Maumee JEDZ Tax Return 2023

What is the Maumee JEDZ Tax Return

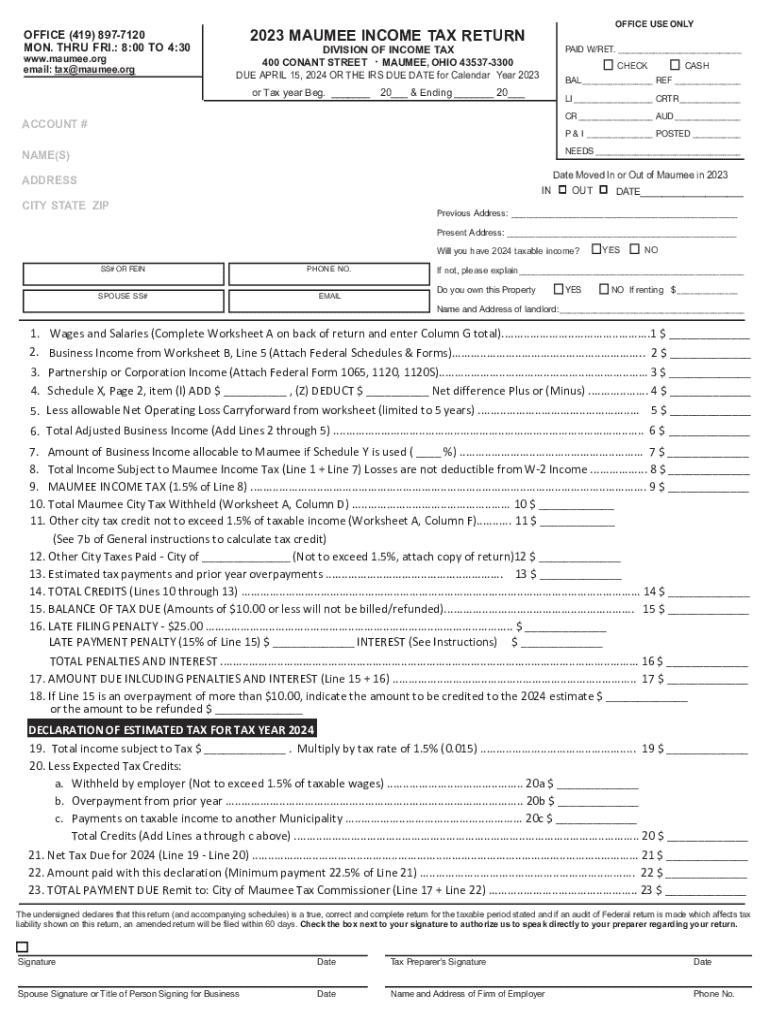

The Maumee JEDZ Tax Return is a specific tax form used by individuals and businesses operating within the Joint Economic Development Zone (JEDZ) in Maumee, Ohio. This form is essential for reporting income and calculating the tax owed to the local government, which supports various community services and infrastructure projects. The JEDZ tax is typically levied on earned income, including wages, salaries, and business profits, ensuring that local economic growth is supported by contributions from those benefiting from the area’s resources.

How to use the Maumee JEDZ Tax Return

Using the Maumee JEDZ Tax Return involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form, ensuring that all income is reported and deductions are applied where applicable. After completing the form, review it for accuracy before submitting it. Finally, choose your submission method, whether online, by mail, or in person, to ensure timely processing of your return.

Steps to complete the Maumee JEDZ Tax Return

Completing the Maumee JEDZ Tax Return requires a systematic approach:

- Collect all relevant income documentation, such as W-2 forms and 1099 forms.

- Access the Maumee JEDZ Tax Return form, available through local government resources.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages and self-employment earnings.

- Apply any eligible deductions or credits to reduce your taxable income.

- Calculate the total tax owed based on the provided tax rates.

- Review the completed form for any errors or omissions.

- Submit the form by your chosen method before the filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Maumee JEDZ Tax Return are crucial for compliance. Typically, the due date aligns with the federal tax filing deadline, which is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in local regulations that may affect these deadlines, as well as any extensions that may be available for specific circumstances.

Required Documents

To successfully complete the Maumee JEDZ Tax Return, you will need several key documents:

- W-2 forms from employers, detailing annual earnings and tax withholdings.

- 1099 forms for any freelance or contract work, showing income received.

- Records of any additional income sources, such as rental income or investments.

- Documentation for deductions, including receipts for business expenses or charitable contributions.

Penalties for Non-Compliance

Failing to file the Maumee JEDZ Tax Return or submitting it late can result in penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal actions for continued non-compliance. It is essential to adhere to all filing requirements and deadlines to avoid these consequences and ensure that contributions to the local economy are fulfilled.

Create this form in 5 minutes or less

Find and fill out the correct maumee jedz tax return 771997221

Create this form in 5 minutes!

How to create an eSignature for the maumee jedz tax return 771997221

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maumee JEDZ Tax Return and why is it important?

The Maumee JEDZ Tax Return is a specific tax form required for businesses operating within the Maumee Joint Economic Development Zone. It is important because it ensures compliance with local tax regulations and helps businesses take advantage of potential tax benefits available in the zone.

-

How can airSlate SignNow help with the Maumee JEDZ Tax Return process?

airSlate SignNow streamlines the Maumee JEDZ Tax Return process by allowing businesses to easily send, sign, and manage their tax documents electronically. This reduces paperwork and speeds up the submission process, ensuring timely compliance with tax deadlines.

-

What features does airSlate SignNow offer for managing the Maumee JEDZ Tax Return?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed to facilitate the Maumee JEDZ Tax Return. These features enhance efficiency and ensure that all necessary documentation is completed accurately.

-

Is there a cost associated with using airSlate SignNow for the Maumee JEDZ Tax Return?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides a cost-effective solution for managing the Maumee JEDZ Tax Return, especially when considering the time and resources saved.

-

Can airSlate SignNow integrate with other software for the Maumee JEDZ Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Maumee JEDZ Tax Return alongside your existing tools. This integration helps streamline workflows and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the Maumee JEDZ Tax Return?

Using airSlate SignNow for the Maumee JEDZ Tax Return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive tax documents. Additionally, the user-friendly interface makes it accessible for businesses of all sizes.

-

How secure is airSlate SignNow when handling the Maumee JEDZ Tax Return?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Maumee JEDZ Tax Return and other sensitive documents. This ensures that your data remains confidential and secure throughout the signing process.

Get more for Maumee JEDZ Tax Return

- Subpoena polk county florida form

- Aftercare plan template 11419545 form

- New patient information package pdf neurologyconcerns com

- Cdl military skills waiver certification form ksrevenue

- Short a map hat cat mat bat fan ham bag pan can form

- Usda ccc 933 form

- Ndhsaa one act play proof of royalty form name ndhsaa com

- Las palmas medical center transplant recipient application las palmas medical center transplant recipient application form

Find out other Maumee JEDZ Tax Return

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT