Cigarette Resale Certificate of Exemption Application Virginia 2018-2026

Understanding the Virginia ST-10C Form

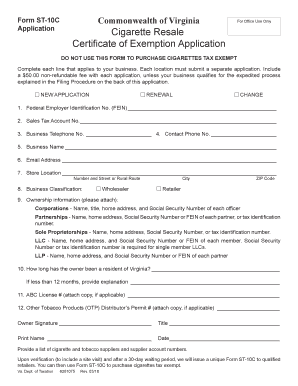

The Virginia ST-10C form, also known as the Cigarette Resale Certificate of Exemption Application, is a crucial document for businesses engaged in the sale of cigarettes in Virginia. This form allows qualified retailers to purchase cigarettes without paying sales tax, provided they meet specific criteria established by the state. The ST-10C serves as a declaration of the seller's intent to resell the product, ensuring compliance with state tax regulations.

Eligibility Criteria for the ST-10C Form

To qualify for the ST-10C form, businesses must meet certain eligibility requirements. These include:

- Being a registered retailer in Virginia.

- Having a valid sales tax registration number.

- Engaging in the resale of cigarettes as a primary business activity.

It is essential for applicants to ensure that they meet these criteria before applying, as failure to do so may result in penalties or denial of the exemption.

Steps to Complete the ST-10C Form

Filling out the ST-10C form involves several straightforward steps:

- Obtain the ST-10C form from the Virginia Department of Taxation website or through authorized distributors.

- Fill in the required business information, including the name, address, and sales tax registration number.

- Indicate the type of cigarettes being purchased and the intended use of the products.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form should be kept on file for tax purposes, as it may be requested during audits or inspections.

Legal Use of the ST-10C Form

The legal use of the ST-10C form is strictly regulated. Retailers must use this certificate only for purchases intended for resale. Misuse of the form, such as using it for personal consumption or for items not intended for resale, can lead to significant penalties, including fines and loss of resale privileges.

Form Submission Methods

The ST-10C form does not require formal submission to the Virginia Department of Taxation at the time of purchase. Instead, retailers must keep the completed form on file and present it upon request. This self-regulatory approach allows businesses to maintain flexibility while ensuring compliance with state laws.

Key Elements of the ST-10C Form

Several key elements must be included in the ST-10C form to ensure its validity:

- Business name and address.

- Sales tax registration number.

- Description of the cigarettes being purchased.

- Signature of the purchaser or authorized representative.

Ensuring that all these elements are accurately filled out is essential for the form to be recognized as valid during audits or inspections.

Create this form in 5 minutes or less

Find and fill out the correct cigarette resale certificate of exemption application virginia

Create this form in 5 minutes!

How to create an eSignature for the cigarette resale certificate of exemption application virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 10c form and why is it important?

The st 10c form is a crucial document used for tax exemption purposes in various transactions. Understanding its significance can help businesses ensure compliance and avoid unnecessary tax liabilities. Utilizing airSlate SignNow can streamline the process of sending and eSigning the st 10c form efficiently.

-

How does airSlate SignNow simplify the st 10c form process?

airSlate SignNow simplifies the st 10c form process by providing an intuitive platform for document management. Users can easily upload, send, and eSign the st 10c form, reducing the time spent on paperwork. This efficiency allows businesses to focus on their core operations while ensuring compliance.

-

What are the pricing options for using airSlate SignNow for the st 10c form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while allowing you to manage the st 10c form effectively. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for managing the st 10c form?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for managing the st 10c form. This allows you to connect with CRM systems, cloud storage, and other tools you already use. Integrating these systems can streamline your document management process.

-

What features does airSlate SignNow provide for the st 10c form?

airSlate SignNow provides a range of features designed to enhance the management of the st 10c form. These include customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that your documents are handled efficiently and securely.

-

Is airSlate SignNow secure for handling the st 10c form?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the st 10c form. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

-

How can airSlate SignNow benefit my business when dealing with the st 10c form?

Using airSlate SignNow for the st 10c form can signNowly enhance your business's efficiency and compliance. The platform reduces the time spent on manual paperwork, minimizes errors, and ensures that all documents are securely stored and easily accessible. This leads to improved productivity and peace of mind.

Get more for Cigarette Resale Certificate Of Exemption Application Virginia

- Arkansas tobacco quitline fax referral form fax number 1 888 healthy arkansas

- Apostillecertification order instructions nevada secretary of form

- Medical records release raleigh neurology associates form

- Multimodal dangerous goods form 255040206

- Diagnostic imaging outpatient order form order form

- Definition annex to apartment lease 1 landlord 2 form

- Fein the district court of iowa iowacourts form

- Www kcgov usview2701in the matter of the guardianship of kcgov us form

Find out other Cigarette Resale Certificate Of Exemption Application Virginia

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History