solution ensures that you only pay for what you need.

-

Can I integrate airSlate SignNow with other software for State And Local Forms?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage State And Local Forms. Whether you use CRM systems, cloud storage, or project management tools, you can easily connect them with airSlate SignNow. This integration helps streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for State And Local Forms?

Using airSlate SignNow for State And Local Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform allows for quick document turnaround times and ensures that all signatures are legally binding. Additionally, users can track the status of their forms in real-time.

-

Is airSlate SignNow secure for handling State And Local Forms?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all State And Local Forms are handled with the utmost care. The platform employs advanced encryption and security protocols to protect sensitive information. Users can confidently manage their documents knowing they are secure.

-

How can I get started with airSlate SignNow for State And Local Forms?

Getting started with airSlate SignNow for State And Local Forms is easy. Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating your forms. Our intuitive interface and helpful resources will guide you through the process.

Get more for State And Local Forms

- Donation form running aces casino amp racetrack

- B form

- Nc 4p form

- Vial of life form 1 town of windsor

- 5870a form california franchise tax board yumpu

- Service level for training providers agreement template form

- Service level for payroll agreement template form

- Service level for training and development agreement template form

Find out other State And Local Forms

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure