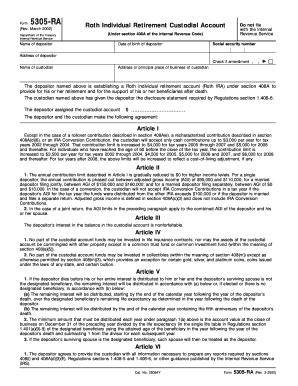

5305 RA Form

What is the 5305 RA

The 5305 RA is a form used by the Internal Revenue Service (IRS) to establish a retirement plan for self-employed individuals and small businesses. This form is essential for those looking to create a Simplified Employee Pension (SEP) plan, which allows for contributions to be made on behalf of employees, including the business owner. The SEP IRA is a popular choice due to its simplicity and flexibility, making it an attractive option for small business owners and self-employed individuals.

How to use the 5305 RA

To use the 5305 RA, individuals must complete the form accurately and submit it to the IRS. The form outlines the terms of the SEP plan, including contribution limits and eligibility requirements. Once the form is submitted, the business can begin making contributions to eligible employees' accounts. It is important to keep records of all contributions and maintain compliance with IRS regulations to ensure the plan remains valid and beneficial.

Steps to complete the 5305 RA

Completing the 5305 RA involves several key steps:

- Obtain the form from the IRS website or other reliable sources.

- Fill in the required information, including the name of the business, the tax identification number, and the plan year.

- Specify the contribution limits and eligibility criteria for employees.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the 5305 RA

The legal use of the 5305 RA is governed by IRS regulations, which outline the requirements for establishing and maintaining a SEP plan. Businesses must adhere to contribution limits and ensure that all eligible employees are included in the plan. Failure to comply with these regulations can result in penalties or disqualification of the plan, which may affect tax benefits and employee retirement savings.

Key elements of the 5305 RA

Key elements of the 5305 RA include:

- The name and address of the employer.

- The employer's tax identification number.

- Details regarding the plan year and contribution limits.

- Eligibility criteria for employees participating in the plan.

- Instructions for amending the plan if necessary.

Filing Deadlines / Important Dates

Filing deadlines for the 5305 RA are crucial for compliance. Typically, the form must be submitted by the tax filing deadline for the employer’s business. For most businesses, this is April fifteenth of the following year. However, if an extension is filed, the deadline may be extended. It is important to stay informed about any changes in IRS regulations that may affect these dates.

Quick guide on how to complete 5305 ra

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, either by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 5305 RA

Create this form in 5 minutes!

How to create an eSignature for the 5305 ra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5305 RA document in the context of airSlate SignNow?

The 5305 RA document is a form that businesses can easily manage and eSign using airSlate SignNow. It streamlines the process of obtaining required signatures while ensuring compliance with relevant regulations.

-

How much does it cost to use airSlate SignNow for the 5305 RA?

airSlate SignNow offers a cost-effective solution for signing the 5305 RA document. Pricing plans are flexible and cater to various business needs, allowing you to choose an option that suits your budget.

-

What features does airSlate SignNow offer for managing the 5305 RA?

With airSlate SignNow, users can easily create, send, and eSign the 5305 RA document. Key features include customizable templates, automated workflows, and secure cloud storage to enhance your document management process.

-

How can airSlate SignNow benefit my business when dealing with the 5305 RA?

Using airSlate SignNow for the 5305 RA can improve efficiency and reduce turnaround times for document signing. The platform simplifies the eSigning process, allowing your team to focus on core business activities.

-

Is it easy to integrate airSlate SignNow with other software for the 5305 RA?

Yes, airSlate SignNow easily integrates with various software solutions, ensuring smooth workflows for handling the 5305 RA document. This integration capability enhances overall productivity by connecting with your existing tools.

-

What security measures does airSlate SignNow provide for the 5305 RA?

airSlate SignNow is committed to safeguarding your data while managing the 5305 RA document. It employs advanced encryption, secure access controls, and complies with industry standards to ensure your information remains protected.

-

Can I track the status of the 5305 RA document in airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 5305 RA document in real time. You will receive notifications about document views, completions, and any pending actions, ensuring transparency in the signing process.

Get more for 5305 RA

Find out other 5305 RA

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template