Maumee JEDZ Tax Return 2023

What is the Maumee JEDZ Tax Return

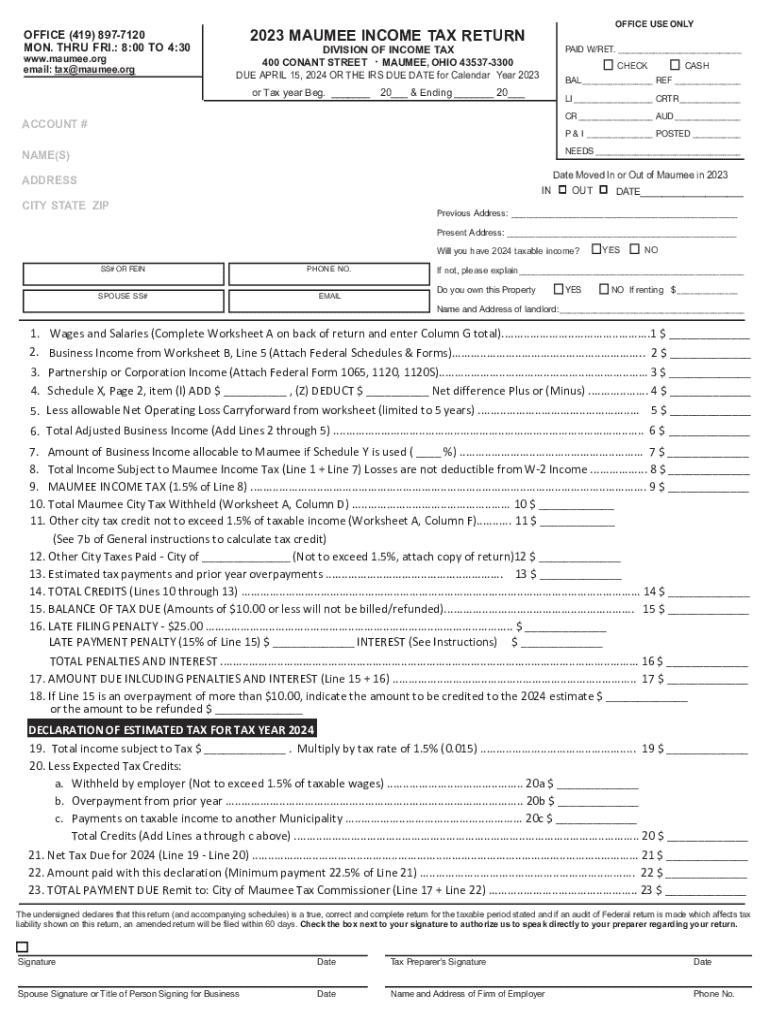

The Maumee JEDZ Tax Return is a specific tax form used by individuals and businesses operating within the Joint Economic Development Zone (JEDZ) in Maumee, Ohio. This form is essential for reporting income and calculating the tax owed to the local government, which supports various community services and infrastructure projects. The JEDZ tax is typically levied on earned income, including wages, salaries, and business profits, ensuring that local economic growth is supported by contributions from those benefiting from the area’s resources.

How to use the Maumee JEDZ Tax Return

Using the Maumee JEDZ Tax Return involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form, ensuring that all income is reported and deductions are applied where applicable. After completing the form, review it for accuracy before submitting it. Finally, choose your submission method, whether online, by mail, or in person, to ensure timely processing of your return.

Steps to complete the Maumee JEDZ Tax Return

Completing the Maumee JEDZ Tax Return requires a systematic approach:

- Collect all relevant income documentation, such as W-2 forms and 1099 forms.

- Access the Maumee JEDZ Tax Return form, available through local government resources.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages and self-employment earnings.

- Apply any eligible deductions or credits to reduce your taxable income.

- Calculate the total tax owed based on the provided tax rates.

- Review the completed form for any errors or omissions.

- Submit the form by your chosen method before the filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Maumee JEDZ Tax Return are crucial for compliance. Typically, the due date aligns with the federal tax filing deadline, which is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in local regulations that may affect these deadlines, as well as any extensions that may be available for specific circumstances.

Required Documents

To successfully complete the Maumee JEDZ Tax Return, you will need several key documents:

- W-2 forms from employers, detailing annual earnings and tax withholdings.

- 1099 forms for any freelance or contract work, showing income received.

- Records of any additional income sources, such as rental income or investments.

- Documentation for deductions, including receipts for business expenses or charitable contributions.

Penalties for Non-Compliance

Failing to file the Maumee JEDZ Tax Return or submitting it late can result in penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal actions for continued non-compliance. It is essential to adhere to all filing requirements and deadlines to avoid these consequences and ensure that contributions to the local economy are fulfilled.

Create this form in 5 minutes or less

Find and fill out the correct maumee jedz tax return 771997221

Create this form in 5 minutes!

How to create an eSignature for the maumee jedz tax return 771997221

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maumee JEDZ Tax Return and why is it important?

The Maumee JEDZ Tax Return is a specific tax form required for businesses operating within the Maumee Joint Economic Development Zone. It is important because it ensures compliance with local tax regulations and helps businesses take advantage of potential tax benefits available in the zone.

-

How can airSlate SignNow help with the Maumee JEDZ Tax Return process?

airSlate SignNow streamlines the Maumee JEDZ Tax Return process by allowing businesses to easily send, sign, and manage their tax documents electronically. This reduces paperwork and speeds up the submission process, ensuring timely compliance with tax deadlines.

-

What features does airSlate SignNow offer for managing the Maumee JEDZ Tax Return?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed to facilitate the Maumee JEDZ Tax Return. These features enhance efficiency and ensure that all necessary documentation is completed accurately.

-

Is there a cost associated with using airSlate SignNow for the Maumee JEDZ Tax Return?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides a cost-effective solution for managing the Maumee JEDZ Tax Return, especially when considering the time and resources saved.

-

Can airSlate SignNow integrate with other software for the Maumee JEDZ Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Maumee JEDZ Tax Return alongside your existing tools. This integration helps streamline workflows and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the Maumee JEDZ Tax Return?

Using airSlate SignNow for the Maumee JEDZ Tax Return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive tax documents. Additionally, the user-friendly interface makes it accessible for businesses of all sizes.

-

How secure is airSlate SignNow when handling the Maumee JEDZ Tax Return?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Maumee JEDZ Tax Return and other sensitive documents. This ensures that your data remains confidential and secure throughout the signing process.

Get more for Maumee JEDZ Tax Return

- Lufthansa betreuungsformular

- Resale license ny form

- Master promissory note form omb no 1845 0007

- 53788 form

- Employee payroll deduction authorization form todays date worksite employer name of employee ssn effective date of deduction

- Summons and complaint to establish parentage form

- No contact agreement template 787745172 form

- No interest loan agreement template form

Find out other Maumee JEDZ Tax Return

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast