Form 8038T Rev January Fill in Version Arbitrage Rebate and Penalty in Lieu of Arbitrage Rebate

What is the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

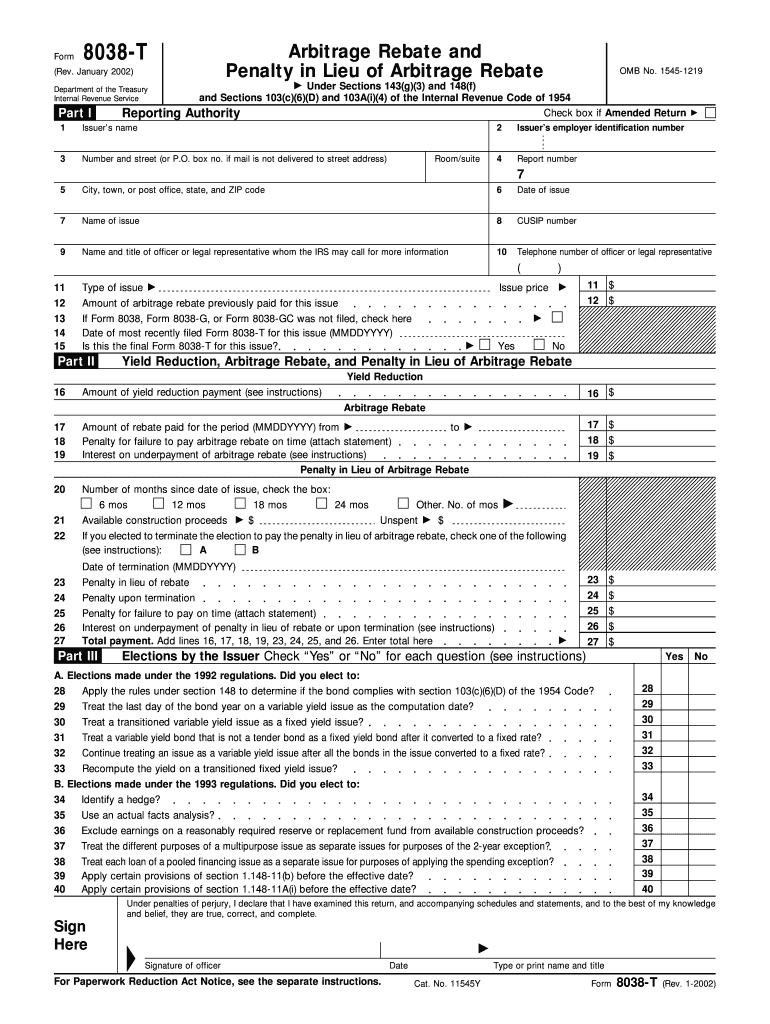

The Form 8038T Rev January is a tax form used by issuers of tax-exempt bonds to report arbitrage rebate and any penalties in lieu of arbitrage rebate. This form is essential for ensuring compliance with federal tax regulations governing tax-exempt bonds. By accurately completing this form, issuers can report their calculations regarding the arbitrage rebate due to the Internal Revenue Service (IRS) and any penalties associated with non-compliance. Understanding this form is crucial for entities that issue tax-exempt bonds to maintain their tax-exempt status.

How to use the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

Using the Form 8038T Rev January involves several steps to ensure accurate reporting. First, gather all necessary financial data related to the tax-exempt bonds issued, including interest earned and investment earnings. Next, complete the form by providing the required information, such as the issuer's name, address, and details about the bonds. It is important to calculate the arbitrage rebate accurately, as this will determine the amount owed to the IRS. Once completed, the form must be submitted by the deadline to avoid potential penalties.

Steps to complete the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

Completing the Form 8038T Rev January requires careful attention to detail. Follow these steps:

- Gather all relevant financial records related to the bonds.

- Fill in the issuer's name and address in the designated fields.

- Provide details about the bonds, including issue date and amount.

- Calculate the arbitrage rebate based on IRS guidelines.

- Complete any sections related to penalties if applicable.

- Review the form for accuracy before submission.

Legal use of the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

The legal use of the Form 8038T Rev January is mandated by IRS regulations. Issuers of tax-exempt bonds are legally required to report any arbitrage earnings and pay the corresponding rebate to the IRS. Failure to file this form or to pay the rebate can result in penalties and jeopardize the tax-exempt status of the bonds. It is important for issuers to understand their obligations under federal law to avoid any legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8038T Rev January are critical to ensure compliance with IRS regulations. Generally, the form must be filed within 60 days after the end of the bond's spending period. It is essential to keep track of these deadlines to avoid penalties. Issuers should also be aware of any changes in regulations that may affect their filing requirements.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form 8038T Rev January can lead to significant penalties. If an issuer fails to file the form or pay the required arbitrage rebate, the IRS may impose fines that can accumulate over time. Additionally, failure to comply can result in the loss of tax-exempt status for the bonds, leading to increased tax liabilities for the issuer. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete form 8038t rev january fill in version arbitrage rebate and penalty in lieu of arbitrage rebate

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the features required to create, alter, and electronically sign your documents promptly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The most efficient way to alter and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Take advantage of the tools we provide to finish your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text (SMS), invitation link, or download it directly to your computer.

Eliminate the worries of lost or overlooked documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] and ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

Create this form in 5 minutes!

How to create an eSignature for the form 8038t rev january fill in version arbitrage rebate and penalty in lieu of arbitrage rebate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate?

The Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate is a necessary IRS document that municipalities must file when they are seeking to claim an arbitrage rebate or penalty relief. This form helps ensure compliance with tax regulations associated with tax-exempt bonds and interest earnings. By completing this form accurately, you can avoid potential penalties and maintain good standing with the IRS.

-

How can airSlate SignNow help with the Form 8038T Rev January Fill in Version?

airSlate SignNow offers an efficient platform for completing and eSigning essential documents like the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate. Our user-friendly interface simplifies the form-filling process, making it easier for municipal finance officials to complete the document quickly and accurately. Additionally, you can store and access your forms with ease.

-

What are the key features of airSlate SignNow related to Form 8038T?

With airSlate SignNow, you can eSign your Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate effortlessly. The platform also provides real-time notifications, customizable templates, and secure document storage, ensuring that you have everything needed to manage your forms efficiently. The collaborative capabilities allow multiple users to review and sign, enhancing workflow productivity.

-

Is there a cost associated with using airSlate SignNow for the Form 8038T?

Yes, airSlate SignNow offers subscription plans that vary in pricing based on the features you need, including the ability to complete the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate. The cost is reflective of a comprehensive and cost-effective solution for managing your document needs, which can save you time and reduce errors in the long run.

-

What are the benefits of using airSlate SignNow for municipal forms?

Using airSlate SignNow for forms like the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate enhances efficiency and accuracy. Our platform streamlines the document signing process, minimizing the paperwork involved and ensuring compliance with tax regulations. Additionally, the reduction in administrative tasks allows municipal finance teams to focus more on strategic functions.

-

Can I integrate airSlate SignNow with other software for handling Form 8038T?

Absolutely! airSlate SignNow provides integrations with various software systems, making it easy to manage the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate within your existing workflows. Whether you use accounting, project management, or CRM tools, our platform’s ability to seamlessly integrate will enhance your document processing capabilities.

-

What support does airSlate SignNow offer for users filing Form 8038T?

airSlate SignNow offers comprehensive support for users completing the Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate. Our knowledgeable customer service team is available via multiple channels to assist with any inquiries you may have. We also provide a wealth of resources, including tutorials and FAQs, to guide you through the process.

Get more for Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

Find out other Form 8038T Rev January Fill in Version Arbitrage Rebate And Penalty In Lieu Of Arbitrage Rebate

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document